$13B leaves Canada, Carney tightens screws on steel import quotas

|

| ||||

|

| ||||

|

| ||||

|

|

WHAT'S ON TAP

Capital leaves for 4th straight month

Carney tightens screws on steel

Housing starts beat, inventory builds

Coldplay catches foul play

ACQ sells U.S. dealerships for $80M

Couche-Tard withdraws Seven & i bid

HOT OFF THE PRESS

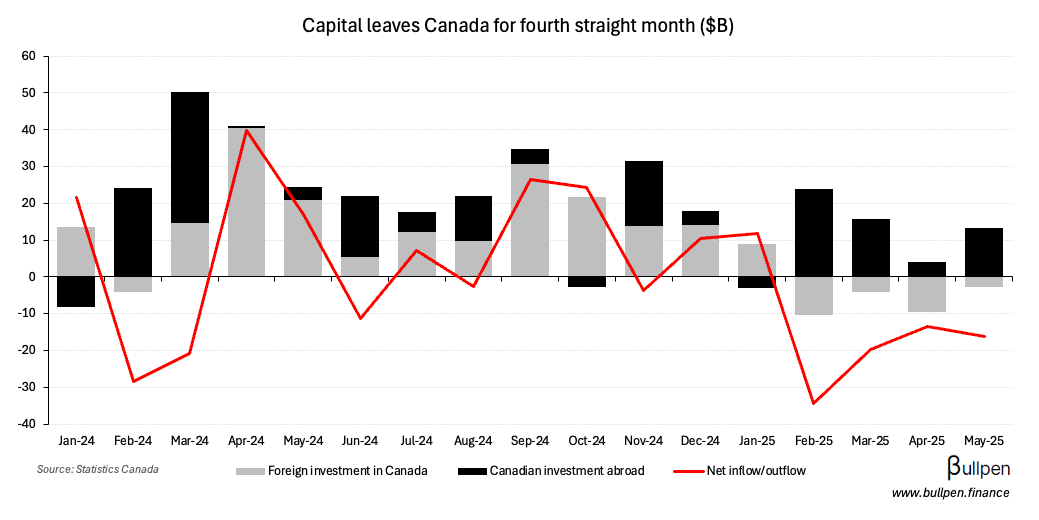

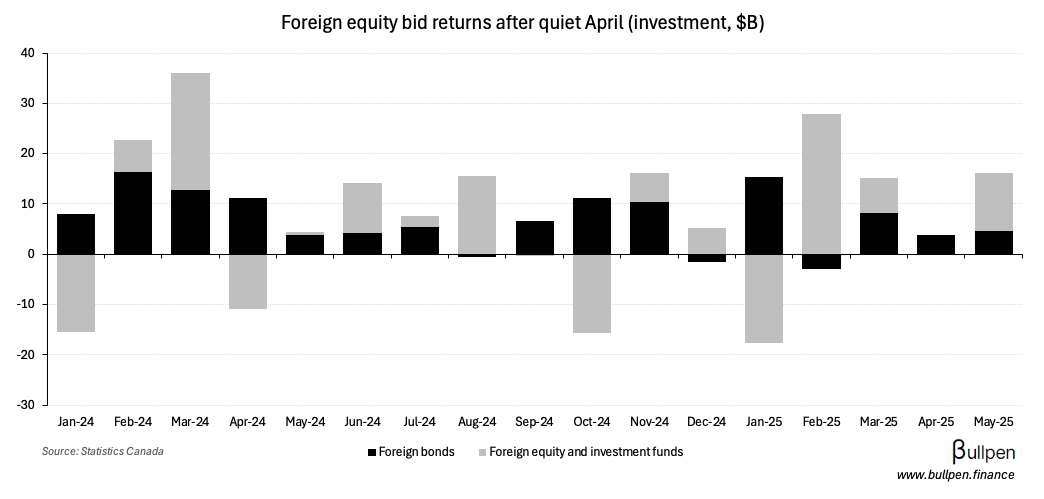

Capital exits Canada for 4th month in a row

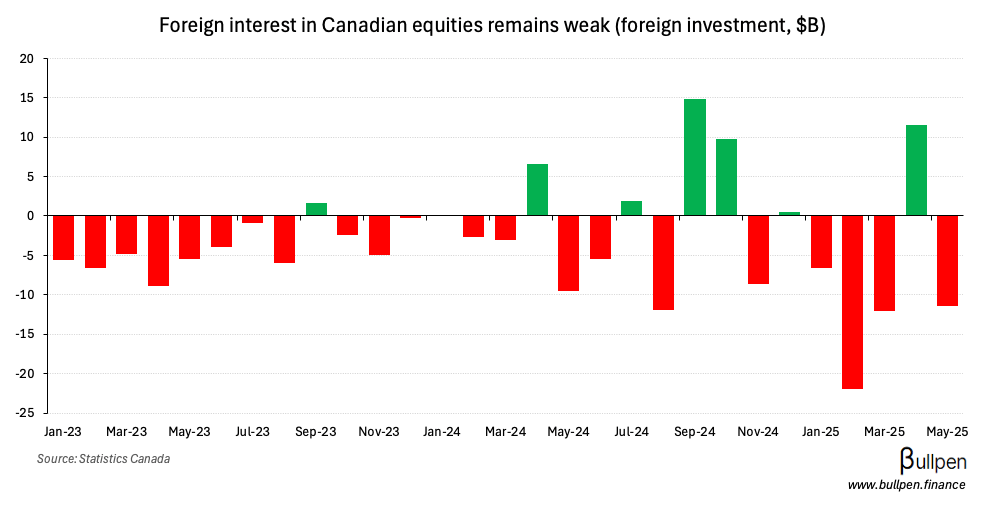

May marked the fourth straight capital outflow, as investors scooped up $13B of foreign securities and foreign investors dumped $3B of Canadian exposure.

The U.S. market got a Canadian bid after a quiet April, with equities pulling in $14B and corporate bonds adding another $3B at the expense of other foreign investments.

In Canada, the foreign outflow was predominantly equities driven - with $11B of net selling led by energy, mining, and manufacturing…

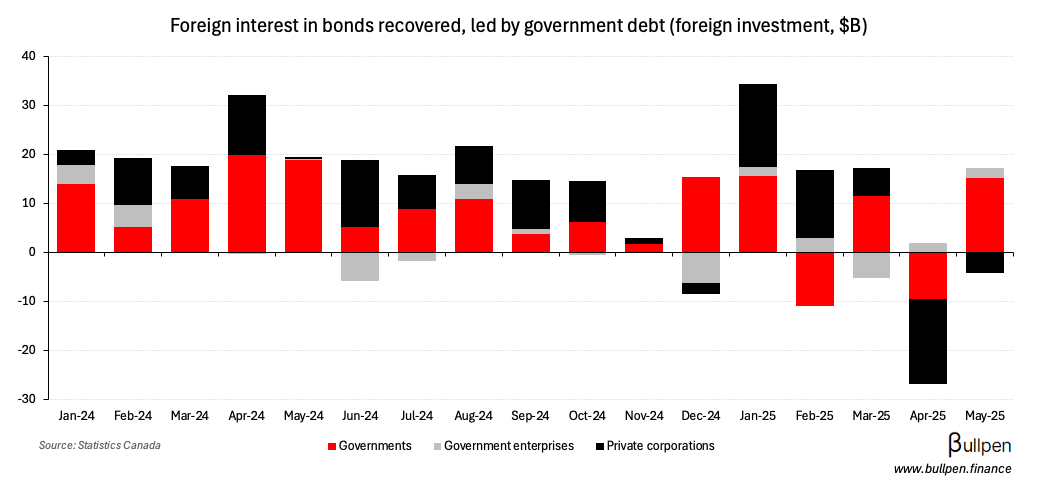

… while foreign demand for Canadian paper returned, with $13B of net buying led by governments and offset slightly by private sector outflows.

Carney tightens screws on steel import quota

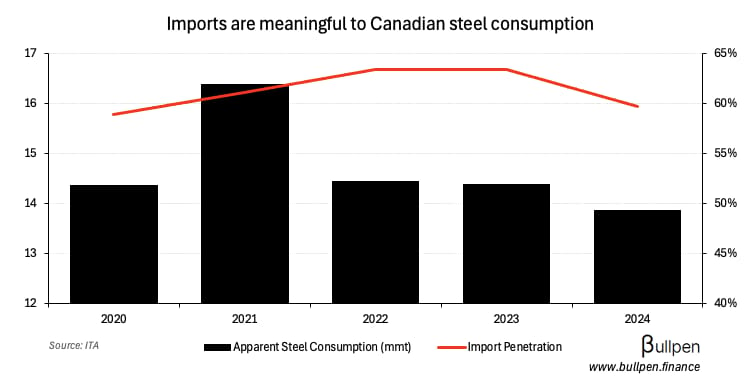

Trump’s 50% steel tariffs are having their intended impact, shutting Canadian producers out of the market and forcing Carney to tighten the screws on previously announced measures to curb anti-competitive dumping.

Over 50% of the Canadian market is serviced by imported steel. And a lot of that imported steel is coming in at pretty low pricing. We believe there’s a significant amount of it that is unfairly traded into Canada.

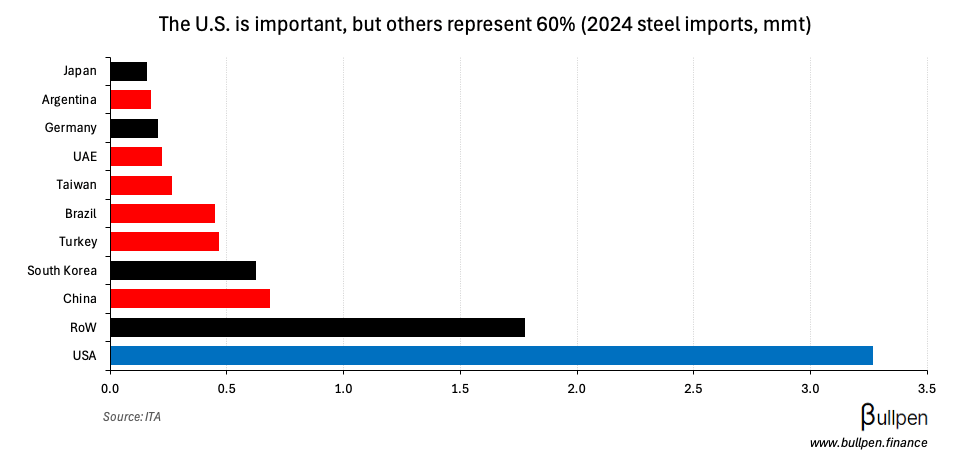

The new measures will cap non-U.S. countries with/without free trade agreements at 100%/50% of 2024 import volumes before hitting them with a 50% tariff. Taking import volumes from countries without trade deals (highlighted in red)…

… and assuming 50% of RoW volumes lack one too, this move should effectively take ~1.5M tonnes of cheap steel out of the market (nearly 20% of imports). Let’s see if that’s enough.

Housing starts beat, inventory builds

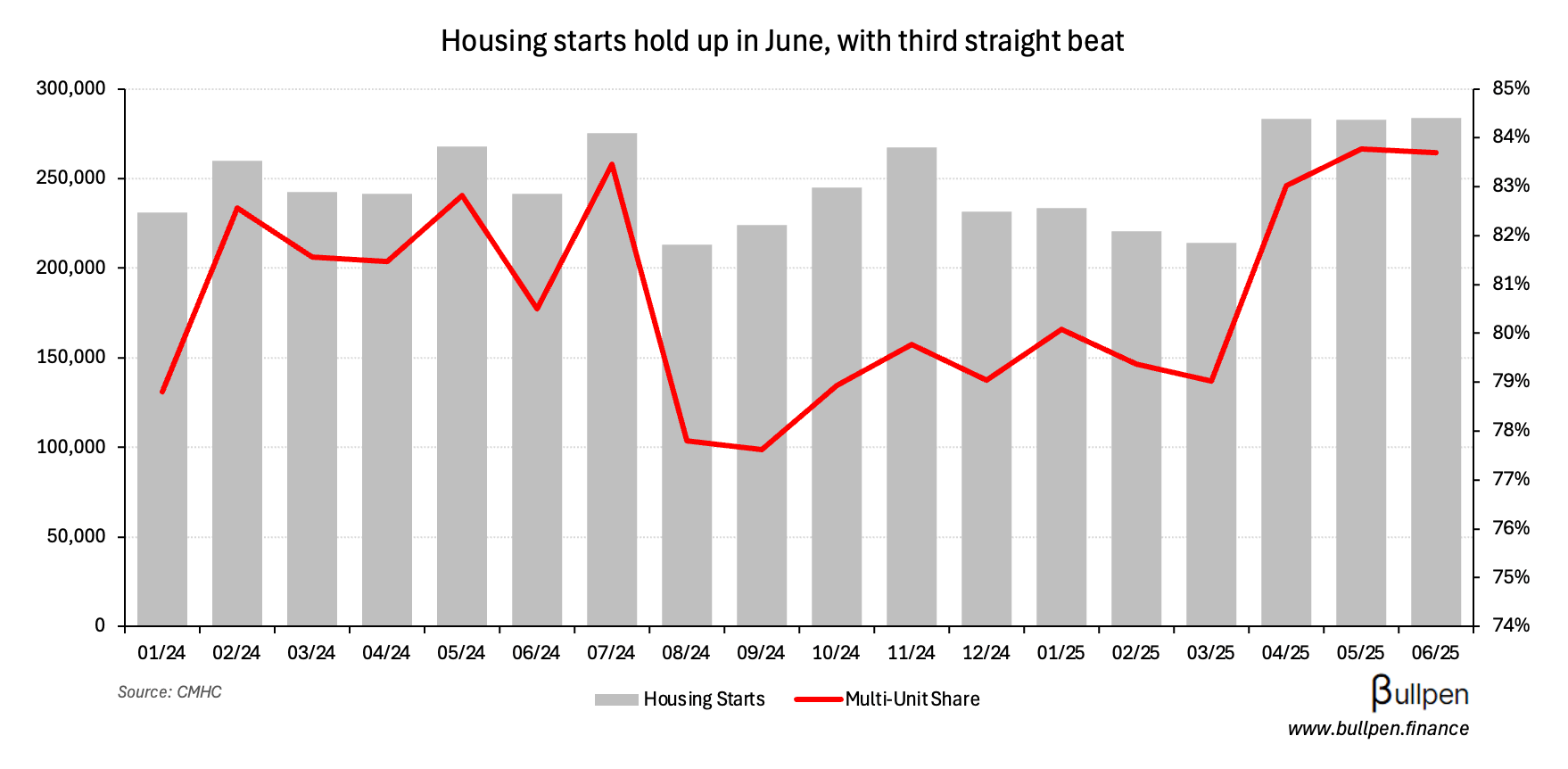

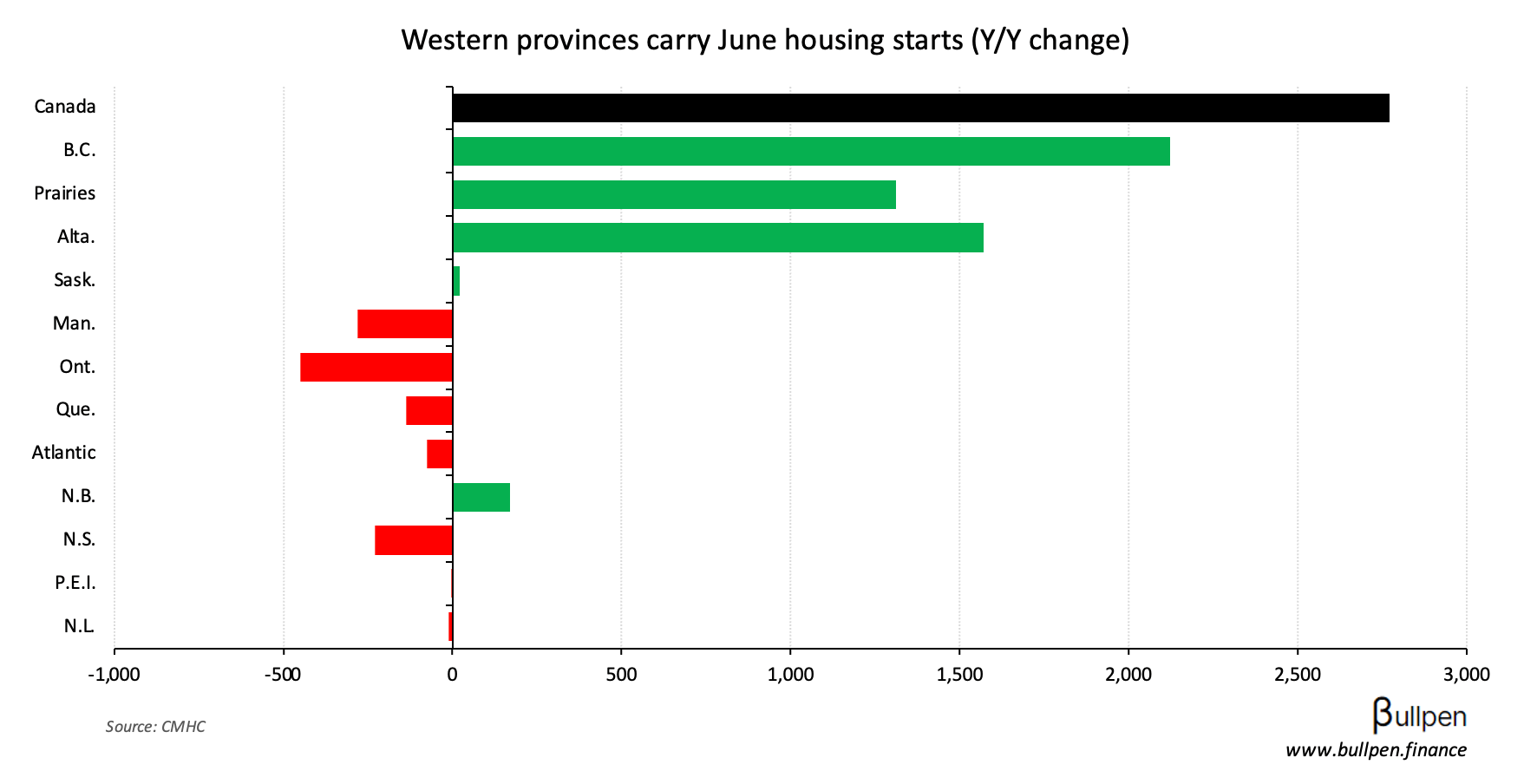

Housing starts posted a third straight beat in June, hitting 284K versus estimates of 259K and up nearly 20% Y/Y thanks to higher multi-unit activity.

June’s ~3K gain was carried by Alberta and BC, which were up over 40% and 60%, respectively - offsetting continued weakness in Ontario, with Toronto starts down 40%.

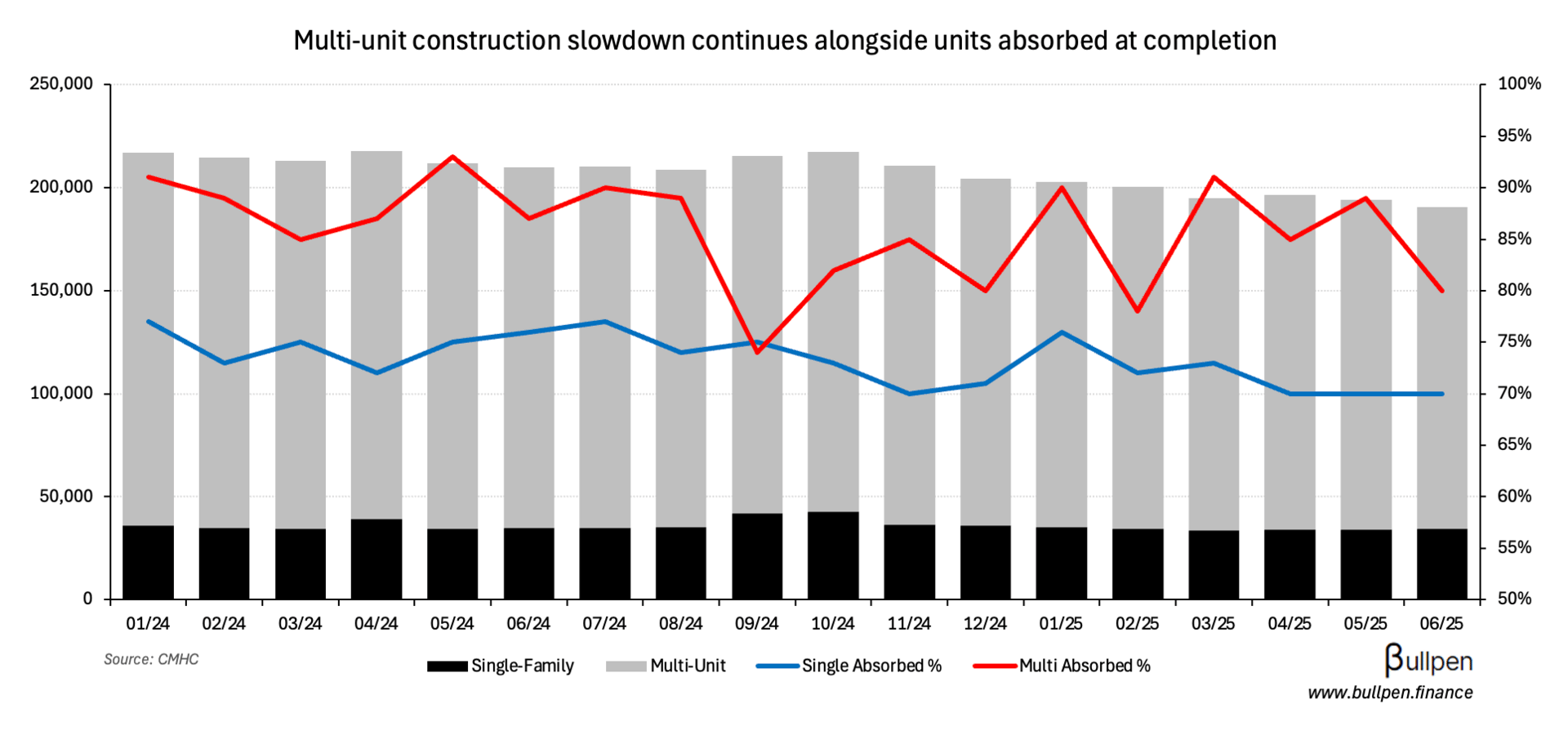

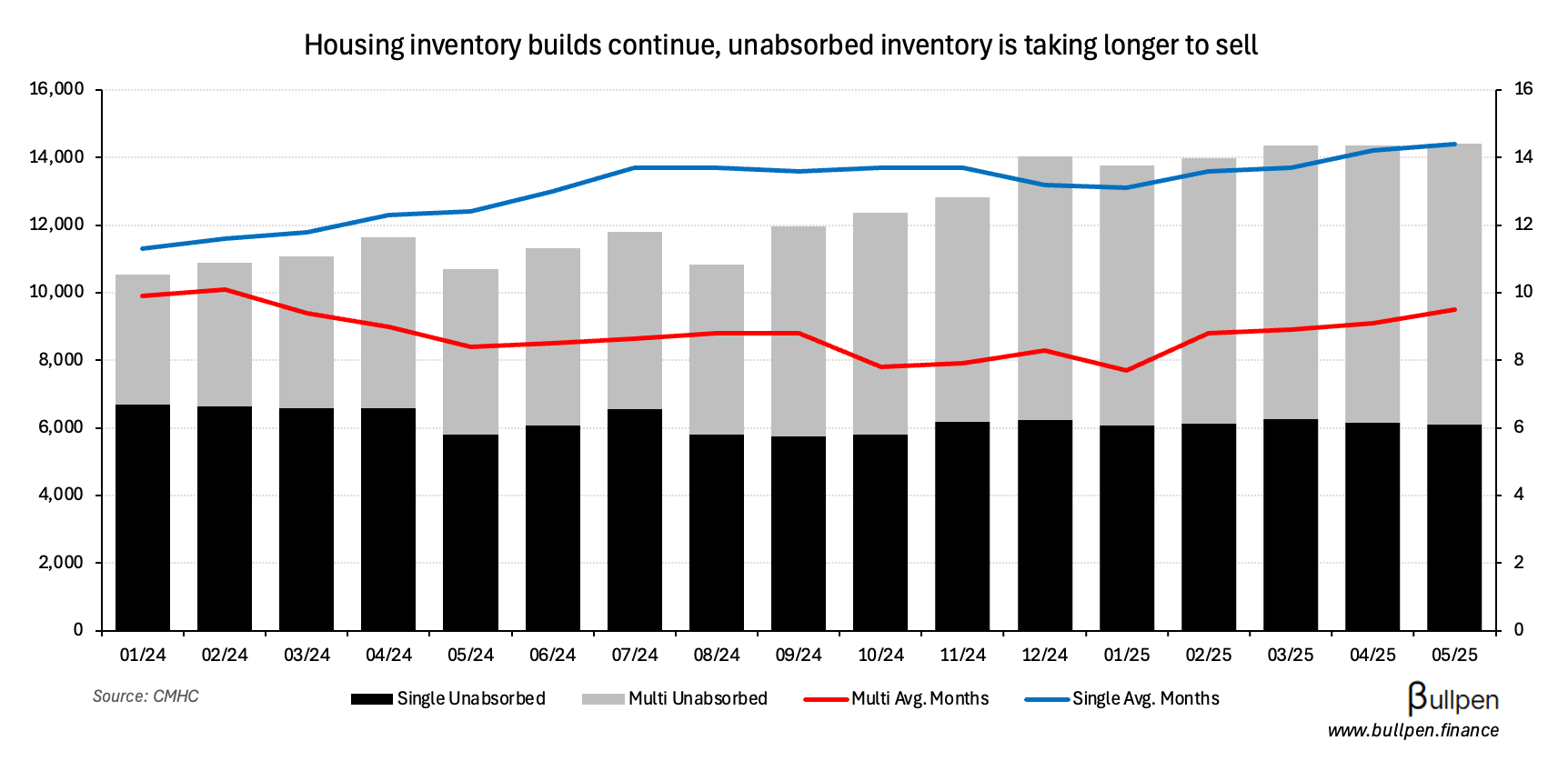

Despite the positive print, construction activity and market absorption of new units continues to trend lower…

… resulting in higher inventory and a longer time on the market.

FUNNY BUSINESS

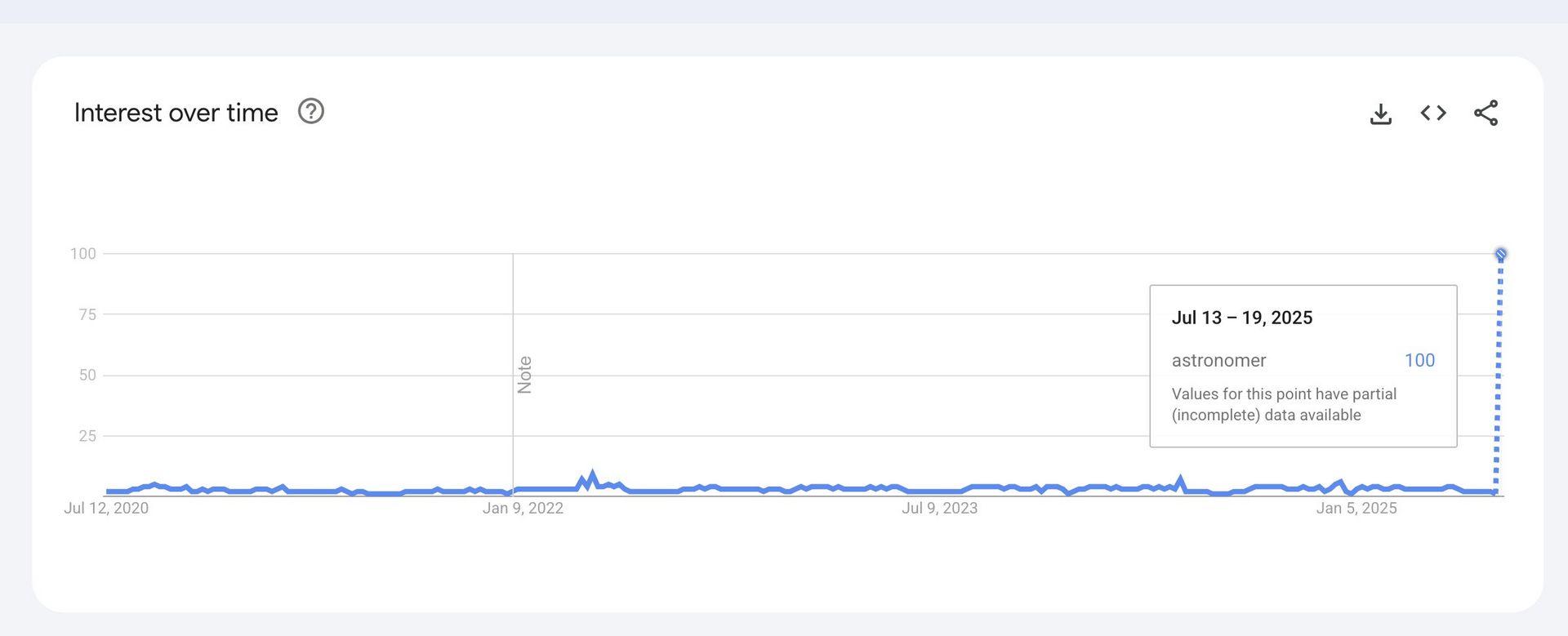

Coldplay took over the internet yesterday (never thought I’d say that). Not because of their music, but due to some high profile shenanigans between the CEO and HR Chief at Astronomer caught on a kiss cam (both married).

Tough scene… but I give at least 10% odds to this tin foil theory: the near-unicorn company just raised $93M in May from leading venture capital players who want to see growth… check out that google search volume!

In a world that increasingly feeds off virality… you never know.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Michael Medline | Empire (EMP-A) | $2.5M |

| Margaret McKenzie | PrairieSky (PSK) | $186K |

ON OUR RADAR

GAINERS & LOSERS

|

| ||||

|

| ||||

|

|

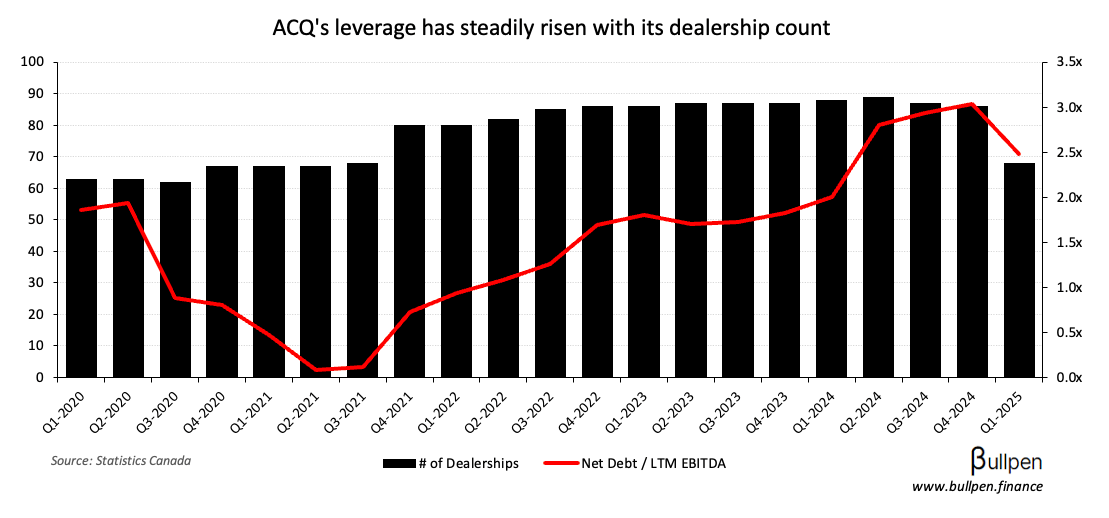

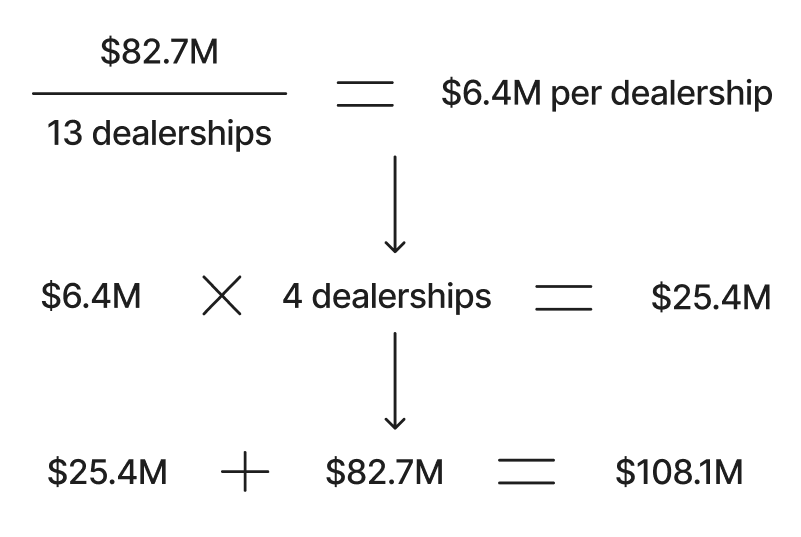

AutoCanada (ACQ) was up 15% after announcing the sale of most of its U.S. dealership footprint for $83M - a move that management said would result in a step-change improvement in the leverage profile.

So why did the market love it so much? The sale was for 13 dealerships and there’s 4 left to go. Should they be able to fetch the same price, that’s another $25M - or ~$110M in total.

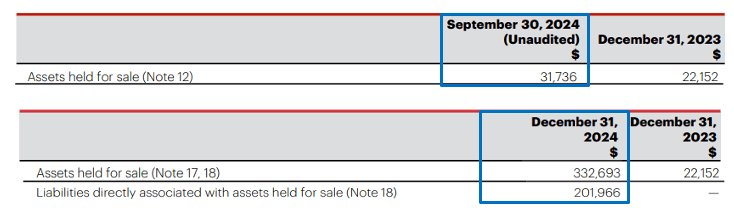

ACQ moved the U.S. segment into discontinued operations at the end of 2024. On the Q4 balance sheet, assets held for sale jumped $300M and liabilities held for sale jumped $200M, meaning the carrying value is around $100M.

So the deal gives the market certainty there won’t be any big writedown, and instead reframes the situation as a potential gain on sale… voila!

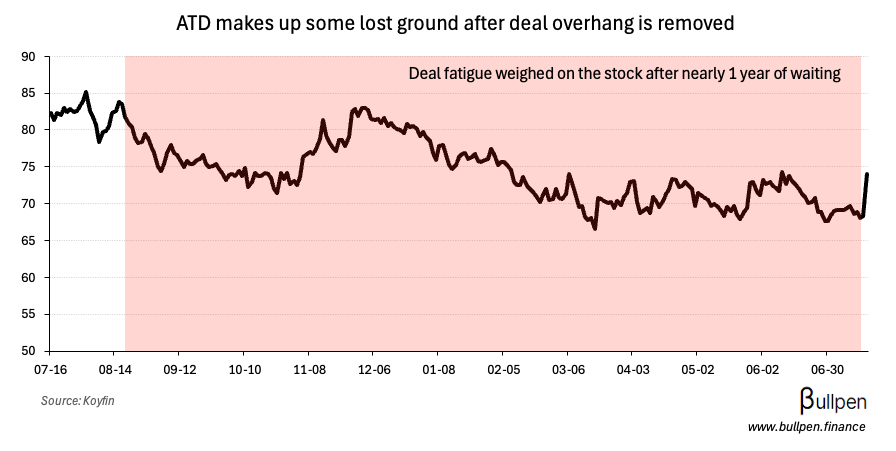

Couche-Tard (ATD) finished 8% higher after withdrawing their ~$50B bid for Seven & i over lack of engagement from the Ito family. The deal has been an overhang on the stock, so investors are likely relieved that it’s over (for now).

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Choice REIT (CHP-U) | 265M | 257M |

| 🇺🇸 Netflix (NFLX) | 7.19 | 7.09 |

| 🇺🇸 Abbott (ABT) | 1.26 | 1.26 |

| 🇺🇸 General Electric (GE) | 1.66 | 1.43 |

| 🇺🇸 PepsiCo (PEP) | 2.12 | 2.03 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇺🇸 American Express (AXP) | AM | 3.88 |

| 🇺🇸 Charles Schwab (SCHW) | AM | 1.06 |

| 🇺🇸 3M (MMM) | AM | 2.01 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 CFIB Biz. Barometer | 50.9 | - |

| 🇨🇦 Foreign Security Buys | -2.8B | -7.3B |

| 🇺🇸 Retail Sales M/M | 0.6% | 0.1% |

| 🇺🇸 Export Prices M/M | 0.5% | 0.0% |

| 🇺🇸 Import Prices M/M | 0.1% | 0.3% |

| 🇺🇸 Jobless Claims | 221K | 235K |

| 🇺🇸 Continuing Claims | 1,956K | 1,970K |

| 🇺🇸 Philly Mftg. Index | 15.9 | -1.0 |

| 🇺🇸 Biz. Inventories M/M | 0.0% | 0.0% |

| 🇺🇸 NAHB Housing Index | 33 | 33 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Building Permits | 8:30AM | 1.39M |

| 🇺🇸 Housing Starts | 8:30AM | 1.30M |

| 🇺🇸 Consumer Sentiment | 10:00AM | 61.5 |

COMMODITIES

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 500+ professionals from: