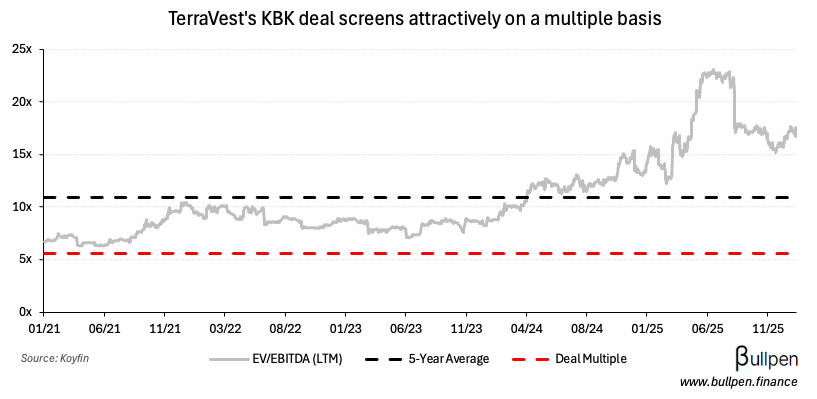

TerraVest (TVK) ran 7% on the back of its $90M acquisition of KBK Industries, representing 5.6x LTM EBITDA - well below where TVK currently trades…

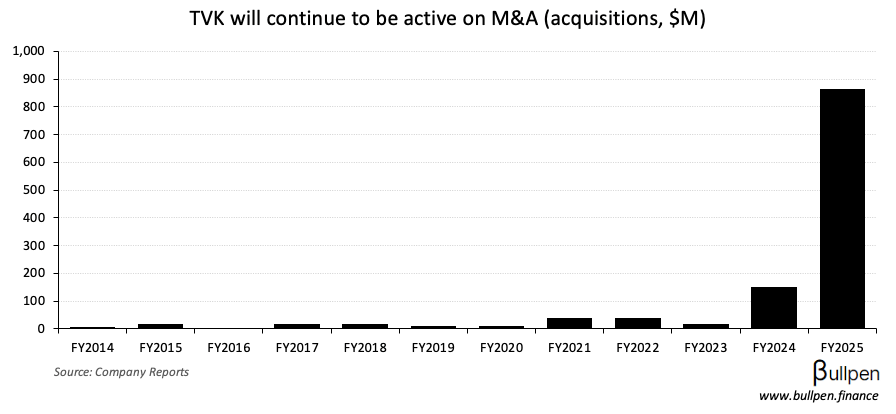

… which should result in a highly accretive deal, even if small. The transaction builds on a series of compressed gas and storage acquisitions in recent years…

… which diversify TVK’s end markets and benefit post-close from the company’s broader sales reach. With receptive equity markets and $1.2B of debt capacity, TerraVest has a lot of rope to keep executing its roll-up strategy.