Thoma Bravo's $12B takeout of Dayforce might not be the last

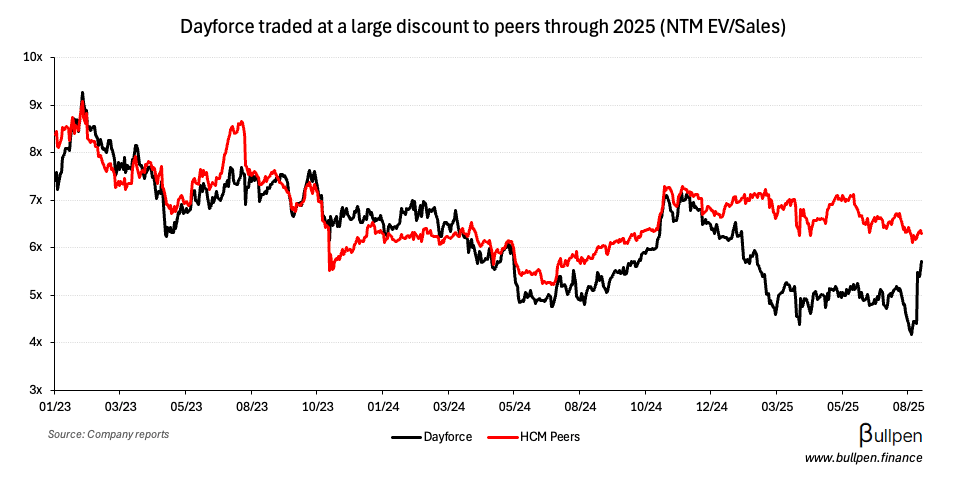

Thoma Bravo is taking Dayforce (DAY) private in a $12.3B deal valuing the company at ~6x NTM EV/Sales - a 30% premium, but still below where peers trade. The purchase price takes advantage of a breakdown in DAY’s historical trading relationship…

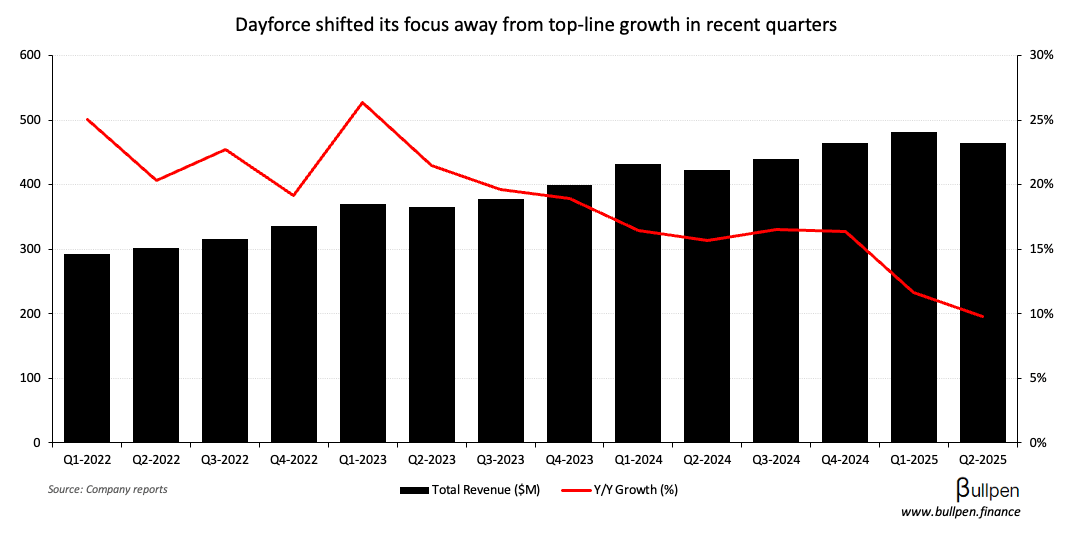

… which was driven by a revenue slowdown, as management takes its foot off the gas…

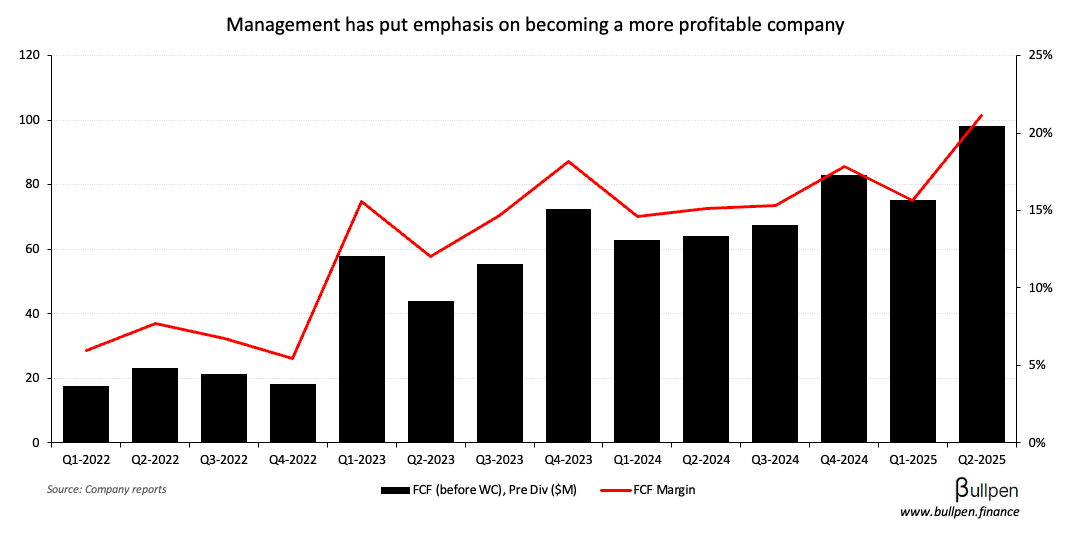

… to focus on profitability, which tends to be when private equity starts circling public software companies.

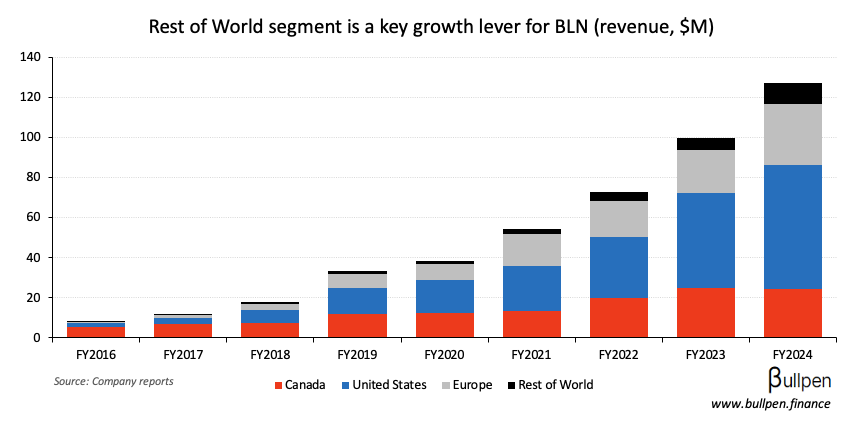

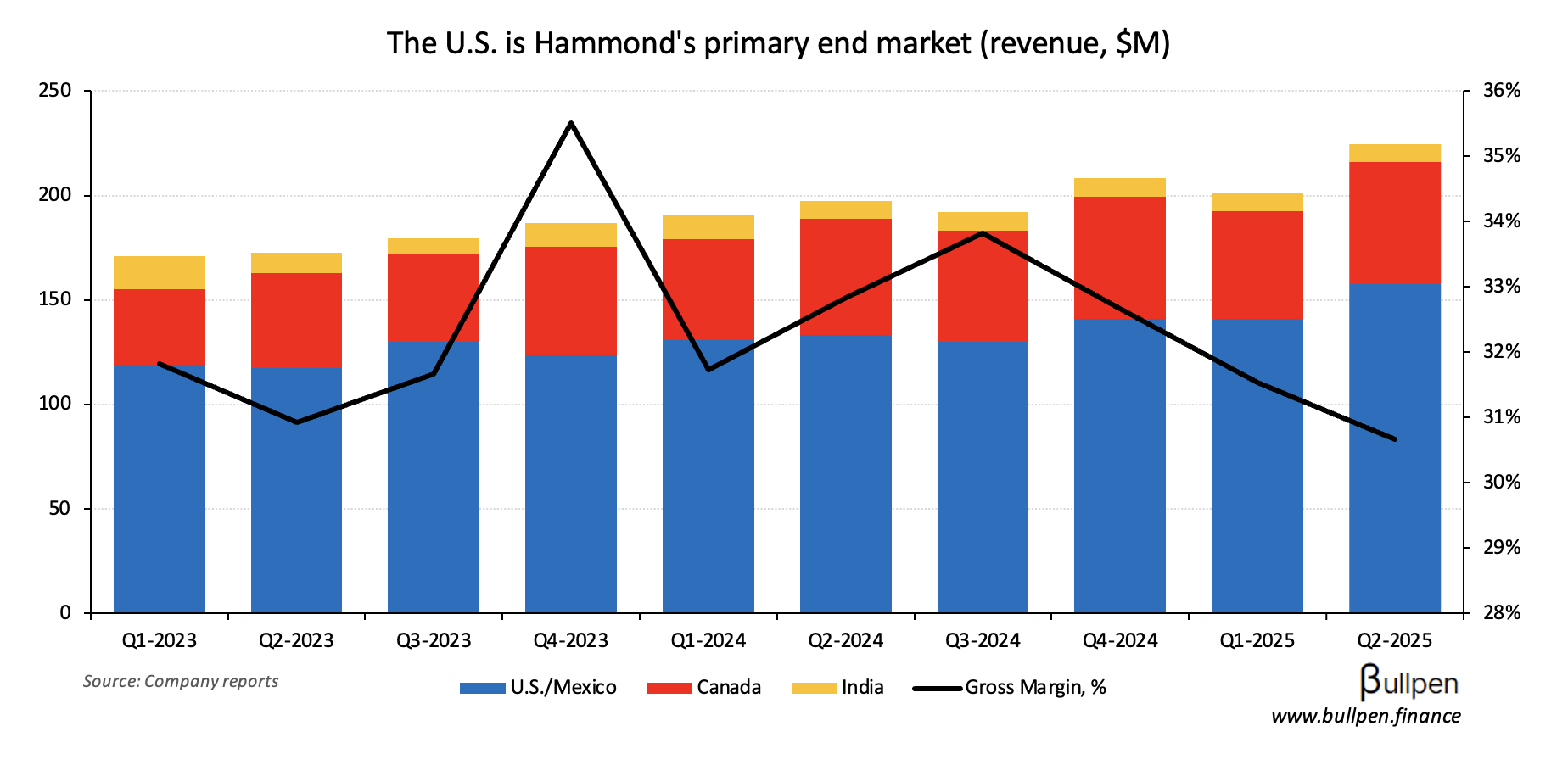

With Thoma raising nearly $35B for what I can best describe as its “buy old software and slap AI on it” strategy, other Canadian tech names could be in play.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: