|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Record non-U.S. trade grows deficit

Payroll employment edges lower

Bombardier is back in Trump’s scope

5N Plus runs 20% on DoW funding

HOT OFF THE PRESS

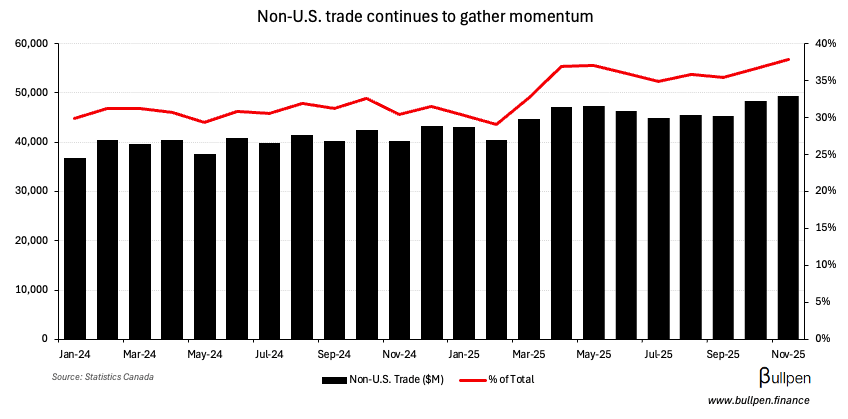

Record non-U.S. trade

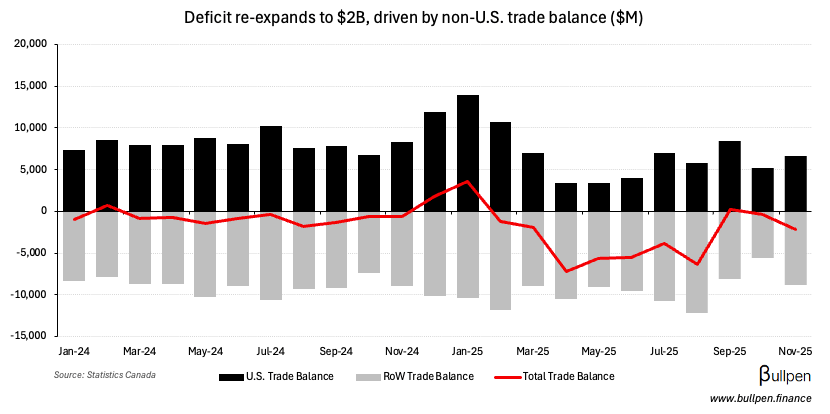

November’s $2.2B trade deficit missed expectations by $1.5B, expanding over last month’s print…

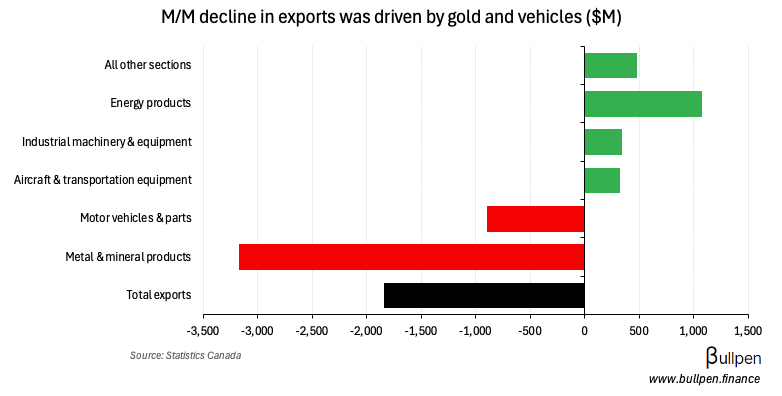

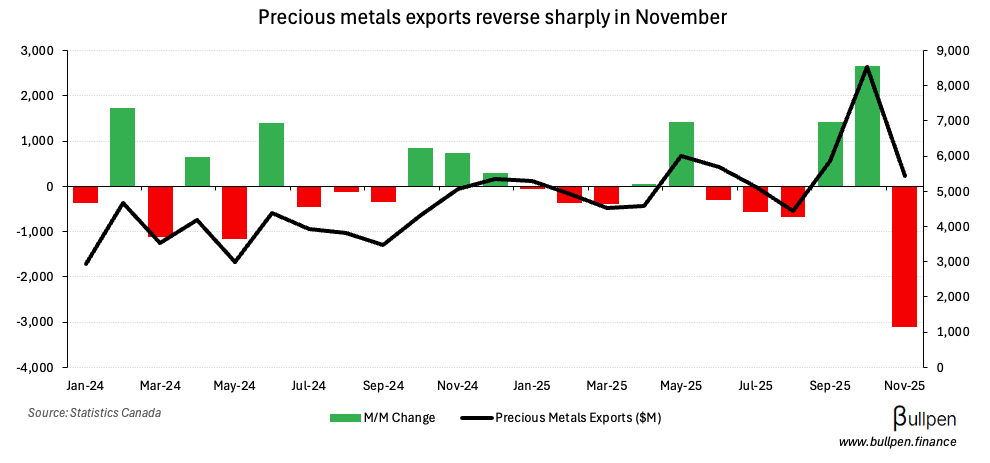

… on the back of a ~3% decline in exports, led by a three-year low in vehicles (down 12%) and a 24% drop in precious metals…

… which erased all of last month’s gain.

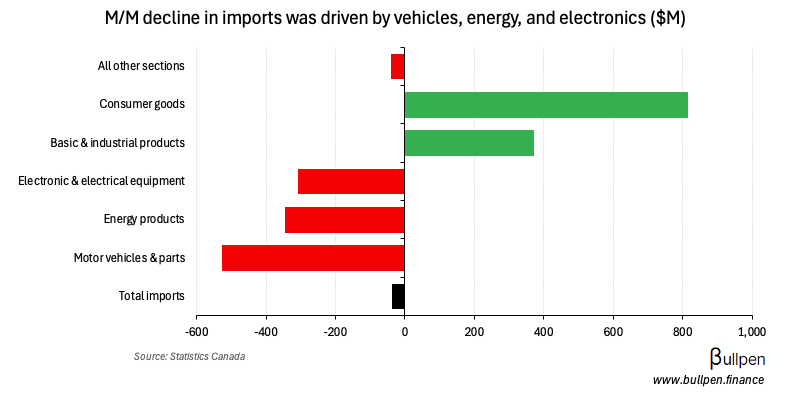

Imports declined slightly, driven by a mixed bag at the category level…

… but the geographic split was more telling, with U.S. imports falling 5% to a three-year low while other international imports jumped 8% to a new record.

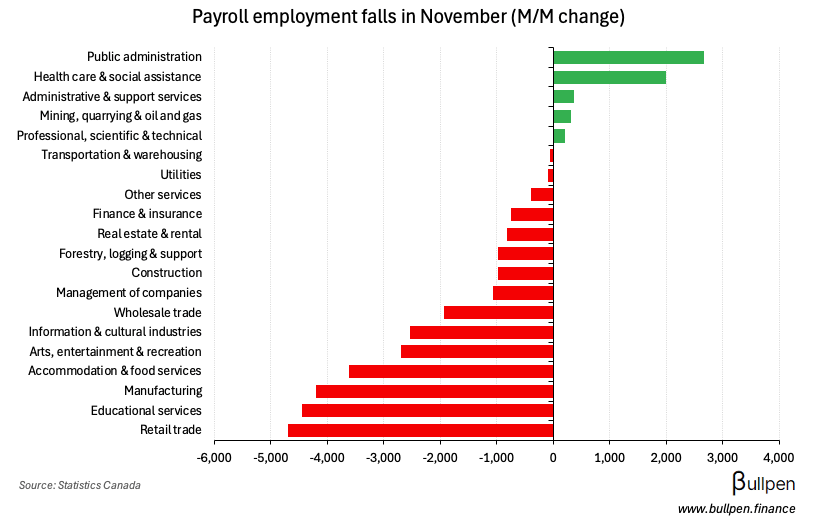

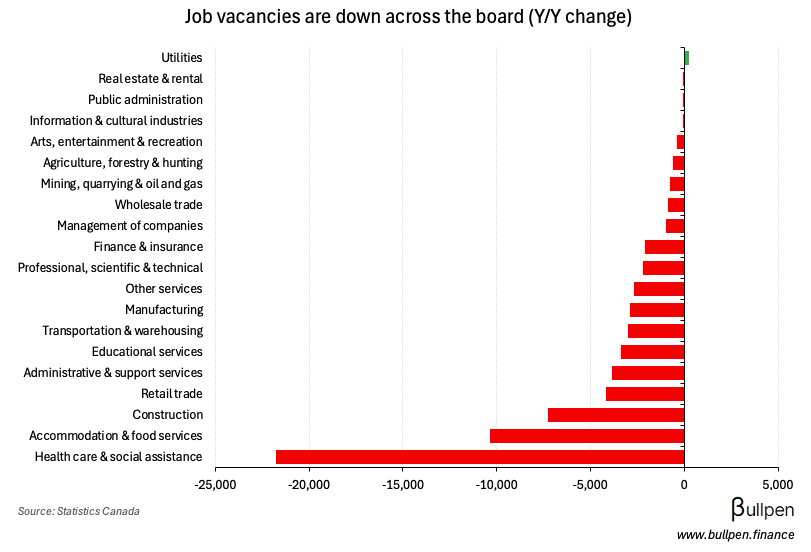

Payroll employment and job vacancies fall

Payroll employment fell 0.1% in November, with broad-based declines led by retail trade, education, and manufacturing offsetting continued strength in healthcare...

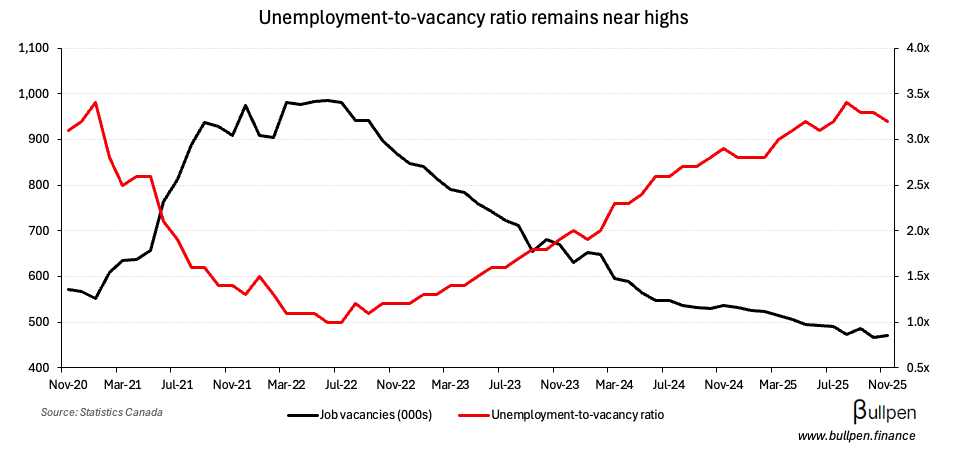

… which likely has limited runway for growth, given the drop in vacant positions over the past year.

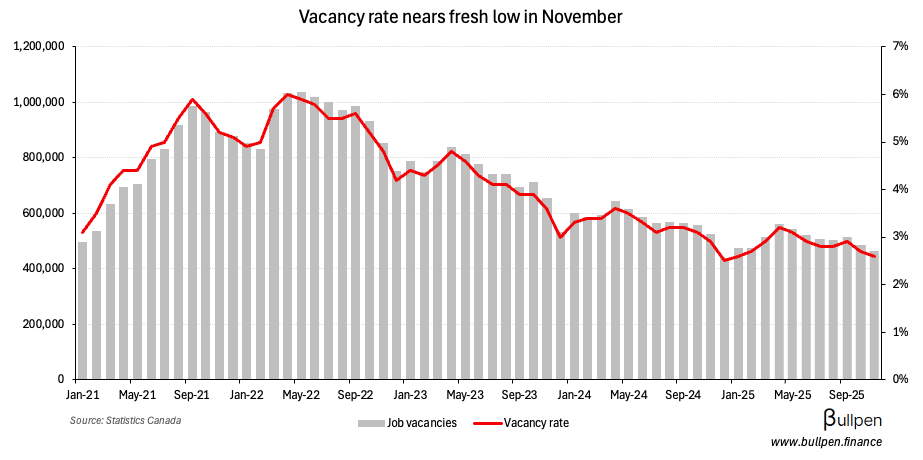

That’s put pressure on job openings as a whole, with the vacancy rate falling to 2.6%…

… and total vacancies sitting at less than a third of job seekers, a sign that we’re still far from a healthy labour market.

ON OUR RADAR

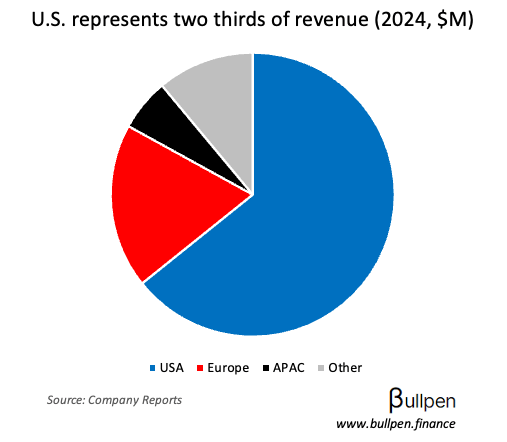

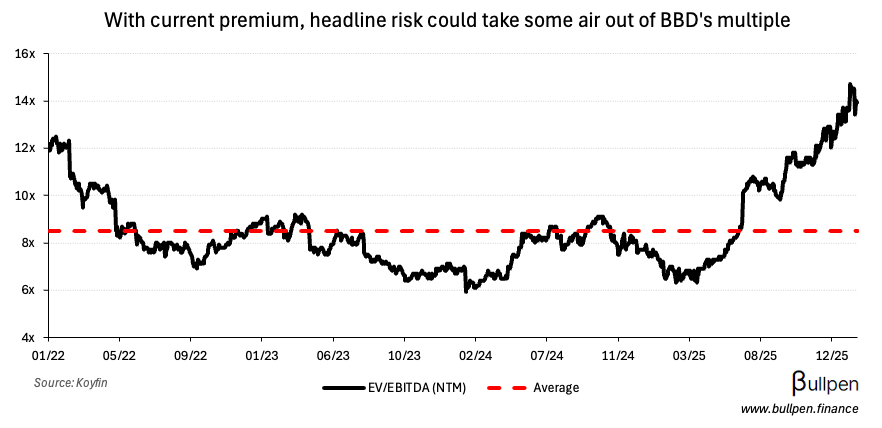

Given the U.S. represents nearly two thirds of company revenue, Bombardier (BBD) could be volatile today - with Trump threatening to decertify and slap a 50% tariff on all Canadian planes…

… until we certify a handful of Gulfstream models. It wouldn’t be the first time BBD is in Trump’s scope, with its C-Series jets getting hit with a 300% tariff in his first term - and with the stock trading at a premium…

… even headline risk could take some air out of the multiple.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

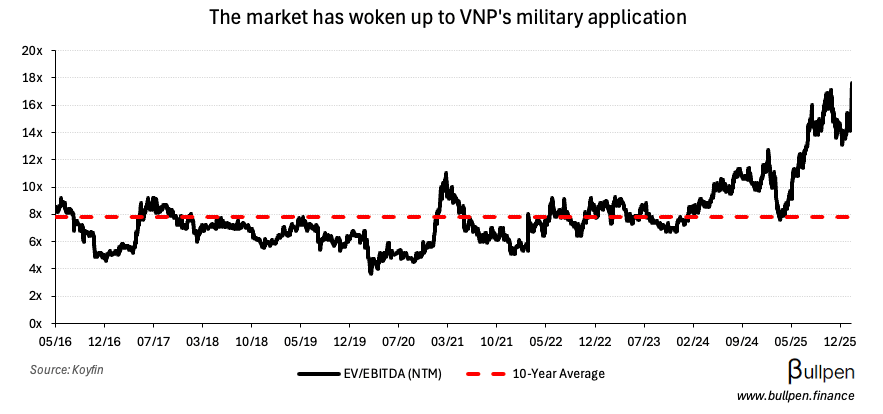

5N Plus (VNP) was up nearly 20% on an $18M investment from the Department of War to expand the company’s germanium refining capacity. That will show up in its specialty semiconductors segment…

… which has been the driver of VNP’s recent run, given its military applications. The company is a leading supplier of this critical material in the West…

… and now it’s priced that way.

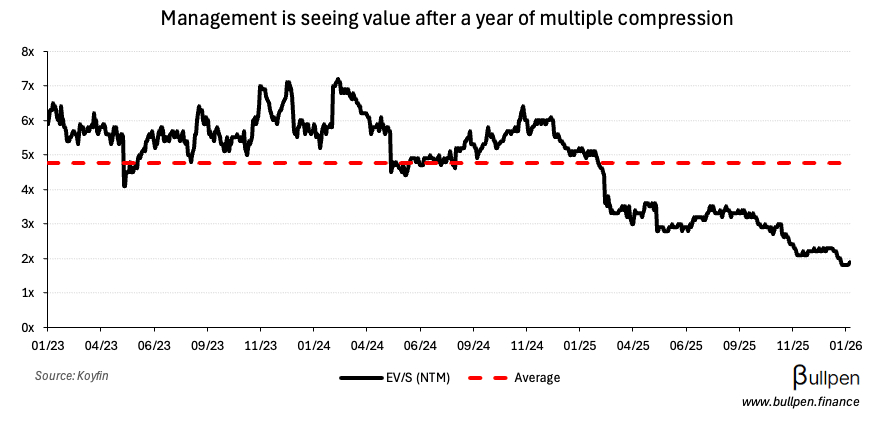

Docebo (DCBO) was the only software name that didn’t take a beating yesterday after announcing a $60M SIB, representing 10% of shares at a 10% premium…

… and funded by a 50/50 mix of cash and debt, given the recent $54M 365Talents acquisition chewed through its dry powder.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Harley Finkelstein | Shopify (SHOP) | $238K |

| Jessica Hertz | Shopify (SHOP) | $265K |

| Jeff Hoffmeister | Shopify (SHOP) | $280K |

| Troy Andersen | Cdn. Natural (CNQ) | $1.0M |

| Warren Raczynski | Cdn. Natural (CNQ) | $512K |

| Dwayne Giggs | Cdn. Natural (CNQ) | $640K |

| Devin Lowe | Cdn. Natural (CNQ) | $501K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Rogers (RCI) | 1.51 | 1.40 |

| 🇨🇦 Brookfield Infra (BIP) | 0.45 | 0.27 |

| 🇨🇦 Real Matters (REAL) | -0.01 | 0.00 |

| 🇨🇦 Coveo (CVO) | -0.02 | 0.00 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Cdn. National (CNR) | AM | 1.98 |

| 🇨🇦 Brookfield Ren. (BEP) | AM | -0.38 |

| 🇨🇦 Imperial (IMO) | AM | 1.89 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Trade Balance | -2.2B | -0.7B |

| 🇺🇸 Trade Balance | -56.8B | -40.5B |

| 🇺🇸 Jobless Claims | 209K | 205K |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 GDP M/M | 8:30AM | 0.1% |

| 🇺🇸 PPI M/M | 8:30AM | 0.2% |

Was this forwarded to you? Join 6,000+ investors reading The Morning Meeting by clicking the button below.