|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Unemployment rate rises to 6.8%

TVK keeps the roll-up strategy rolling

Aritzia’s U.S. momentum is building

AFN runs on contained Brazil risk

HOT OFF THE PRESS

Unemployment picks up

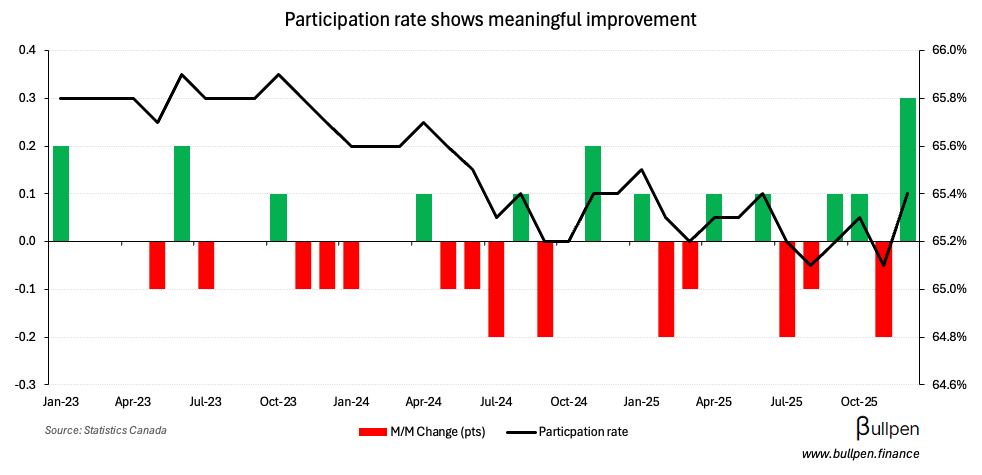

The unemployment rate moved higher to 6.8% in December, above estimates of 6.6% and up from 6.5% in November…

… despite 50K full-time adds, which more than offset a 42K decline in part-time employment (carried results in the prior two months). So, a net 8K gain on an absolute basis…

… that was outpaced by a 30 bps rise in workforce participation, driving the unemployment rate higher.

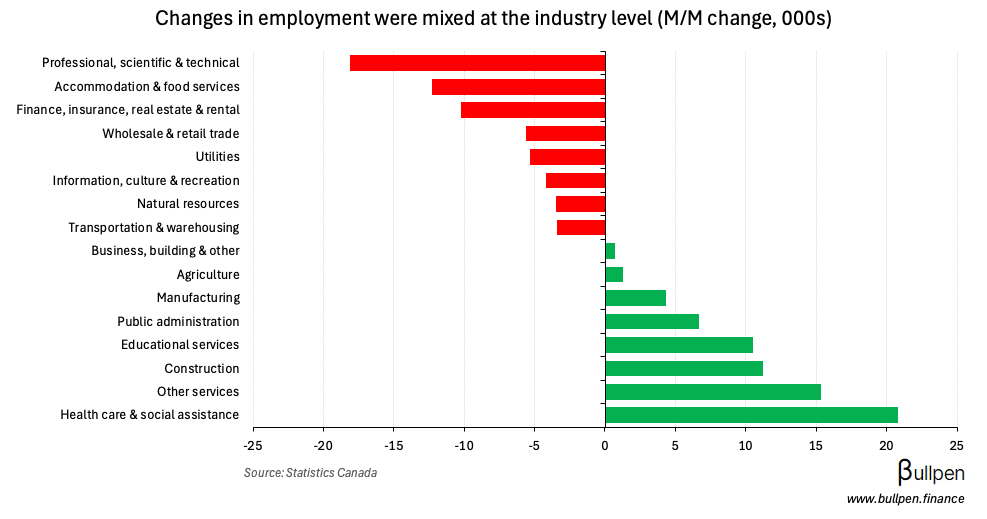

At the industry level results were mixed - but health care, construction, and manufacturing showed continued strength…

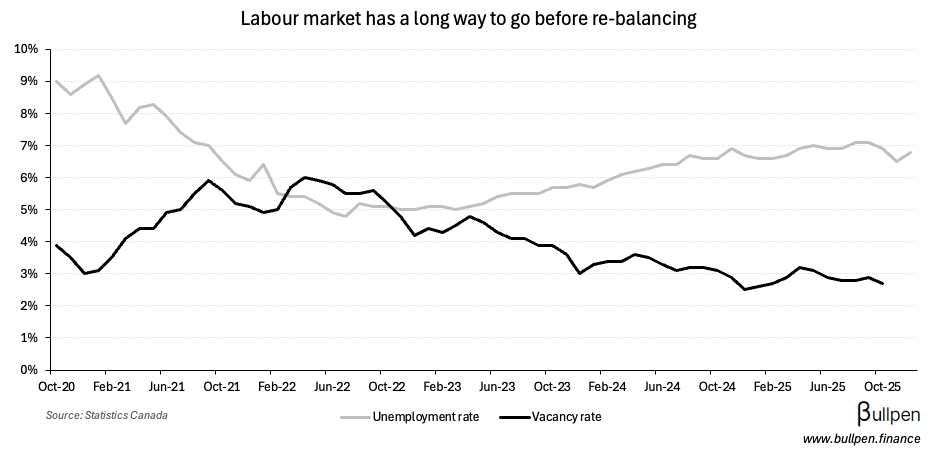

… which we highlighted as likely after the Ivey PMI print. With the imbalance between job seekers and vacancies persisting…

… the labour market is on shaky ground.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

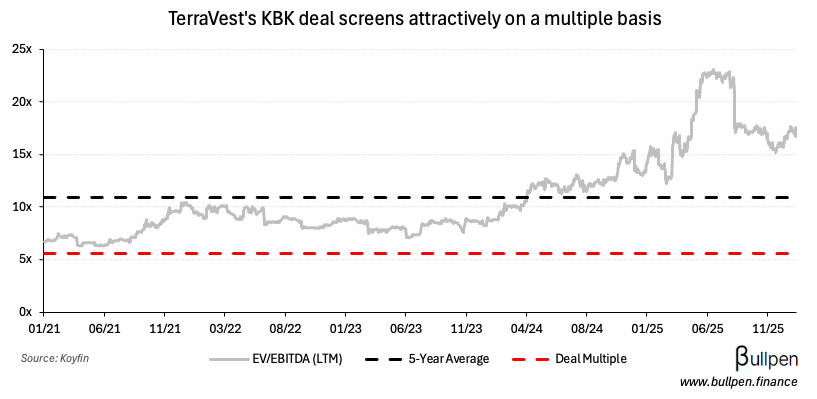

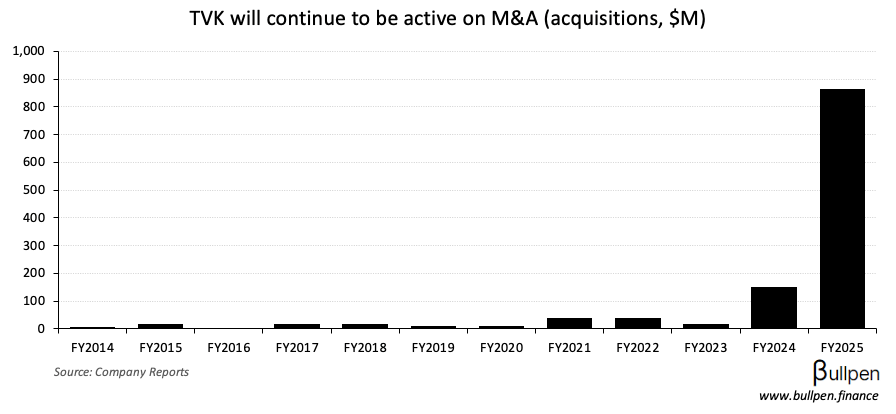

TerraVest (TVK) ran 7% on the back of its $90M acquisition of KBK Industries, representing 5.6x LTM EBITDA - well below where TVK currently trades…

… which should result in a highly accretive deal, even if small. The transaction builds on a series of compressed gas and storage acquisitions in recent years…

… which diversify TVK’s end markets and benefit post-close from the company’s broader sales reach. With receptive equity markets and $1.2B of debt capacity, TerraVest has a lot of rope to keep executing its roll-up strategy.

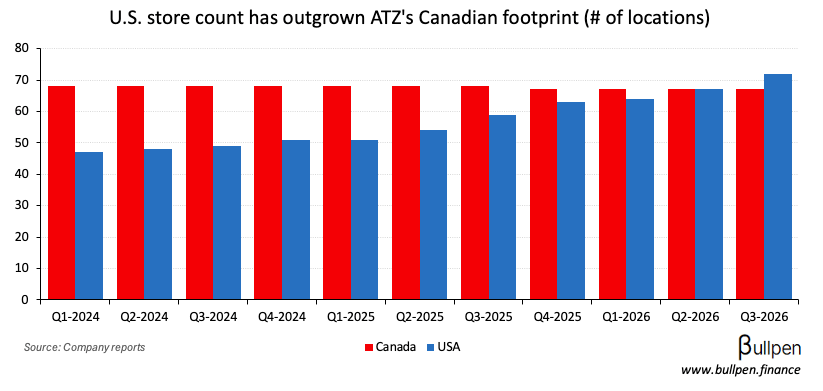

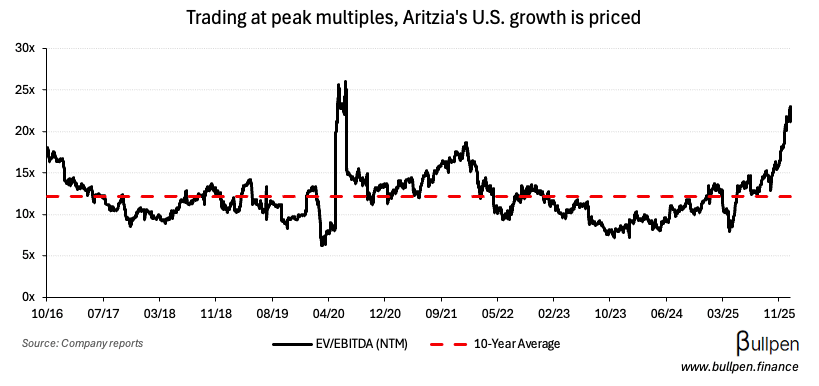

Aritzia (ATZ) added 5% in Friday’s session after another big quarter, with revenue and EPS beating estimates by 11% and 24%, respectively. Results were driven by a continued acceleration in U.S. growth…

… which now has a larger physical footprint than in Canada and a lot of runway left. That’s translating to better margins and FCF conversion…

… but at this point, it’s tough to imagine that’s not priced. Trading at its peak multiple on forward EBITDA, it’s likely that future returns will be more a function of fundamentals than a re-rate.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Brian Lawson | Brookfield (BAM) | $1.9M |

| Jean-Francois Poulin | Great-West (GWO) | $689K |

| John Giamatteo | Blackberry (BB) | $565K |

| Tavis Carlson | Peyto (PEY) | $511K |

| Michael Collens | Peyto (PEY) | $327K |

| Patrick Dussault | BRP Inc. (DOO) | $1.4M |

| Joshua Kobza | Restaurant Brands (QSR) | $232K |

| Dean Swanberg | Zedcor (ZDC) | $471K |

Flagging the buying at Zedcor (ZDC), which brings the insider total to $728K this week. Clearly, they’re not too worried about Amazon’s entry into the market.

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Ag Growth (AFN) | 1.31 | 1.02 |

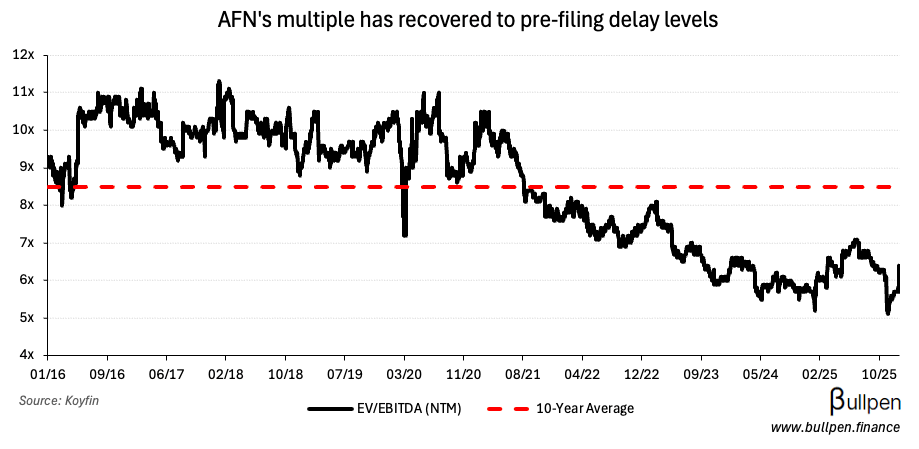

Ag Growth International (AFN) jumped 22% after reporting its Q3 results, which beat estimates on continued strength in the commercial segment…

… specifically in Brazil and EMEA. The former is the reason for the gap up…

… as the cause for the filing delay turned out to be nothing sinister (weak internal controls). With AFN’s valuation returning to pre-delay levels…

… a discount to the long-term average should persist until those issues are resolved.

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 6.8% | 6.6% |

| 🇨🇦 Employment Change | 8K | -5K |

| 🇺🇸 Unemployment Rate | 4.4% | 4.5% |

| 🇺🇸 Non Farm Payrolls | 50K | 60K |

Was this forwarded to you? Join 4,000+ investors reading The Morning Meeting by clicking the button below.