Home prices fall for 3rd month in a row, retail sales drop on cars and booze

|

| ||||

|

| ||||

|

| ||||

|

|

WHAT'S ON TAP

New home prices drop for 3rd month

Retail sales fall on cars, gas, booze

Sydney Sweeney adds $250M

The plot thickens in SCR’s MEG bid

Algoma Steel is in trouble

SVI and FSV jump 10% on earnings

HOT OFF THE PRESS

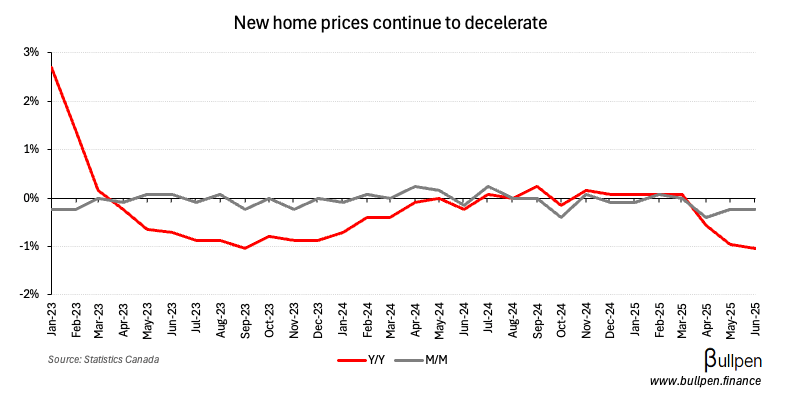

Home prices drop for 3rd month straight

New home prices surprised to the downside in June, falling 0.2% M/M versus estimates for a flat reading - the third straight sequential decline.

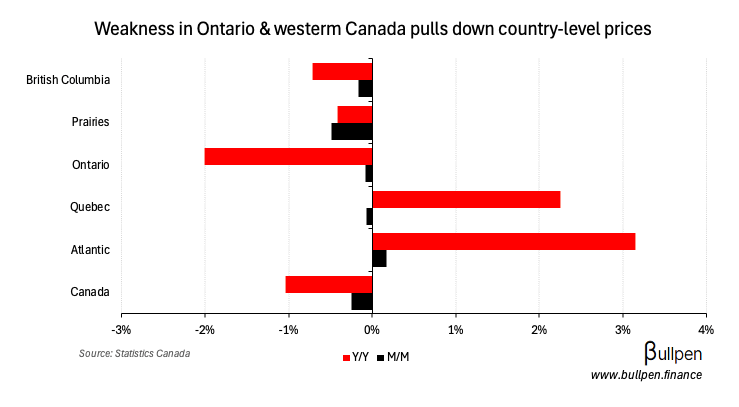

The slowdown was felt almost universally, with all geographic regions except the atlantic softening versus May - especially in the western provinces.

With unabsorbed inventory builds keeping pressure on the housing market, it’s unlikely this will be the last weak month we see this year.

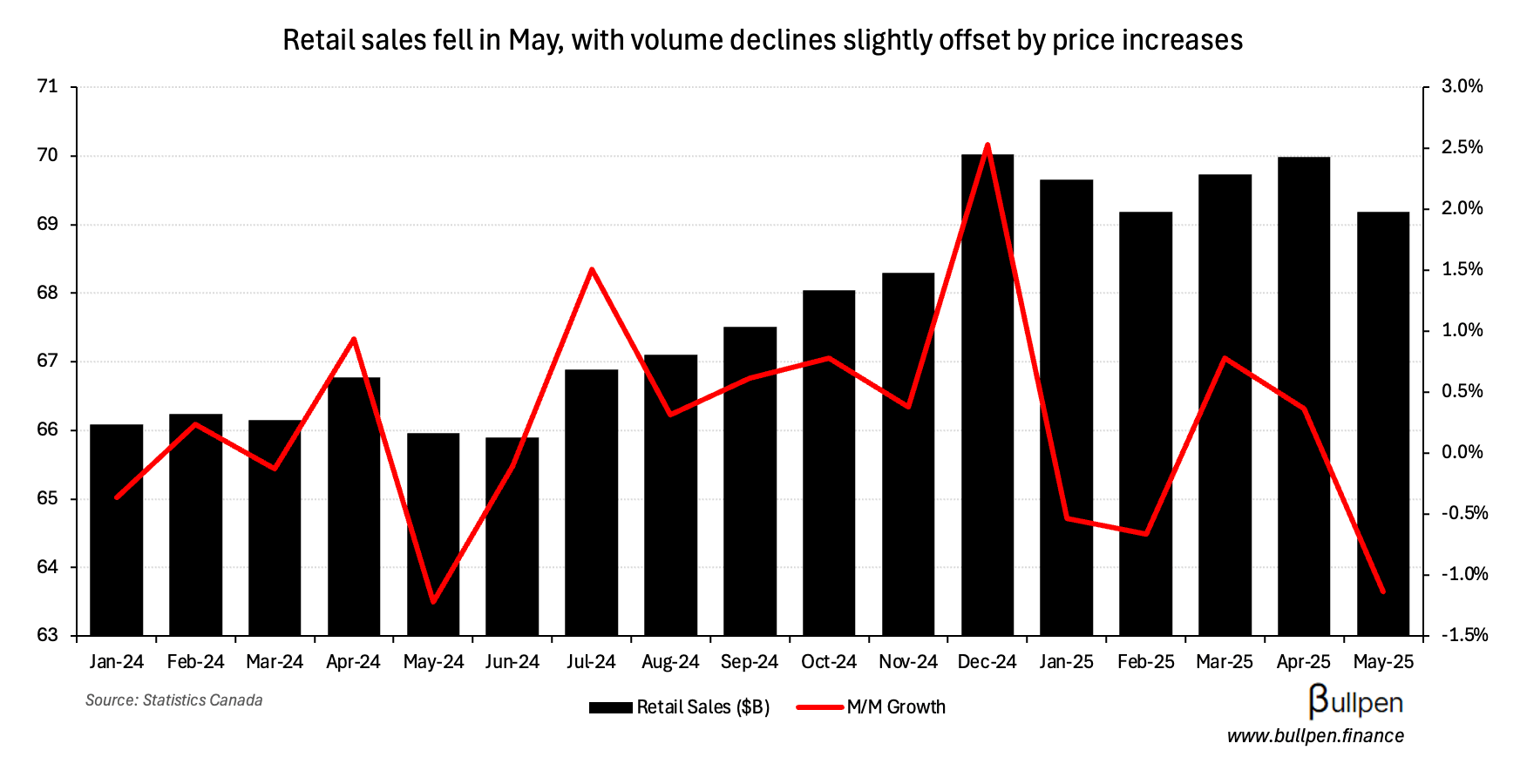

Retail sales fall on cars, gas, and booze

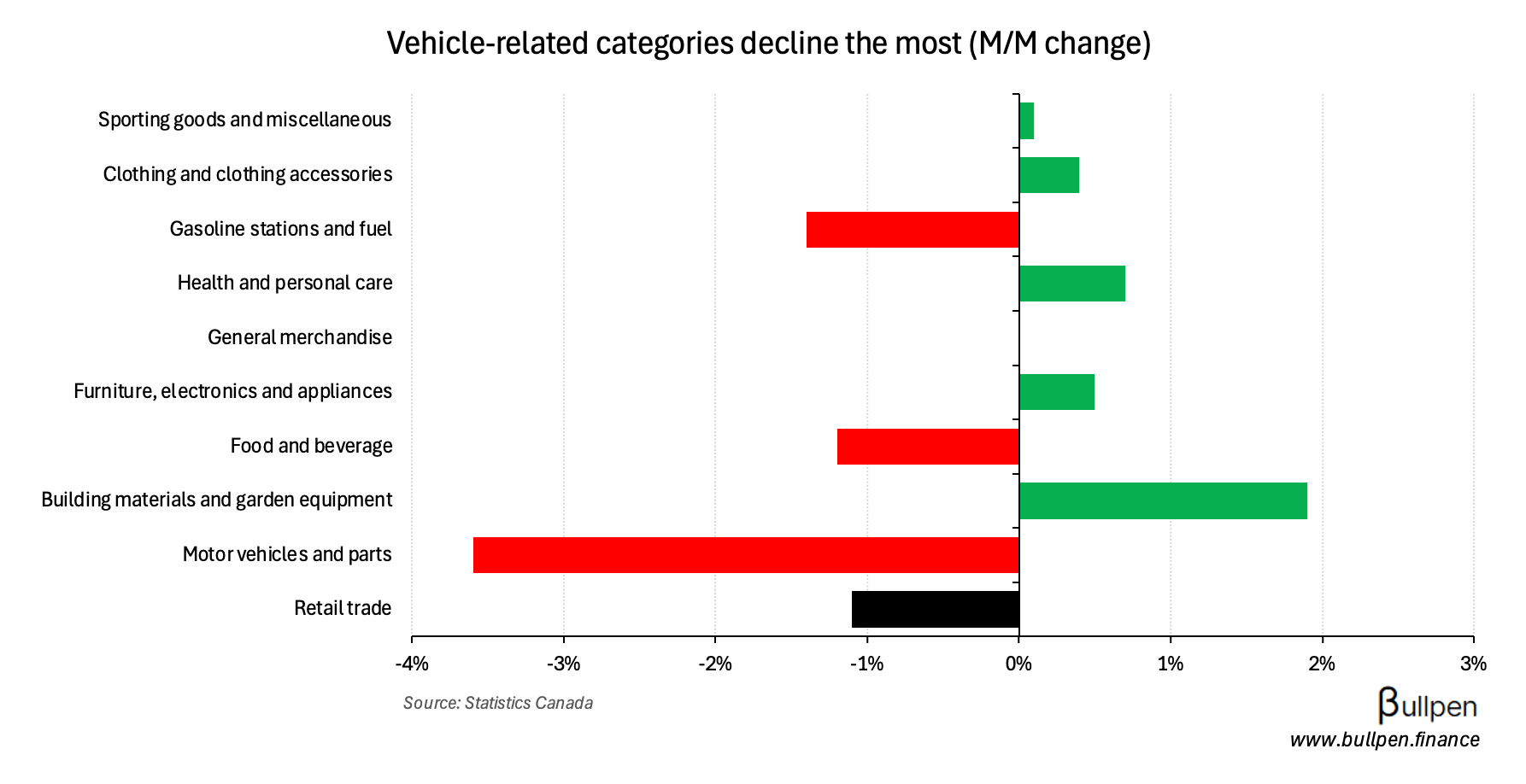

May’s retail sales data shaped up largely as expected, falling 1.1% M/M on the back of a 1.4% decline in volumes, offset partly by higher prices.

The auto sector led the slowdown, down 3.6% due to a near-5% drop in new dealership sales - while gasoline and food weighed on results for the third straight month on lower volumes of both vehicle (-2%) and human fuel (booze, -3%).

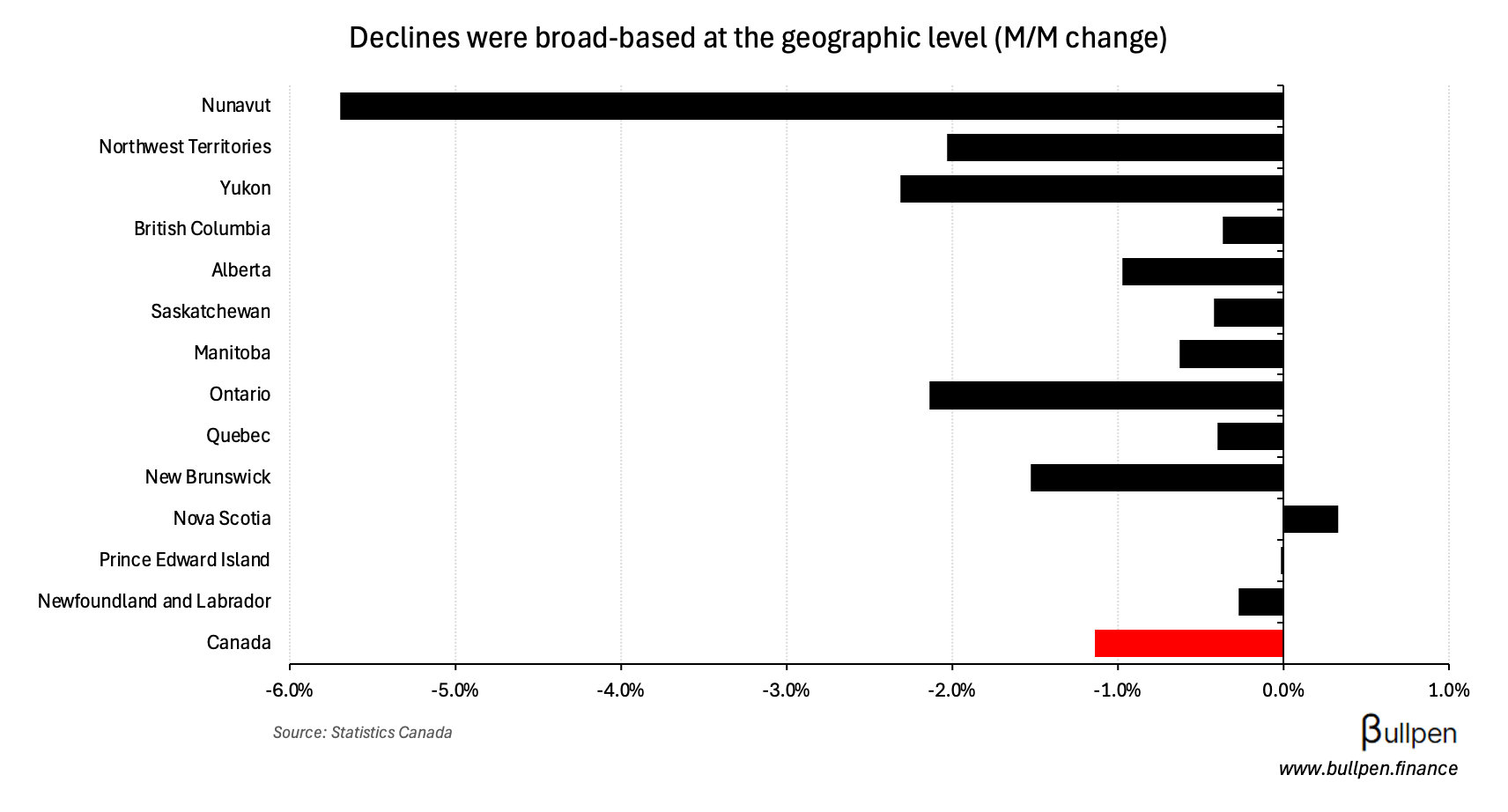

At a regional level, May’s decline was broad-based…

… but that looks set to reverse course in June, with preliminary estimates suggesting a 1.6% lift versus this print.

FUNNY BUSINESS

American Eagle has risen around 15% in the last few days, adding roughly $250M in market cap after launching a marketing campaign featuring Sydney Sweeney.

Now I’m not here to talk about the campaign (my mom reads this), but it underscores an interesting shift in how companies connect with their core audience - and how quickly the market reacts to it. Bud Light is a perfect example:

It’s a new market regime, with the real-time fire hose of information from social media driving trade faster than sell-side can type “channel checks” - I’m just waiting for Canadian consumer names to show up to the party.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Pierre Fournier | TerraVest (TVK) | $496K |

| Shauneen Bruder | Cdn National Railway (CNR) | $999K |

Flagging the CNR buy, which comes after a tough quarter and negative guidance revision - this is what you want to see from management when shares sell off.

ON OUR RADAR

Flagging the rumour that Cenovus (CVE) is going to put a bid in for MEG Energy by Monday - the stock was down 1.5% on financing concerns…

… while Strathcona (SCR) was up 1%, as the company will benefit whether it wins a price war or not - given it accumulated a ~10% stake prior to its initial bid.

GAINERS & LOSERS

|

| ||||

|

| ||||

|

|

Algoma Steel (ASTL) was off 11% after announcing it’s seeking $500M in government financing to weather the storm from U.S. tariffs. It appears Carney’s latest measures to protect the industry aren’t enough, and with ASTL taking a ~$250M hit from 25% tariffs in 2018, the success of this financing could be crucial.

StorageVault (SVI) finished 11% higher on a couple target price bumps, which followed some pretty strong Q2 results that beat estimates thanks to a re-acceleration of self-storage revenue.

Management also highlighted its willingness to keep hitting the buyback, should shares remain undervalued.

FirstService (FSV) jumped 9% on earnings, beating revenue slightly and crushing profit estimates on the back of continued margin expansion. While margin growth should moderate, it’s enough for management to reaffirm guidance.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Mullen (MTL) | 0.21 | 0.31 |

| 🇨🇦 Loblaw (L) | 2.40 | 2.33 |

| 🇨🇦 Teck (TECK) | 0.38 | 0.24 |

| 🇨🇦 FirstService (FSV) | 1.71 | 1.46 |

| 🇨🇦 Winpak (WPK) | 0.49 | 0.62 |

| 🇨🇦 Athabasca (ATH) | 0.11 | 0.14 |

| 🇨🇦 Hammond (HPS) | 1.72 | 1.84 |

| 🇨🇦 Colabor (GCL) | 5.4M | 7.9M |

| 🇨🇦 Ovintiv (OVV) | 1.02 | 1.02 |

| 🇺🇸 Blackstone (BX) | 1.21 | 1.10 |

| 🇺🇸 Union Pacific (UNP) | 3.03 | 2.90 |

| 🇺🇸 Honeywell (HON) | 2.75 | 2.66 |

| 🇺🇸 Intel (INTC) | -0.10 | 0.01 |

| 🇺🇸 Nasdaq (NDAQ) | 0.85 | 0.81 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇺🇸 HCA (HCA) | AM | 6.32 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Retail Sales M/M | -1.1% | -1.1% |

| 🇨🇦 Retail Sales Ex-Auto | -0.2% | -0.3% |

| 🇨🇦 Retail Sales M/M Prel. | 1.6% | - |

| 🇨🇦 Mftg. Sales M/M Prel. | 0.4% | - |

| 🇺🇸 Jobless Claims | 217K | 227K |

| 🇺🇸 Continuing Claims | 1,955K | 1,960K |

| 🇺🇸 S&P Mftg. PMI | 49.5 | 52.6 |

| 🇺🇸 S&P Services PMI | 55.2 | 53.0 |

| 🇺🇸 New Home Sales | 0.63M | 0.65M |

| 🇺🇸 Building Permits | 1.39M | 1.40M |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Budget Balance | 11:00AM | - |

| 🇺🇸 Durable Goods M/M | 11:00AM | -10.8% |

COMMODITIES

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: