Gildan's $4.4B Hanes deal could be a sign of things to come

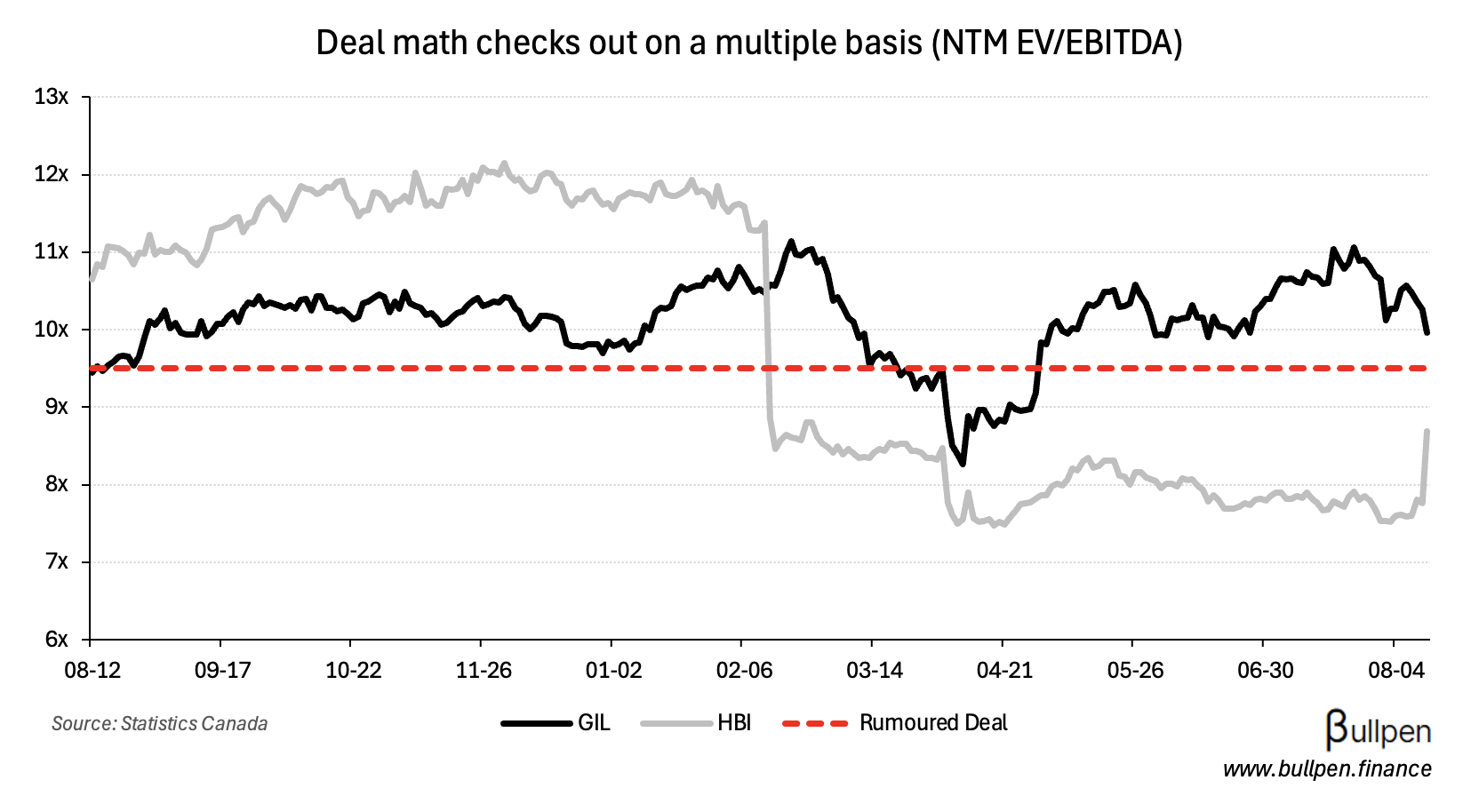

It didn’t take long for the rumour of Gildan’s $5B bid for Hanes to materialize… and better than expected too - with a lower $4.4B price tag representing an 8.9x EBITDA multiple (6.3x post-synergies) that the market rewarded with a 15% bump in shares.

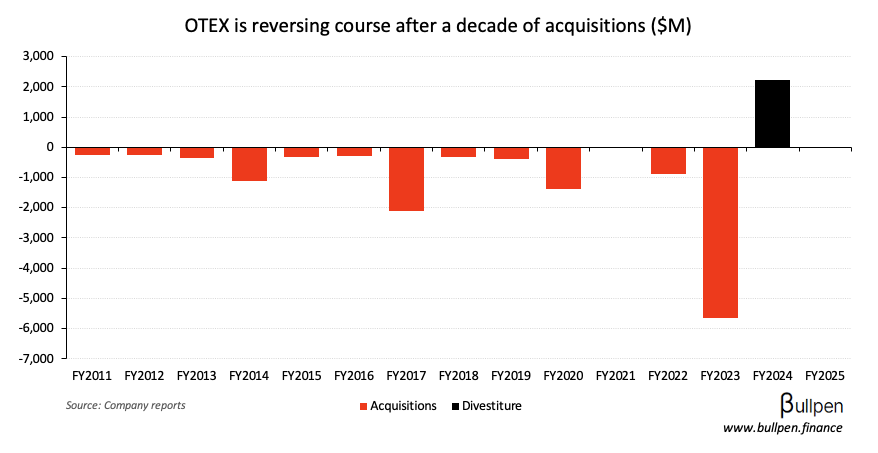

Gildan elected to finance nearly 90% of the equity value with stock - keeping pro-forma leverage at a modest 2.6x, which management expects to get back below 2x shortly with the help of a buyback pause and divestiture of HBI’s Australian unit.

Purchase price: check, financing package: check, strategic rationale: interesting. Cost savings are pegged at ~$200M via higher capacity utilization, overlap in the product mix & manufacturing footprint, and debt refinancing…

… supporting its 3-year guidance for ~20%/yr EPS growth. The combined company is more balanced, both in the products it makes and the path those products take to market.

But most interesting for the long-term investor is how management frames why this transaction works:

… and contrary to what Hanes has been doing, investing in their brand, Gildan has been investing in low-cost vertically integrated manufacturing… that’s where all of our capital has gone in.

Gildan’s manufacturing expertise is the durable advantage - it’s the heartbeat of retail. If it can digest this deal well, don’t be surprised to see it acquire more extremities in the future…

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: