In February, we highlighted the Digital Services Tax (DST) as an area Trump would likely press on with future policy action. His proposed “One Big Beautiful Bill Act” (OBBA) does just that, saddling Canadian investors and corporates with huge tax hikes.

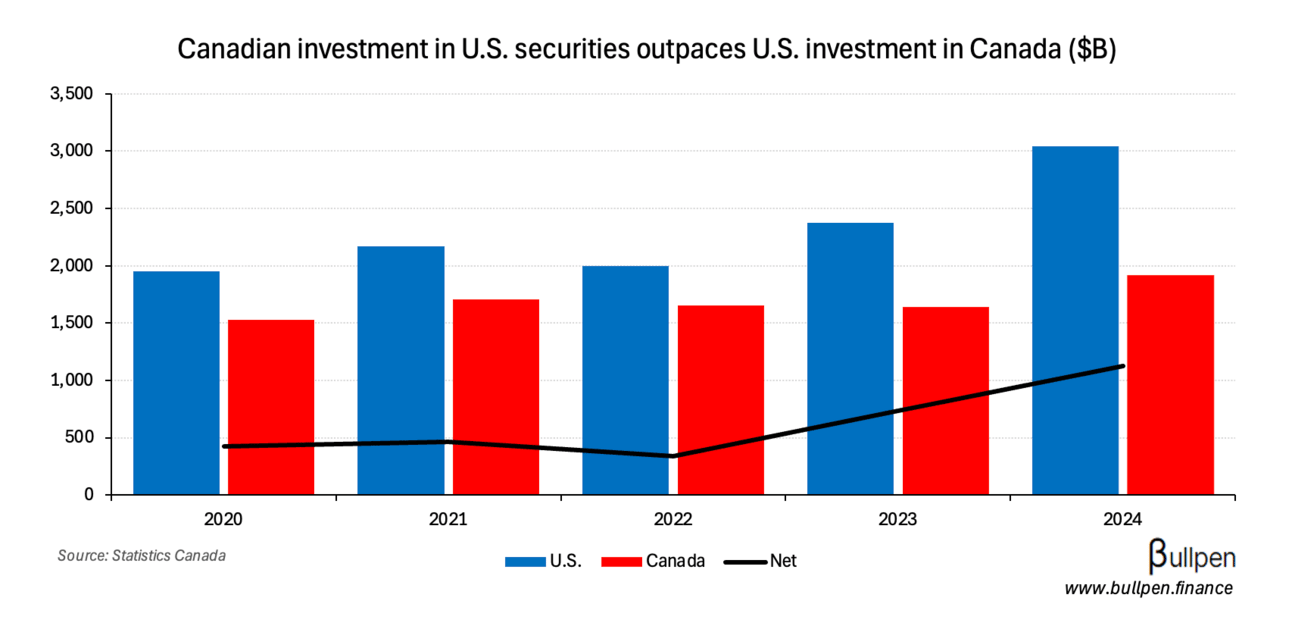

On the investor side, a jump from a 15% withholding tax on U.S. dividends to 50% (5% per year) could stick Canadians with an $80B bill over 7 years.

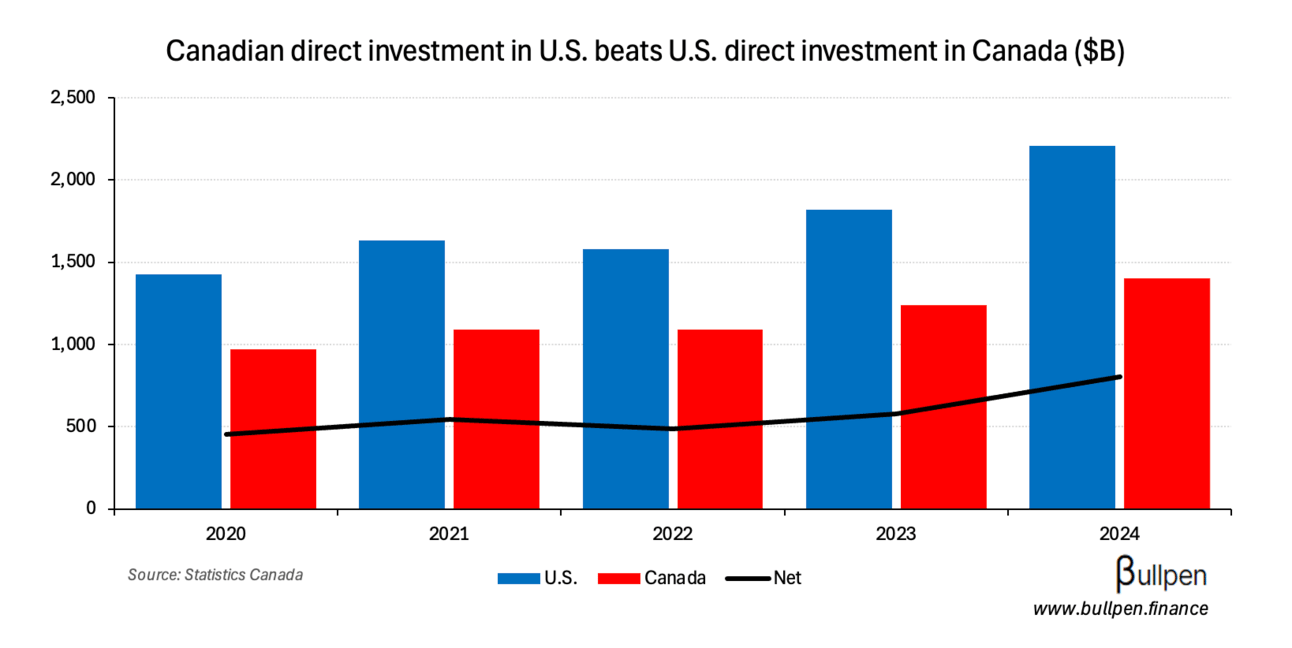

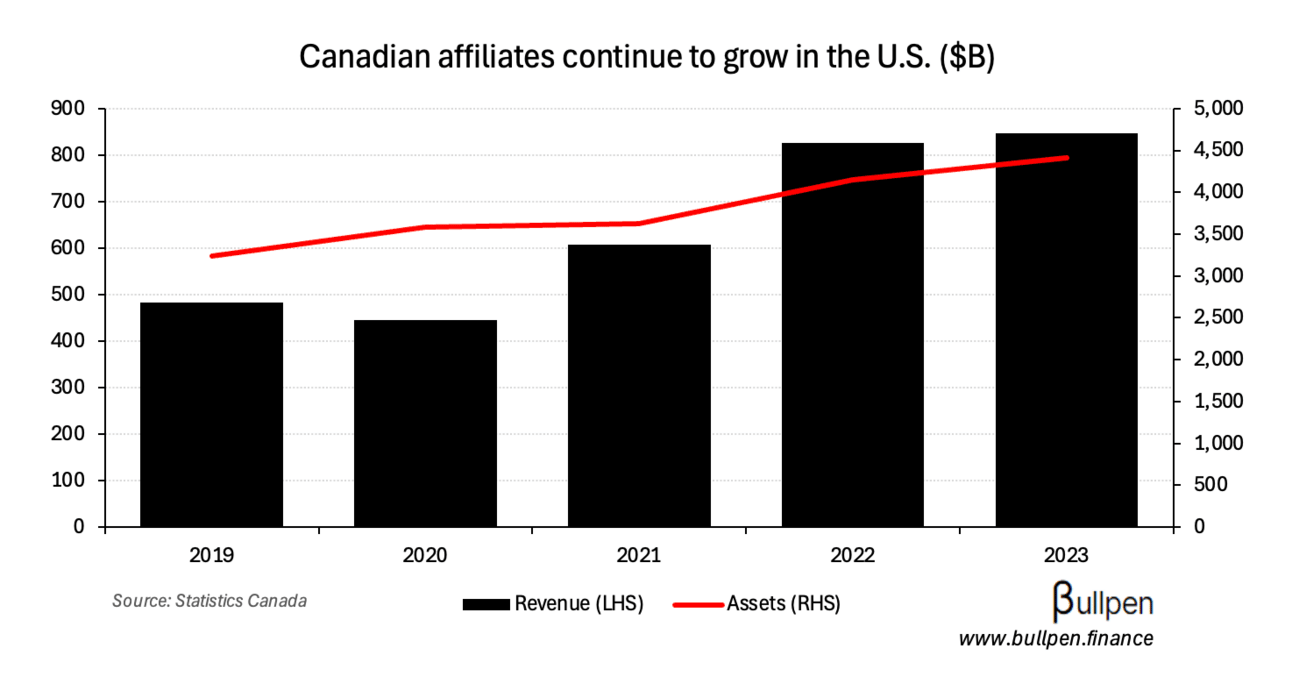

Similarly, Canadian corporations would face the same 5% annual bump - up to 50% - on dividends from U.S. subsidiaries. The U.S. subs have been getting increased investment dollars from the Canadian parents…

… resulting in increased contributions to financial performance - a tough spot to be.

The bill, set to pass by July 4th if Carney doesn’t walk back measures the U.S. deems unfair, would have massive implications for capital flows - a topic we’re going to dig into more this week.