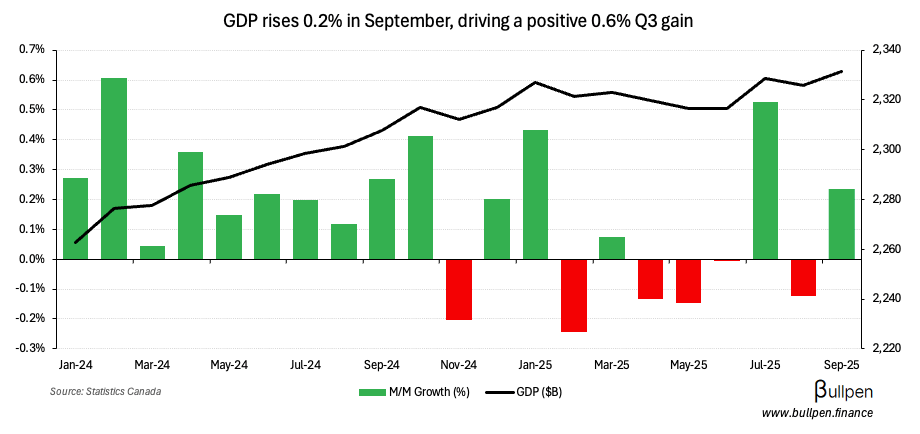

Friday’s GDP print was in-line with estimates, gaining 0.2% M/M and capping off Q3 on a positive note.

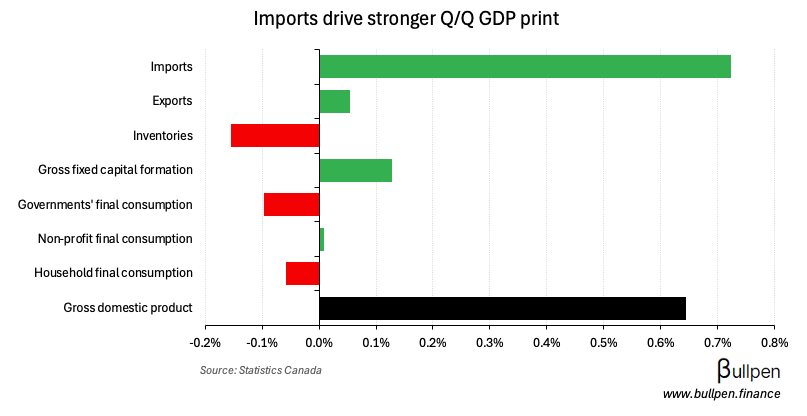

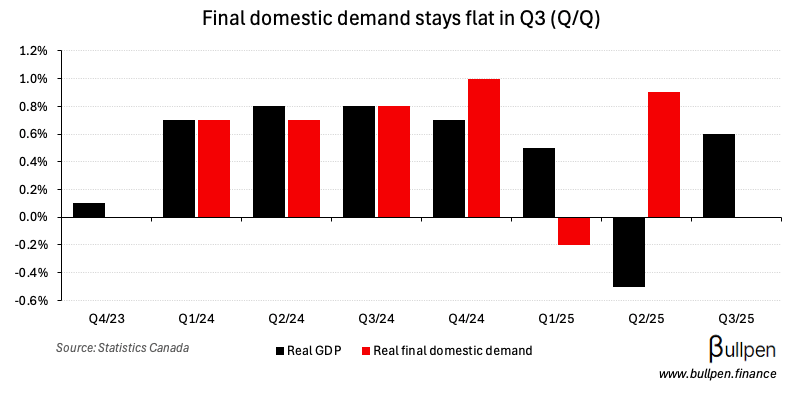

The 0.6% Q/Q gain was almost entirely driven by an improving trade balance, with imports posting their biggest decline since Q4/22 (down 2.2%)…

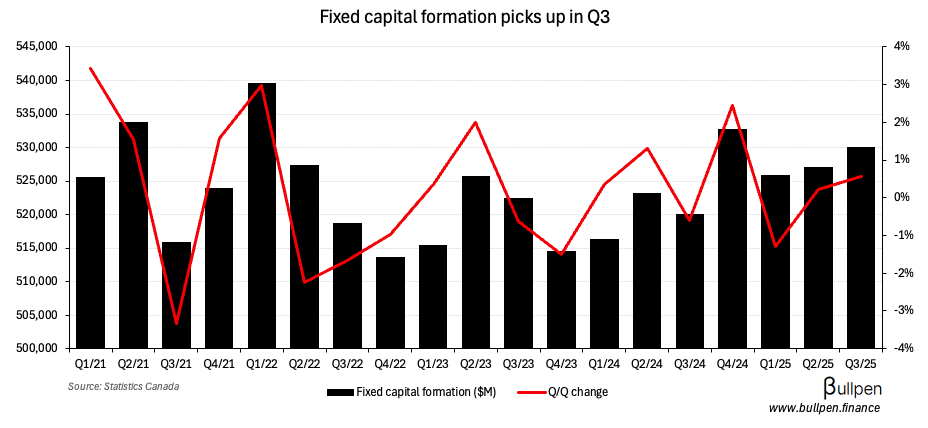

… but fixed capital formation also contributed, with a 3% rise in government investment that was concentrated on weapons systems (up 82%).

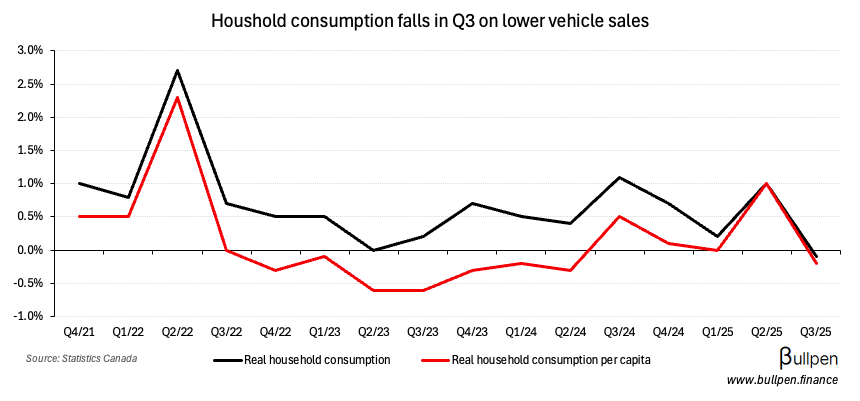

Together, that offset a sequential decline in household consumption…

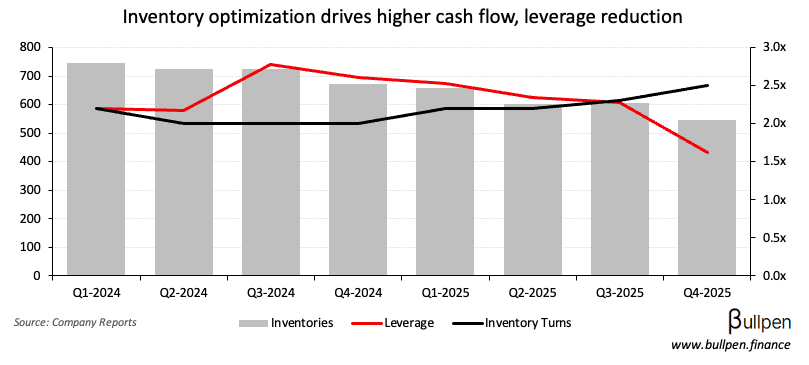

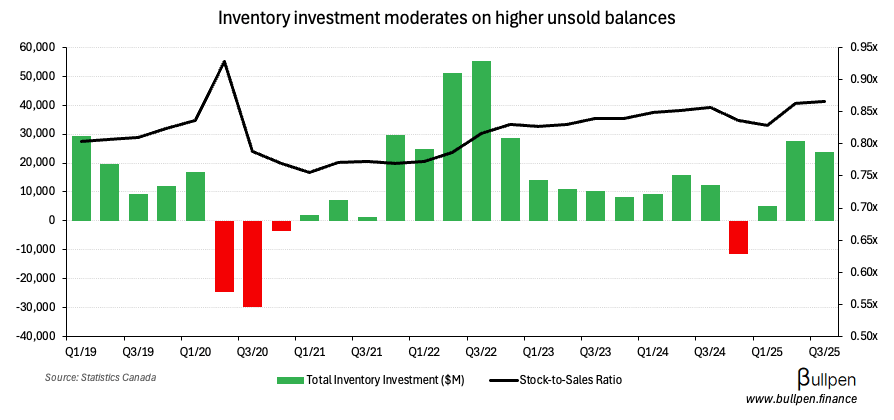

… and inventory investment, which should have a lid on it in the near-term - given inventory balances continue to build.

With that, final domestic demand was flat on the quarter - indicating weak underlying economic momentum…

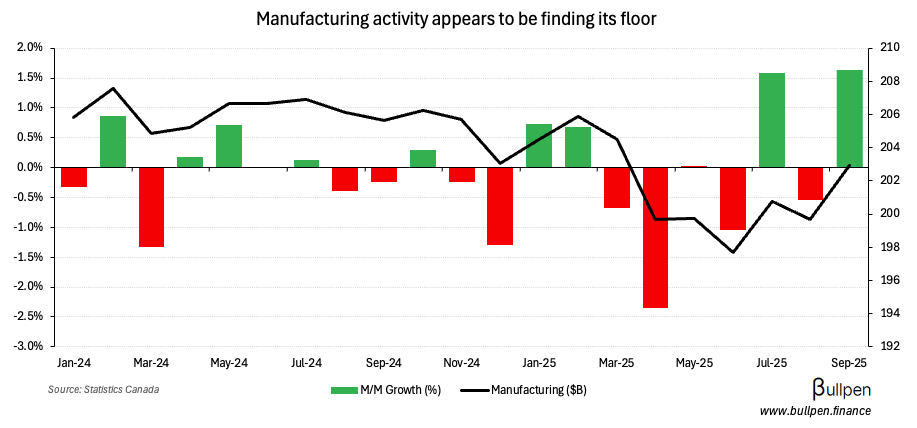

… as businesses continue to push capital investment to the right. That looks set to weigh on October’s GDP print - with preliminary estimates calling for a 0.3% M/M drop led by oil & gas, education, and manufacturing.