|

|

||||

|

|

||||

|

|

||||

|

|

Annnnnd we’re back! Thanks for all the get well wishes. To make up for lost time, this Morning Meeting is a recap piece from my time away. Back to normal next week.

WHAT'S ON TAP

$150M surplus is the first in 8 months

TCL sells packaging business for $2B

EQB and LB deals overshadow Q4

VBNK jumps 11% on U.S. guide

HOT OFF THE PRESS

First surplus in 8 months

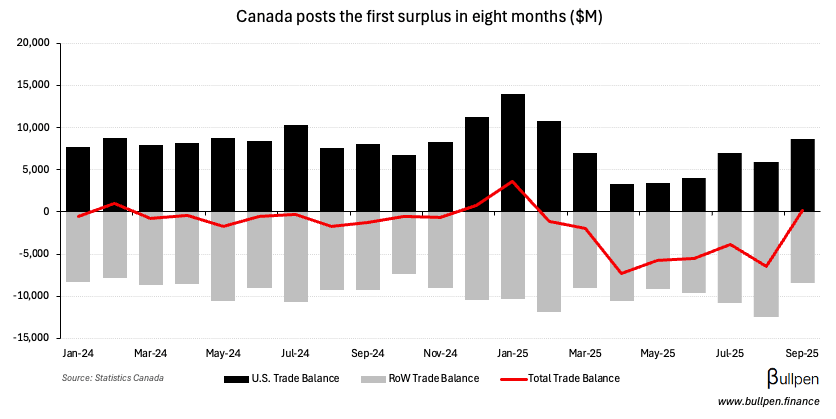

September’s ~$150M trade surplus was the first in eight months, tracking ahead of expectations for a $4.5B deficit and improving versus August’s $6.4B…

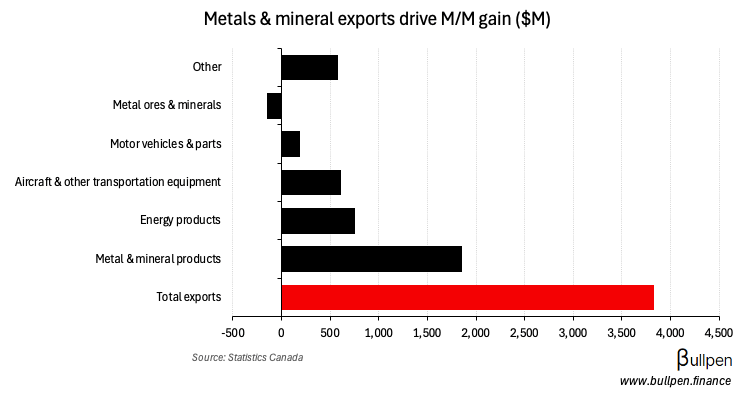

… largely due to metals and minerals (gold, silver, platinum, etc.), which carried exports to a 6% M/M gain…

… and imports to a 4% decline, with the help of a 6% drop in consumer goods.

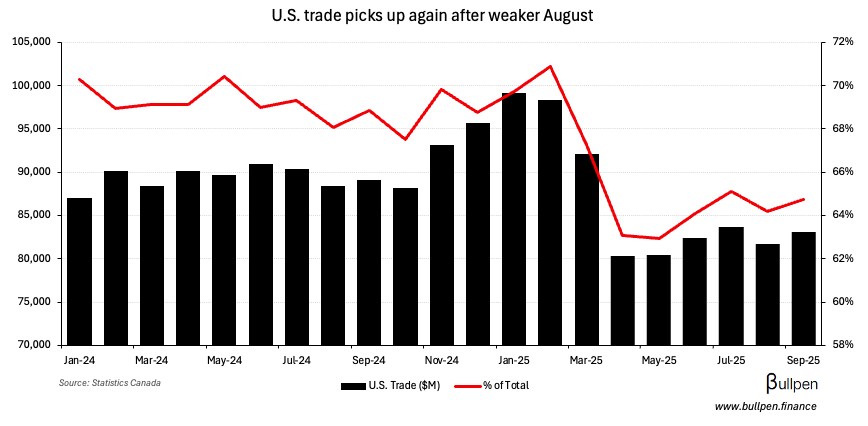

While the print was pretty one-sided, U.S. activity rebounded after a sluggish August - which will be needed to keep total trade balanced going forward ($8.6B surplus is the largest since February).

Some macro bites from my week off:

TCL nets $2B in packaging unit sale

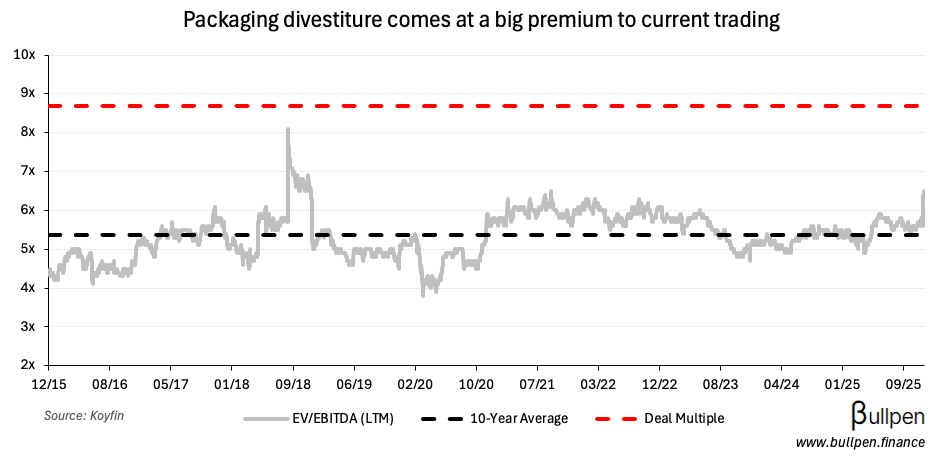

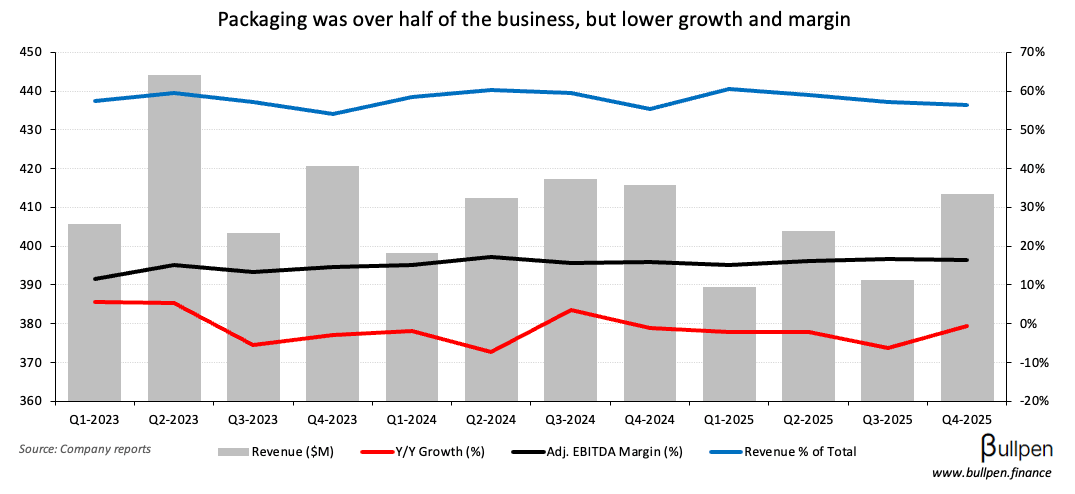

Transcontinental (TCL-A) jumped 20% on the back of its announced $2.2B packaging unit divestiture, a price tag that translates to ~9x LTM EBITDA - well above where the stock has traded historically…

… which limited its ability to grow accretively through M&A. Organic growth has been sluggish too, making now as good a time as any to take the off-ramp.

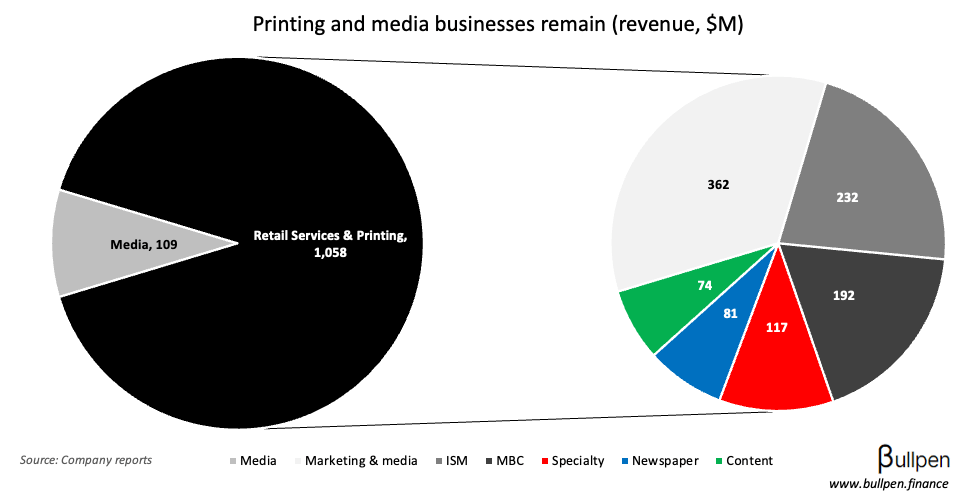

Post-close, management plans to make a $20/sh cash distribution and tighten its focus on the printing and media businesses - citing a healthy M&A pipeline...

… that it believes can close at 4-5X EBITDA. Those numbers make sense on the back of the napkin, so we could see more deals like its Middleton Group acquisition soon.

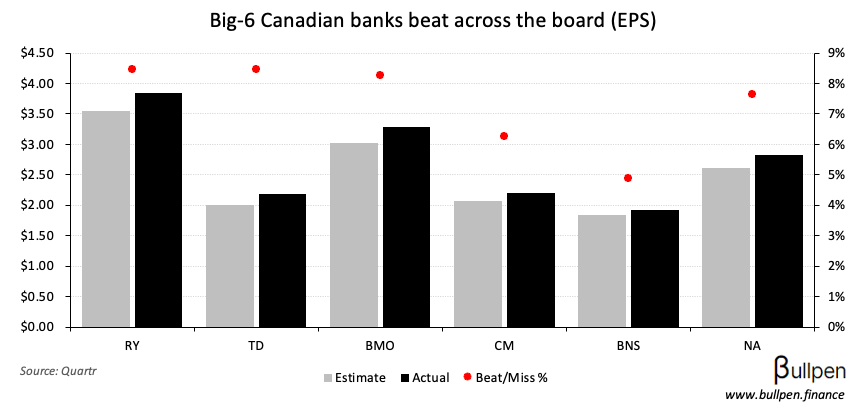

EQB and LB deals overshadow banks Q4

While Canadian banks posted another strong quarter, underpinned by continued capital markets strength and improved credit outlooks - a number of deals in the sector stole the spotlight…

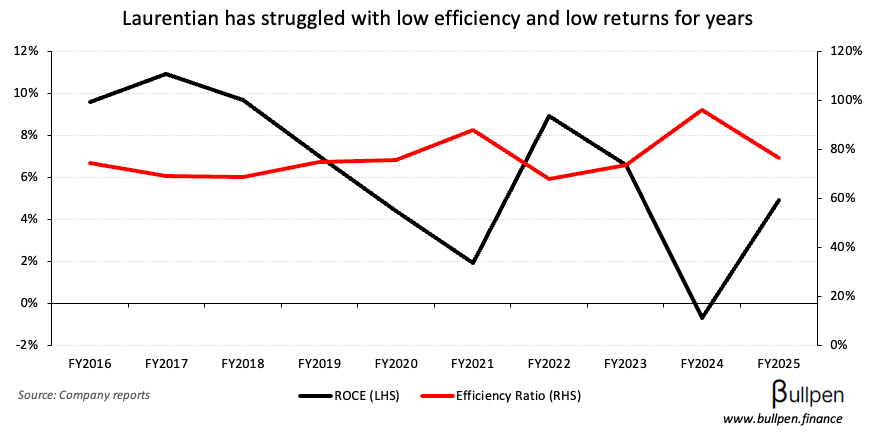

… starting with two transactions to put Laurentian Bank (LB) out of its misery. Fairstone Bank is the ultimate buyer, paying $1.9B - or 0.7x book value…

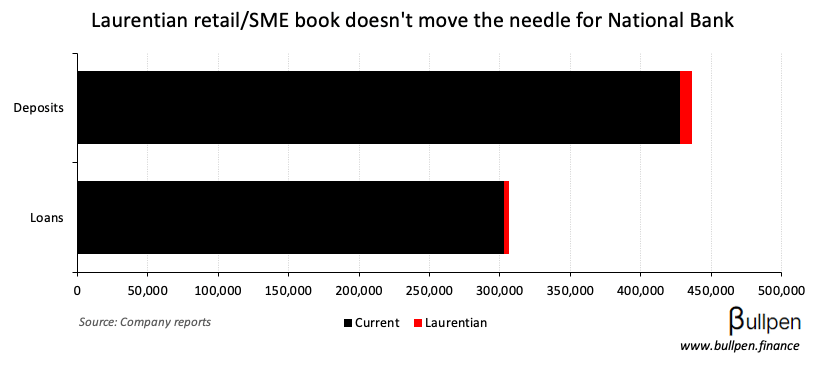

… but only for the commercial book, with National Bank (NA) swooping in to buy its retail and SME portfolio. The lack of interest in acquiring the entire platform is likely why LB’s 2023 review ended in no takeout…

… and with the retail/SME book only offering 1-2% accretion for NA, the deal is a bit of a nothingburger.

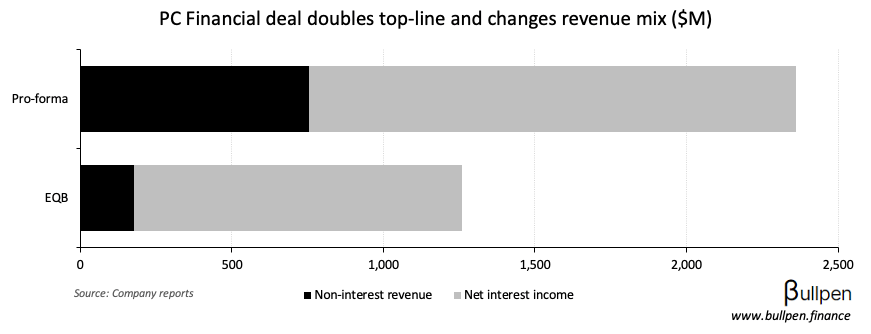

More interesting is EQB’s $800M purchase of PC Financial from Loblaw, which could go either way. The deal quadruples EQB’s customer base, nearly doubles revenue, provides a new source of deposits, and adds a physical network…

… but it was funded by equity after a post-Q3 sell off, with Loblaw taking a 17% stake and two board seats (they might be the real winner here).

Despite the 1.15x book value multiple paid, management is calling for mid-single-digit EPS accretion in year one (cost/funding synergies) - with future upside from cross-selling opportunities.

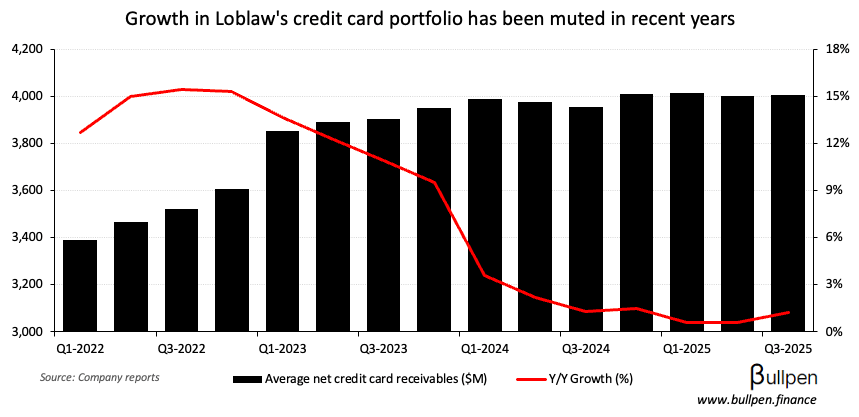

Those will take execution to materialize, as will restarting growth in the portfolio…

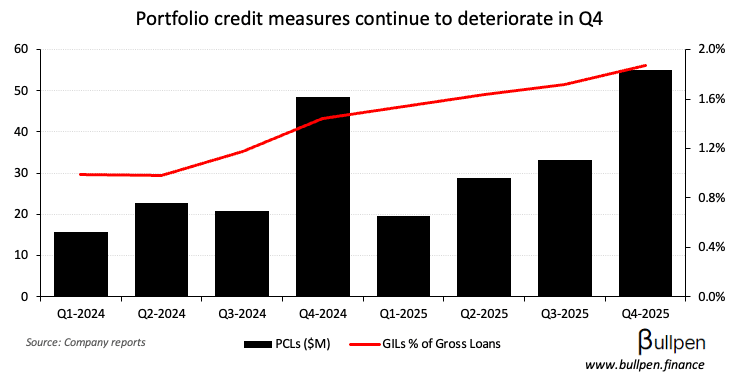

… and managing credit risk, with the deal more than doubling PCLs - which have been a source of investor concern lately.

The market has taken the deal well (up >10%) but time will tell - if nothing else, you can’t hate the new CEO taking a big swing early.

ON OUR RADAR

Canada pauses, USA cuts rates

TMX releases equity financing and consolidated trading stats

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

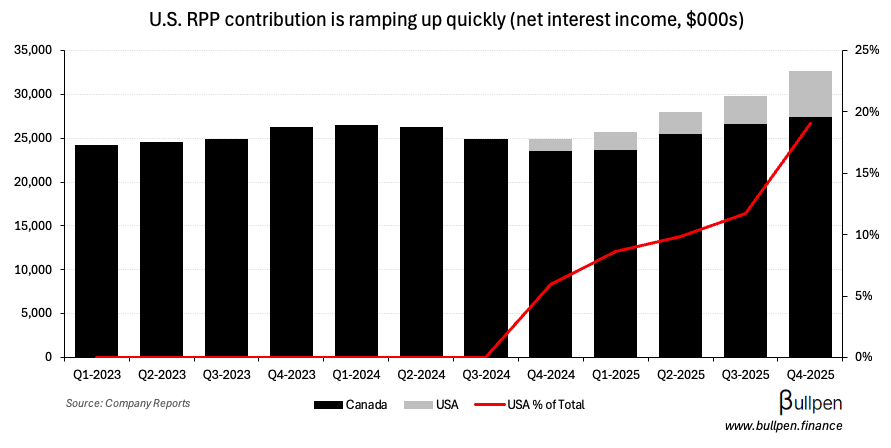

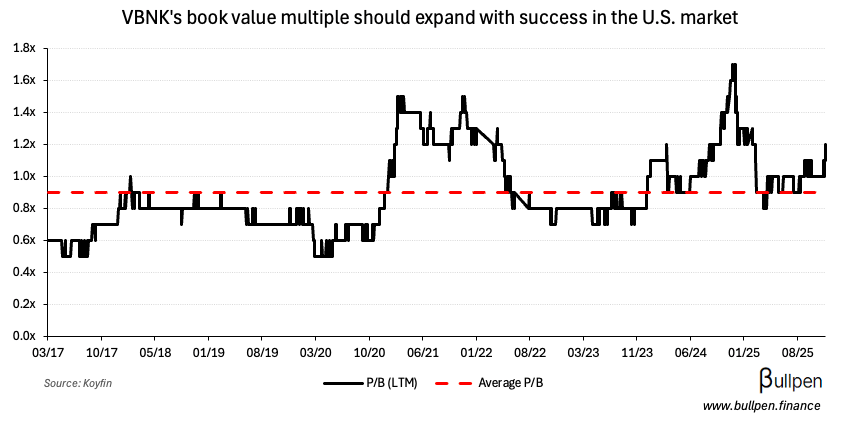

VersaBank (VBNK) gained 11% on the back of a Q4 that missed small but came with a $1B U.S. funding target for 2026, more than 3x 2025 volumes…

… and supported by existing partners. If VBNK can meet or beat its guide, the market could warm up to this story quickly.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Rajagopal Viswanathan | Scotiabank (BNS) | $4.9M |

| Gary Sugar | Seabridge (SEA) | $209K |

| Jared Green | Emera (EMA) | $326K |

| John Hilton | BleMetric (BLM) | $263K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Transcontinental (TCL-A) | 0.82 | 0.87 |

| 🇨🇦 Major Drilling (MDI) | 0.17 | 0.17 |

| 🇨🇦 Empire (EMP-A) | 0.69 | 0.70 |

| 🇨🇦 D2L Inc. (DTOL) | 0.11 | 0.12 |

| 🇨🇦 Dollarama (DOL) | 1.17 | 1.10 |

| 🇨🇦 TerraVest (TVK) | 0.83 | 0.64 |

| 🇺🇸 Costco (COST) | 4.50 | 4.27 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Trade Balance | 0.2B | -4.5B |

| 🇨🇦 Exports | 64.2B | - |

| 🇨🇦 Imports | 64.1B | - |

| 🇺🇸 Trade Balance | -52.8B | -63.3B |

| 🇺🇸 Exports | 289.3B | - |

| 🇺🇸 Imports | 342.1B | - |

| 🇺🇸 Jobless Claims | 236K | 220K |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | 9:30AM | -1.4% |

| 🇨🇦 Capacity Utilization | 9:30AM | 79.3% |

| 🇨🇦 Wholesale Sales M/M | 9:30AM | -0.1% |

Was this forwarded to you? Join 4,000+ investors reading The Morning Meeting by clicking the button below.