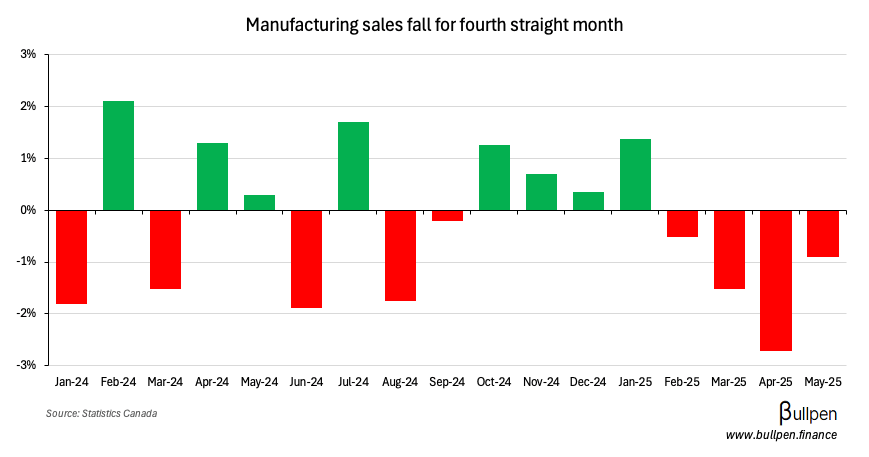

Manufacturing sales of ~$69B fell 0.9% M/M, better than estimates of a 1.3% drop. May marked the fourth straight monthly drawdown and the lowest reading in 2.5 years - driven mainly by lower petroleum, coal, and machinery sales.

Partly offsetting the weakness was the aerospace industry, which jumped 7% and drove the 0.4% decline in unfilled orders…

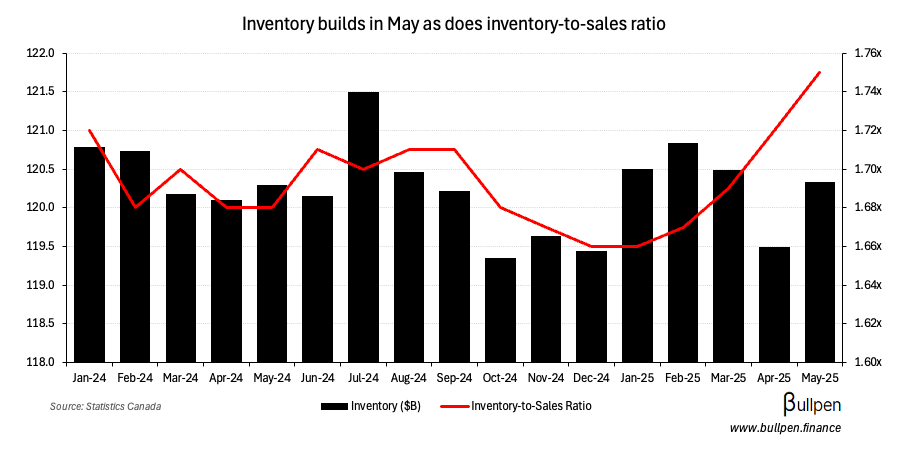

… as well as a 0.7% M/M inventory build. At 1.75x, the inventory-to-sales ratio sits at the highest level since the pandemic as tariffs pressure sales volume.

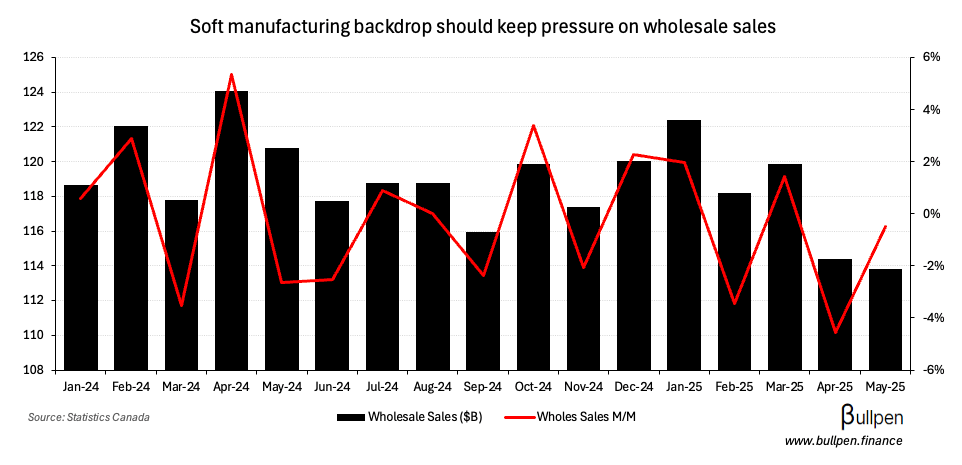

While the soft manufacturing backdrop should keep a lid on wholesale sales in the near-term, May’s print surprised to the upside too - with 0.1% M/M growth beating expectations for a 0.4% decline (excluding petroleum).