|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Q3 GDP rises on trade balance

Budgetary deficit hits $16B

Warburg clears $68M DCBO block

HOT OFF THE PRESS

Q3’s GDP breakdown

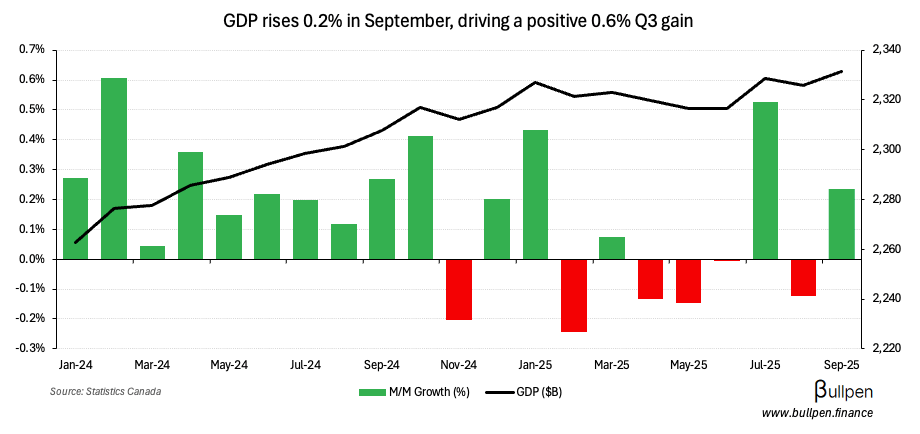

Friday’s GDP print was in-line with estimates, gaining 0.2% M/M and capping off Q3 on a positive note.

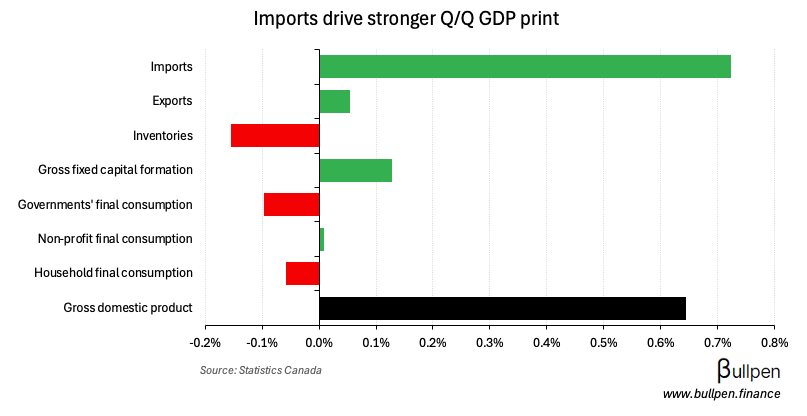

The 0.6% Q/Q gain was almost entirely driven by an improving trade balance, with imports posting their biggest decline since Q4/22 (down 2.2%)…

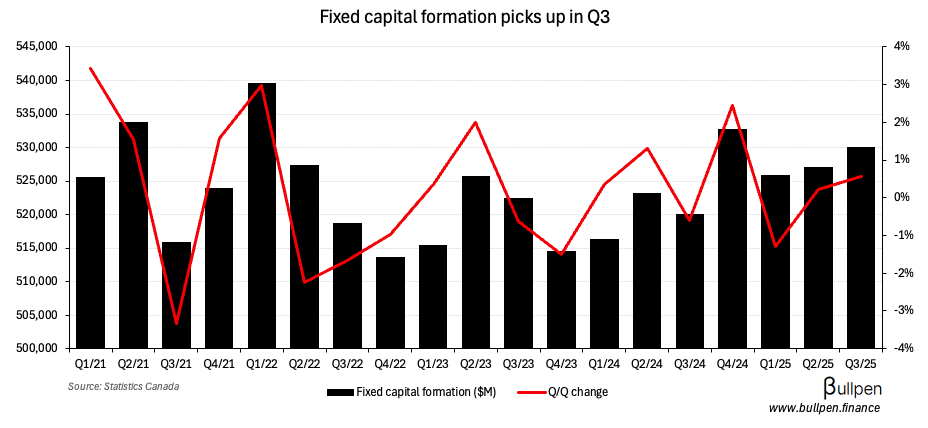

… but fixed capital formation also contributed, with a 3% rise in government investment that was concentrated on weapons systems (up 82%).

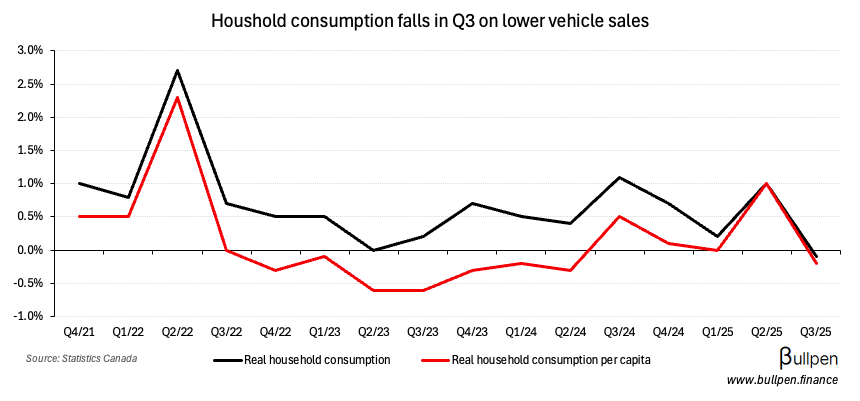

Together, that offset a sequential decline in household consumption…

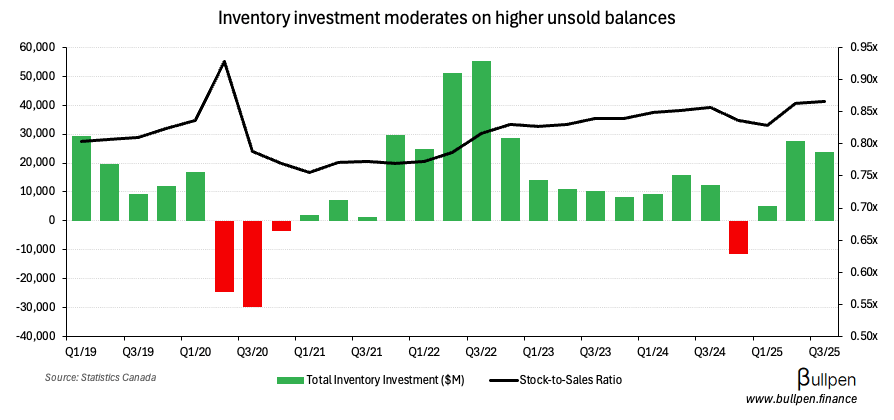

… and inventory investment, which should have a lid on it in the near-term - given inventory balances continue to build.

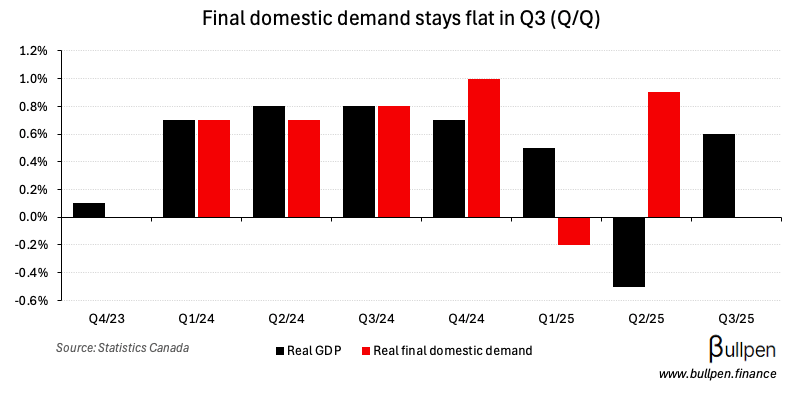

With that, final domestic demand was flat on the quarter - indicating weak underlying economic momentum…

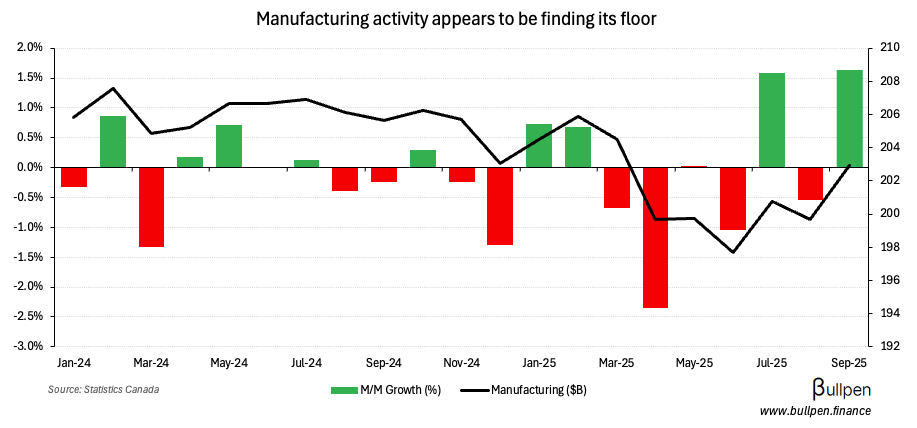

… as businesses continue to push capital investment to the right. That looks set to weigh on October’s GDP print - with early estimates calling for a 0.3% M/M drop led by oil & gas, education, and manufacturing.

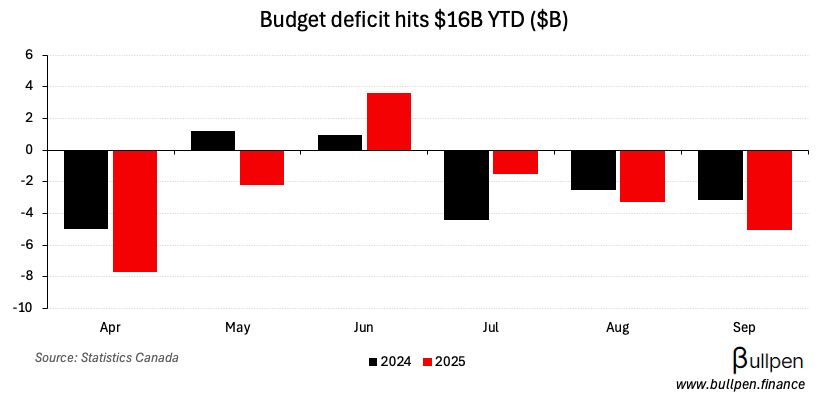

Budget deficit hits $16B

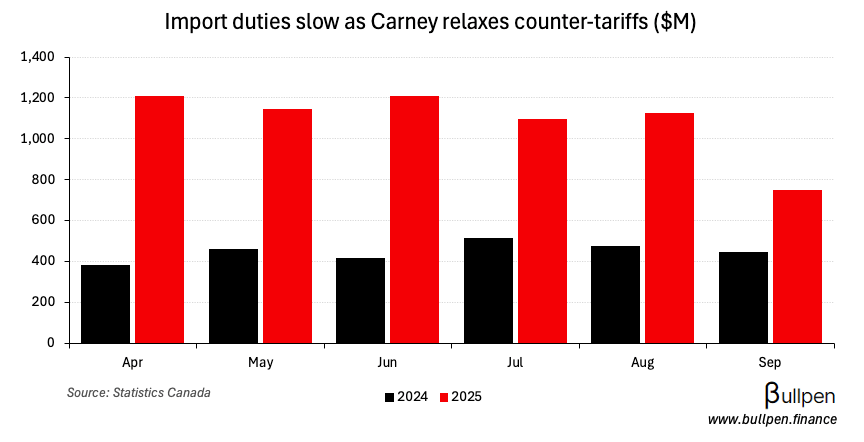

The budgetary deficit was $5B in September, expanding Y/Y on higher program expenses (EI-led) and climbing to $16B on a YTD basis.

It was the first full month since Carney’s rollback of some U.S. tariffs, resulting in a much smaller counterbalance than before…

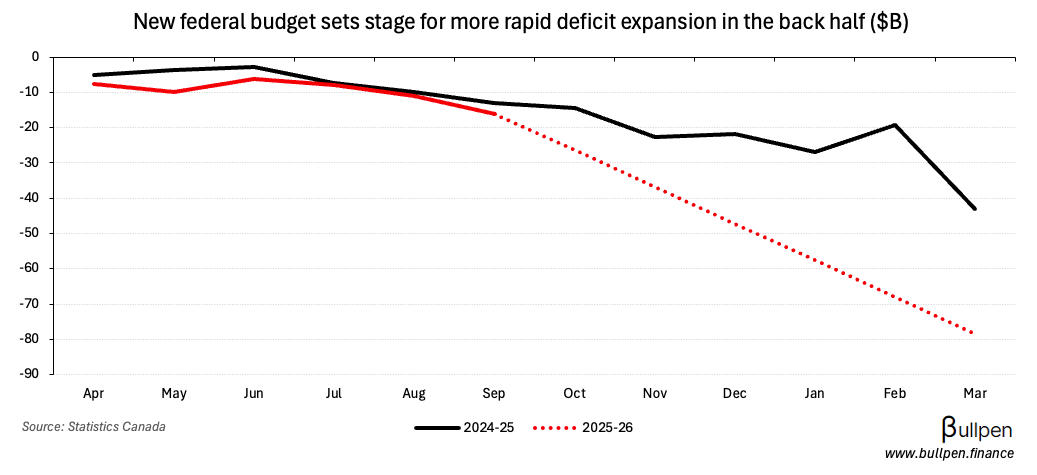

… that should continue to shrink, as the new liberal budget sets the stage for much larger deficits in the back half of the fiscal year.

ON OUR RADAR

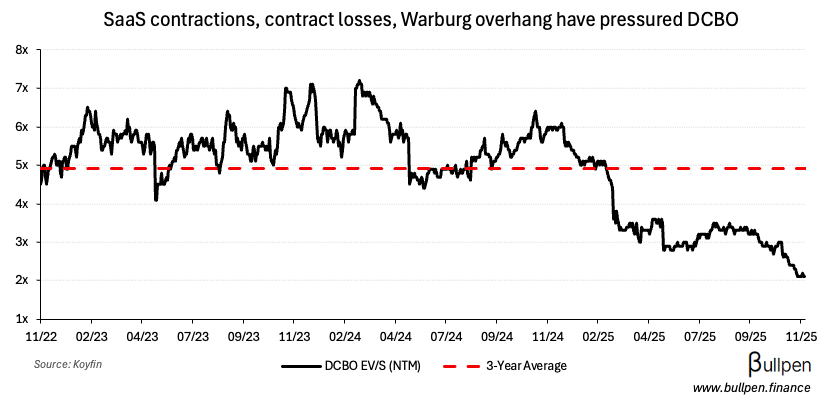

Flagging an early warning report filed by Intercap that states it’ll clear out Warburg’s $68M position, taking Jason Chapnik’s (chair) stake to ~57%. Like we saw with Pet Valu, a block that big can weigh on shares if the market expects selling…

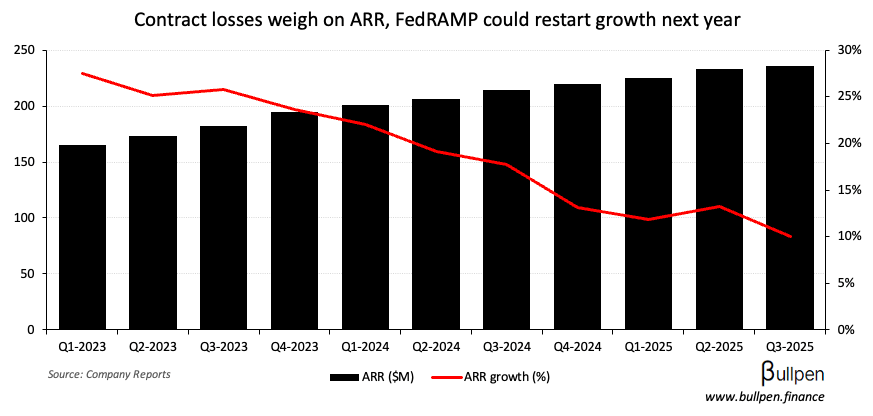

… so it’ll be interesting to see how it trades from here. It’s not the only headwind DCBO’s faced recently, with lost contracts and general pressure on SaaS names - but if its new FedRAMP authorization can bring ARR growth higher…

… another private player could start circling if shares don’t respond.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Edmund Murphy | Great-West (GWO) | $249K |

| Chris Carlsen | Birchcliff (BIR) | $764K |

| Duane Thompson | Birchcliff (BIR) | $259K |

| Benoit Dube | CGI Inc. (GIB-A) | $1.3M |

| Sean Boyd | Stingray (RAY) | $225K |

| Lloyd Feldman | Agnico (AEM) | $8.5M |

| Pippa Morgan | Aritzia (ATZ) | $547K |

| John Hooks | PHX Energy (PHX) | $201K |

| John Hooks | CES Energy (CEU) | $1.2M |

| Dawn de Lima | TC Energy (TRP) | $2.4M |

| William Brennan | Altus (AIF) | $763K |

| Marcel Coutu | Brookfield (BAM) | $251K |

| Meyer Orbach | GO REIT (GO-U) | $1.0M |

| John Paulson | Bausch Health (BHC) | $15.6M |

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Zoomd Tech (ZOMD) | 4.0M | 3.8M |

| 🇨🇦 Hydreight Tech (NURS) | 0.01 | 0.03 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 GDP M/M | 0.2% | 0.2% |

| 🇨🇦 Budget Balance | -5B | - |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 S&P Mftg. PMI | 10:30AM | - |

| 🇺🇸 ISM Mftg. PMI | 11:00AM | 48.6 |

Was this forwarded to you? Join 3,500+ investors reading The Morning Meeting by clicking the button below.