|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Unemployment hits 9-year high

Ivey PMI points to stagnant growth

Carney opens wallet again

Celestica jumps 10% on AVGO Q3

Enghouse falls 8% on tough Q2

HOT OFF THE PRESS

Unemployment hits 9-year high

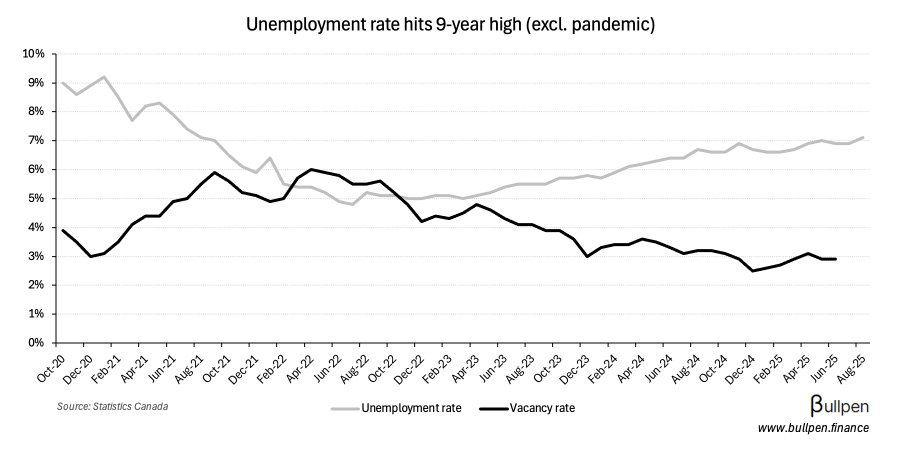

The unemployment rate hit 7.1% in August, the highest level in over nine years ignoring COVID - and worse than expectations for a M/M rise to 7.0%.

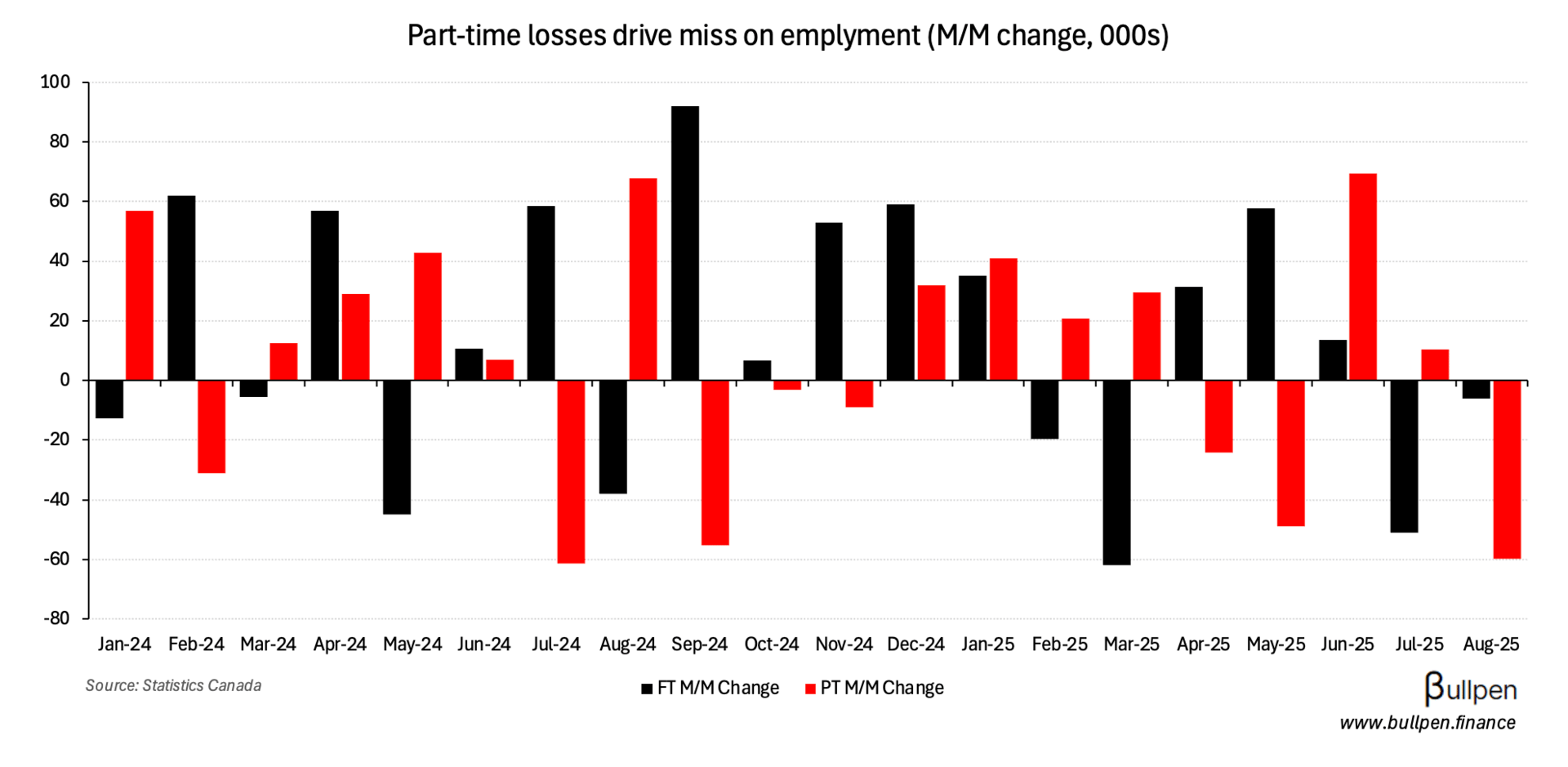

After roughly 50K full-time jobs lost in July, part-time employment was the primary driver this month - shedding 60K jobs…

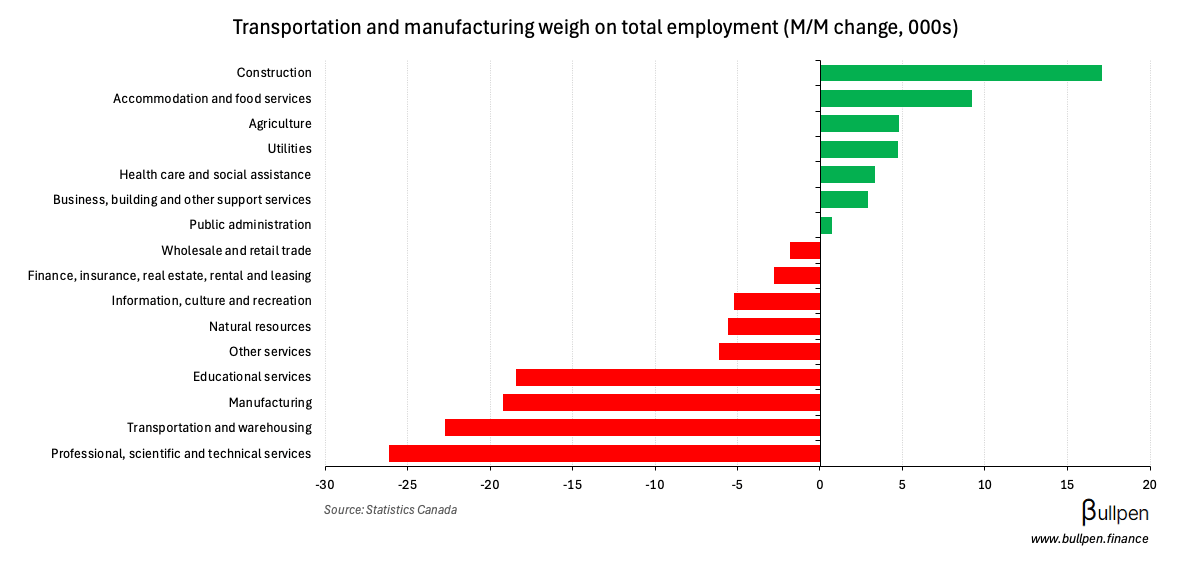

… across multiple industries - led by technical services, transportation, and manufacturing. While the former two have had little YTD variation, manufacturing employment has dropped over 3%…

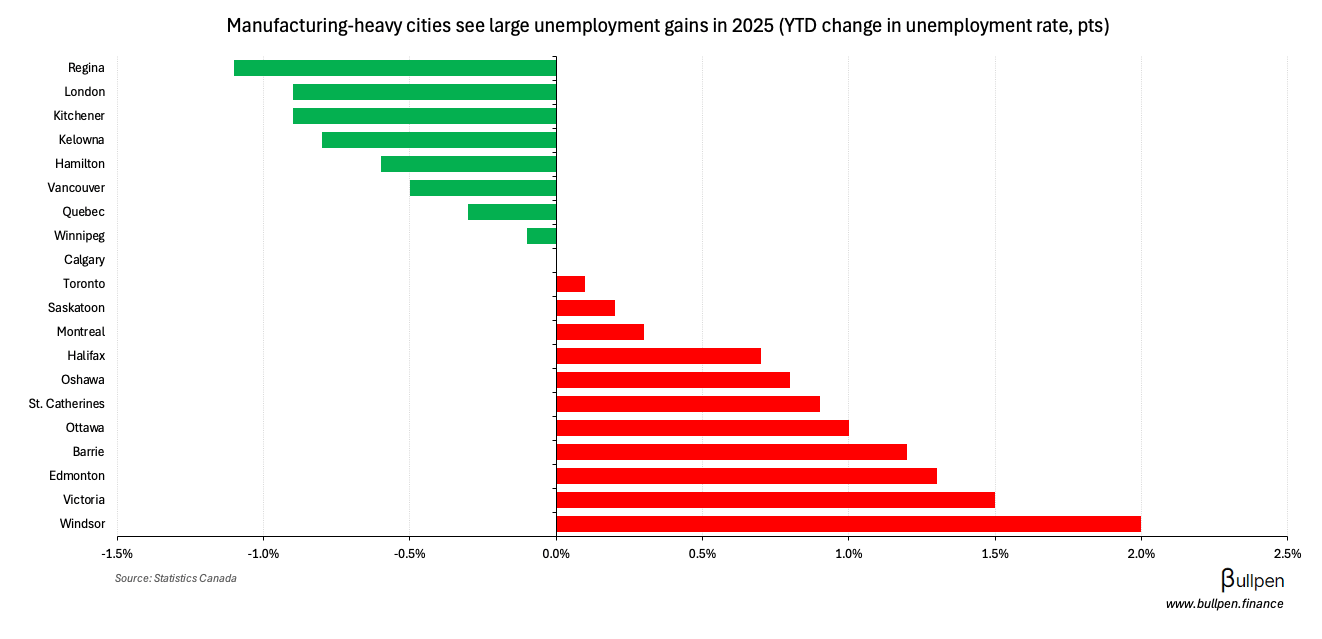

… which is showing up in regional unemployment rates - with areas like Windsor (11.1%) and Oshawa (9.0%) showing large gains in joblessness.

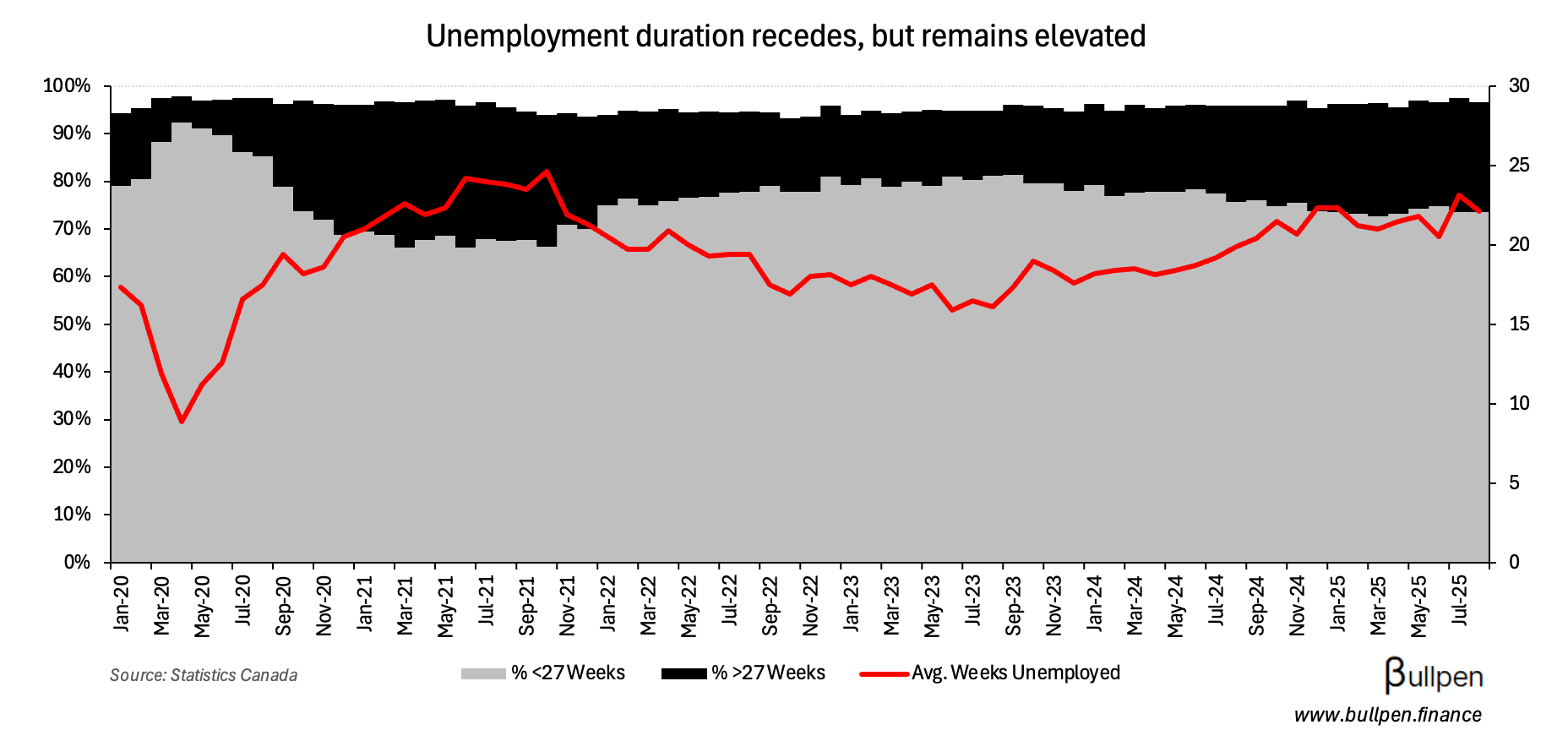

Combined with continued elevation in unemployment duration…

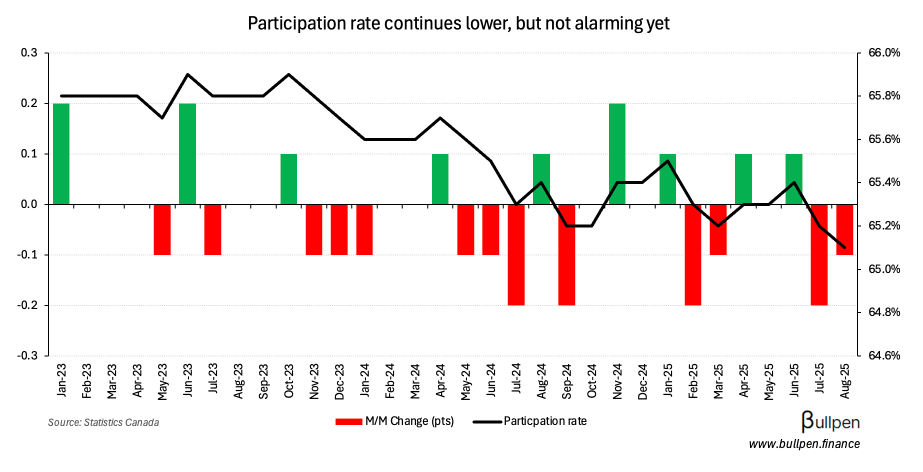

… and downward trending workforce participation, this print has increased the odds for a mid-September rate cut to ~90%.

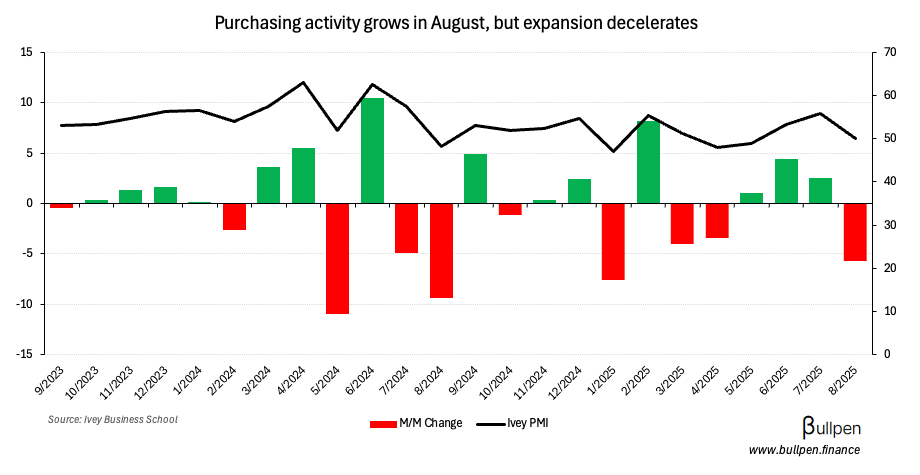

Ivey PMI points to stagnant growth

The Ivey Purchasing Managers Index came in weaker than expectations at 50.1, the first decline in three months and one that puts the index on the cusp of contraction.

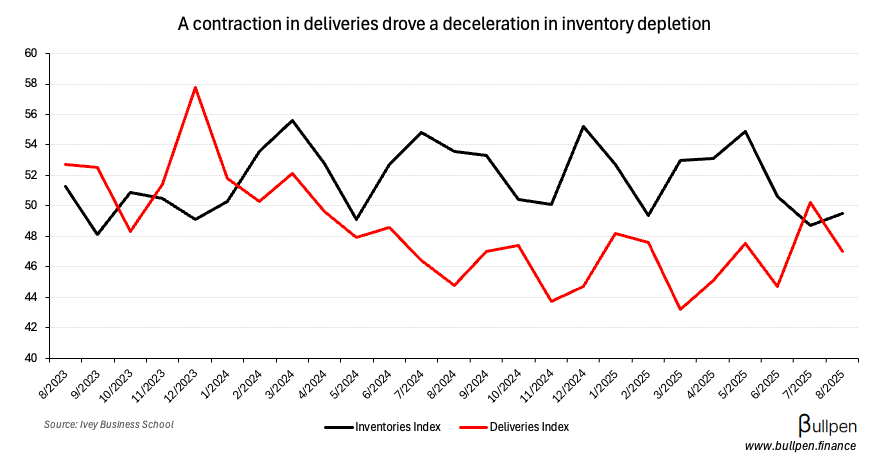

Deliveries fell during the month, slowing down the rate of inventory depletion…

… and employment faltered after a strong July, corroborating the ugly jobs print we broke down above.

FUNNY BUSINESS

Mark Carney’s opening the cheque book again - this time to the tune of $5B, as the government looks to soften the blow of tariffs over and above its previous measures.

As we try to bring this drawn out trade dispute to a resolution, the measures are a necessary bridge - but let’s hope we can reduce government reliance in the future.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Robert Orr | Power Corp. (POW) | $21.0M |

| Claude Genereux | Power Corp. (POW) | $581K |

| Mehmet Yilmaz | Eldorado (ELD) | $214K |

| Shawn Beber | CIBC (CM) | $2.4M |

| Ammar Al-Joundi | Agnico (AEM) | $4.1M |

| Mary Maher | CAE Inc. (CAE) | $239K |

| Yousriya Loza | G Mining (GMIN) | $5.7M |

| Pascal Gauthier | BRP Inc. (DOO) | $2.9M |

| Anne Le Breton | BRP Inc. (DOO) | $798K |

| Annie Biron | BRP Inc. (DOO) | $679K |

| Keith Creel | CPKC (CP) | $8.1M |

| Daniel Dickson | Endeavour (EDR) | $8.1M |

| Shivrani Mudaly | Lightspeed (LSPD) | $200K |

| Mathieu Peloquin | Stingray (RAY) | $245K |

| Ian Robertson | Emera (EMA) | $102K |

| Karine Delbarre | Methanex (MX) | $448K |

| Alison Reed | CGI Inc (GIB) | $100K |

Flagging the selling at BRP Inc. (DOO), which comes on the back of a strong Q2 that sent the stock up nearly 20%.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

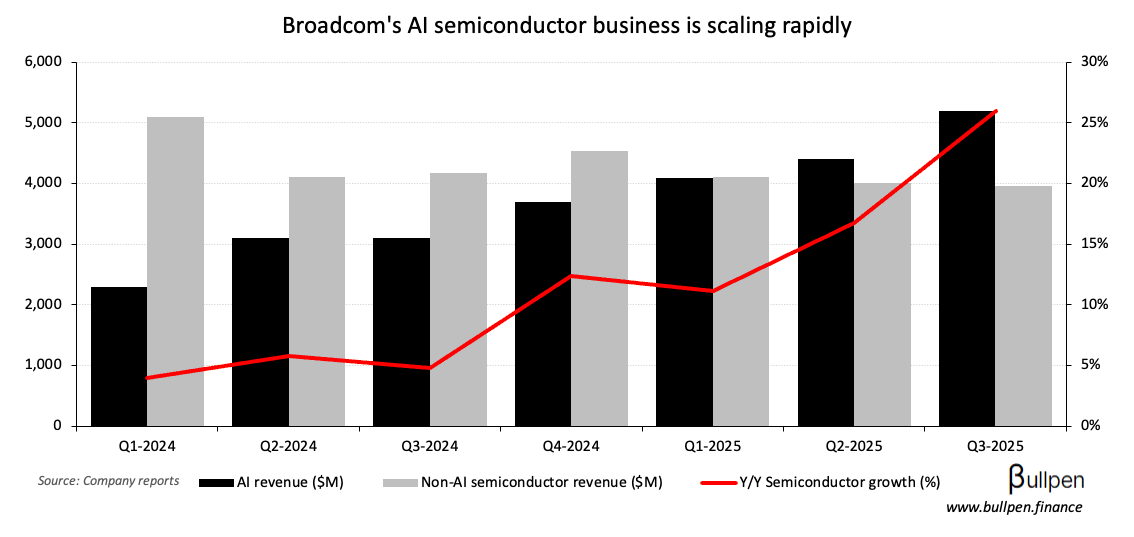

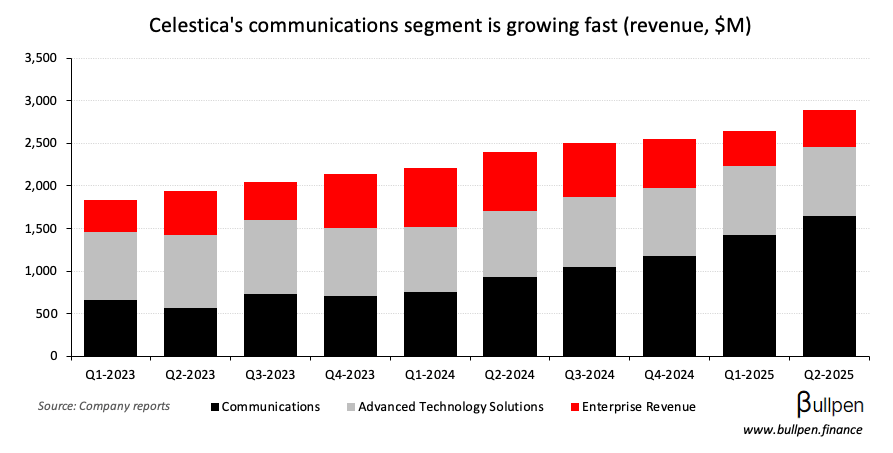

Celestica (CLS) was up 10% on a read-through from Broadcom’s Q3, which beat estimates thanks to strong performance in its AI semiconductor business…

… and came with even stronger guidance - with management calling for 66% Y/Y growth in Q4 and a material improvement versus its original 50-60% guide for 2026.

… we’re seeing the growth rate accelerate as opposed to just remain steady at that 50%, 60%. We are expecting and seeing 2026 to accelerate more than the growth rate we see in 2025.

Supporting that guide are continued share gains at the hyperscalers and a rumoured $10B deal with OpenAI, which was immediately reflected in analyst estimates for Broadcom - but not for Celestica.

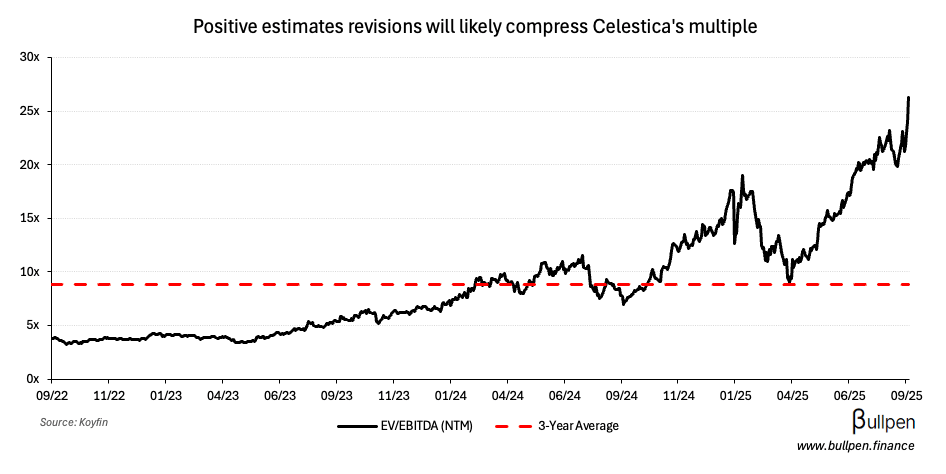

Given much of Celestica’s communications business is built around Broadcom chips, it’s reasonable to assume that higher guidance should flow through…

… and positive estimates revisions should follow - making Celestica’s premium multiple a little more palatable.

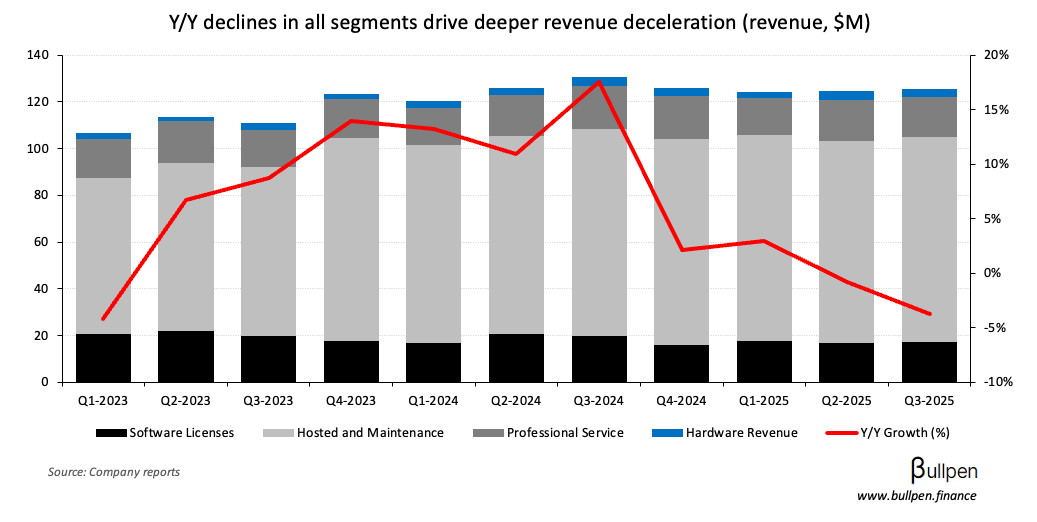

Enghouse Systems (ENGH) fell 8% on its Q3 results, which missed on both top and bottom line - with revenue growth in all segments deteriorating…

... alongside margins, which compressed on sales mix and integration costs.

With uncertainty around the timing of its M&A pipeline, these two negatives could persist for the quarters to come.

As noted last quarter, we continue to see substantial acquisition opportunities, which will provide a return on our investment, but uncertainty continues to lay in completion of our backlog of these opportunities.

EARNINGS

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Major Drilling (MDI) | PM | 0.18 |

| 🇨🇦 North West Co. (NWC) | PM | 0.76 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 7.1% | 7.0% |

| 🇨🇦 Employment Change | -65.5K | 7.5K |

| 🇨🇦 Ivey PMI | 50.1 | 53.1 |

| 🇺🇸 Non-Farm Payrolls | 22K | 75K |

| 🇺🇸 Unemployment Rate | 4.3% | 4.3% |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.