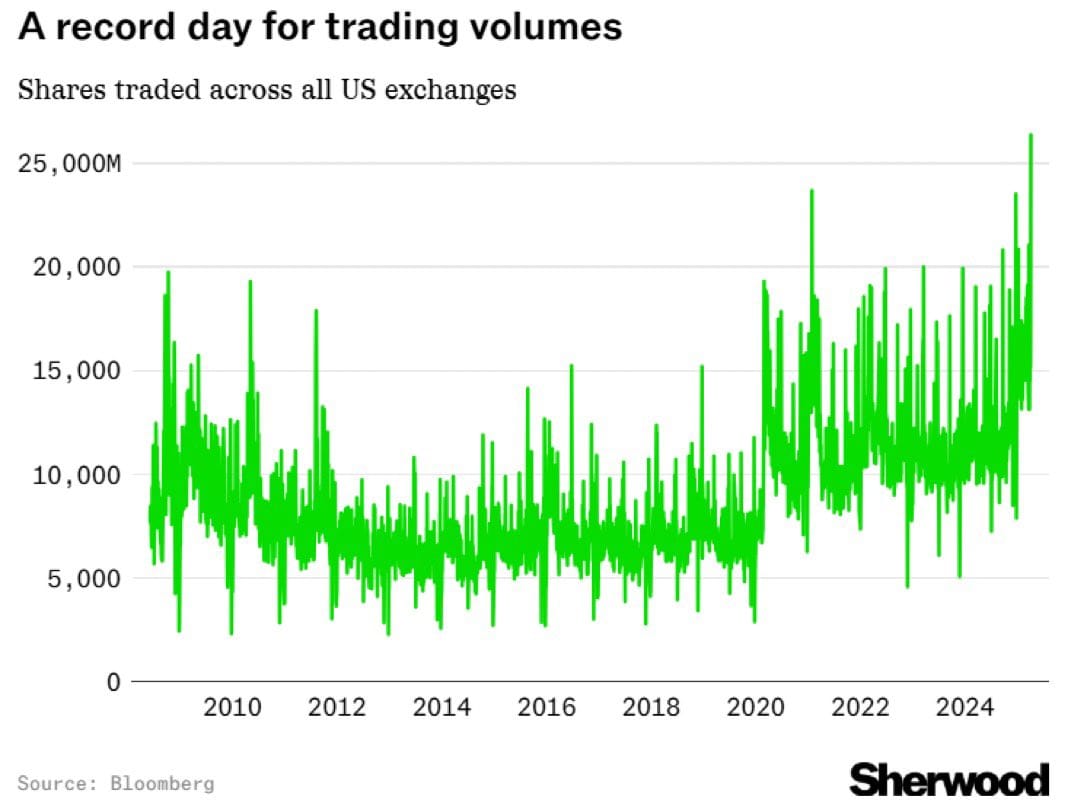

Last week was one of the ugliest in the history of markets, with the fifth worst 2-day sell-off on record volumes.

Flows were extremely bearish to close out the week, with hedge funds selling $40B on Thursday alone.

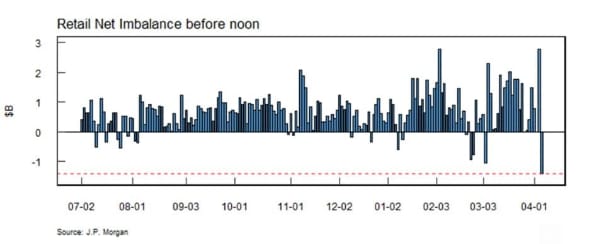

Retail showed its first signs of capitulation too, selling $1.5B in the first two hours of Thursday’s session.

With inflation expectations falling off a cliff alongside both crypto and futures markets, it seems we’re in for another challenging session on Monday.

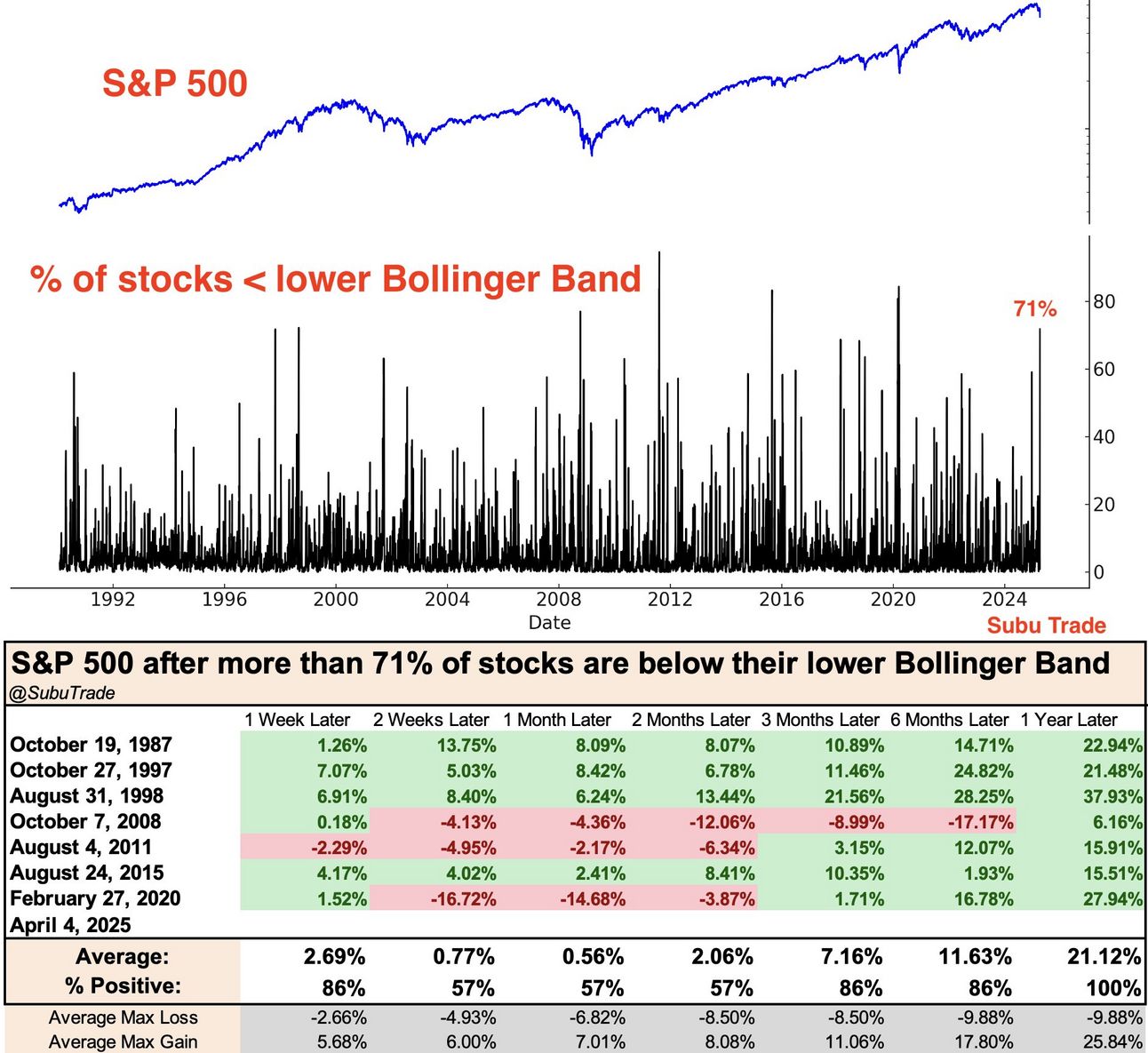

Continued panic could create opportunity

While the Trump administration doesn’t appear to be flinching at this drawdown, the limited number of comparable periods we’ve had in markets would suggest it’s not a bad time to start thinking about increasing exposure.

Extreme volatility has historically been met with near-term recoveries…

… wide spread relative drawdowns have historically reversed course over the medium term…

… and large 2-day drawdowns have historically been followed by good long-term performance.

With the global L/S ratio now sitting at the lowest levels on record, a return in confidence to the market could drive an equally rapid bid for equities.

Valuation & flows say be cautious

That return to confidence could take some time though, as Trump remains firm in his trade stance.

I don’t want anything to go down, but sometimes you have to take medicine to fix something

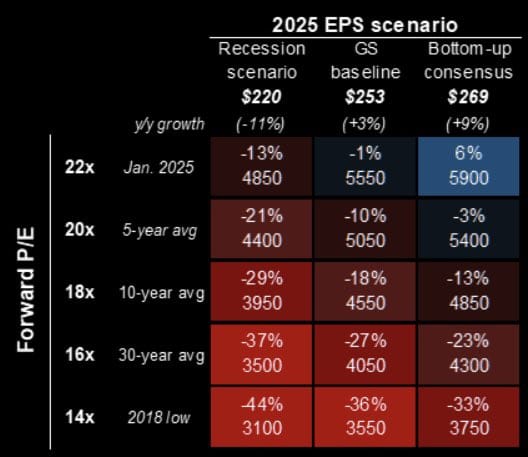

With a weaker business confidence backdrop, value is the only real catalyst outside of positive developments on trade - and valuations aren’t screaming buy just yet.

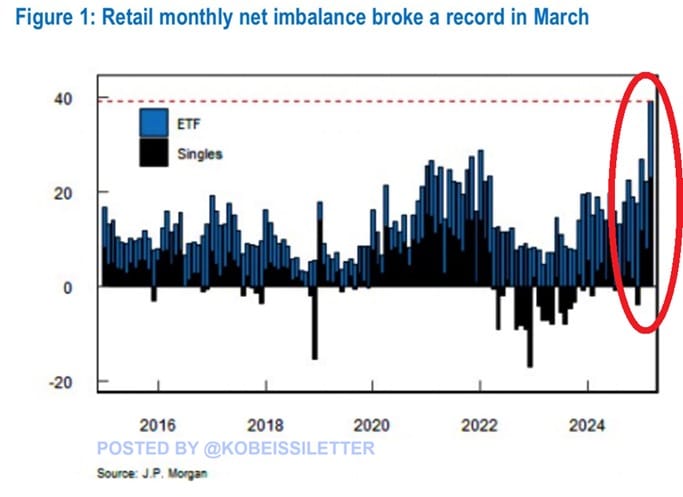

With retail adding significantly over the past year, we could see continued selling pressure as positions get unwound.