|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Job vacancies find a floor

Current account deficit eases

CBOE Canada is up for sale

Carney supports lumber & steel

Calian rebounds on Q4 growth

HOT OFF THE PRESS

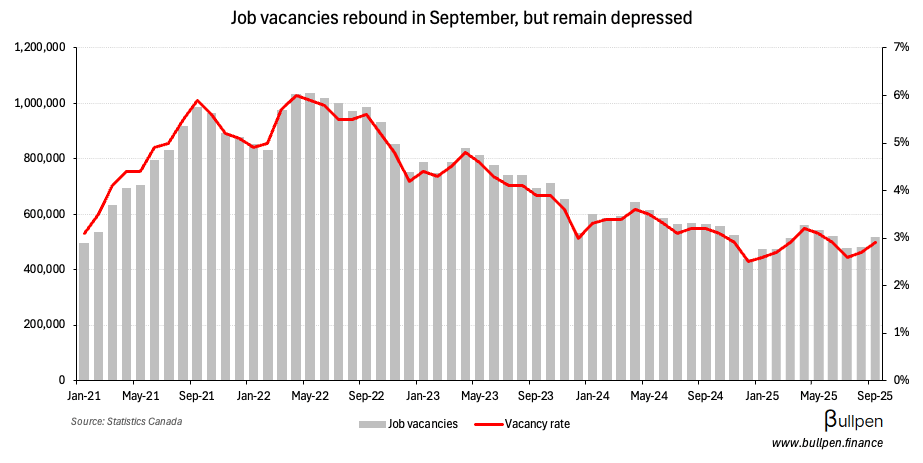

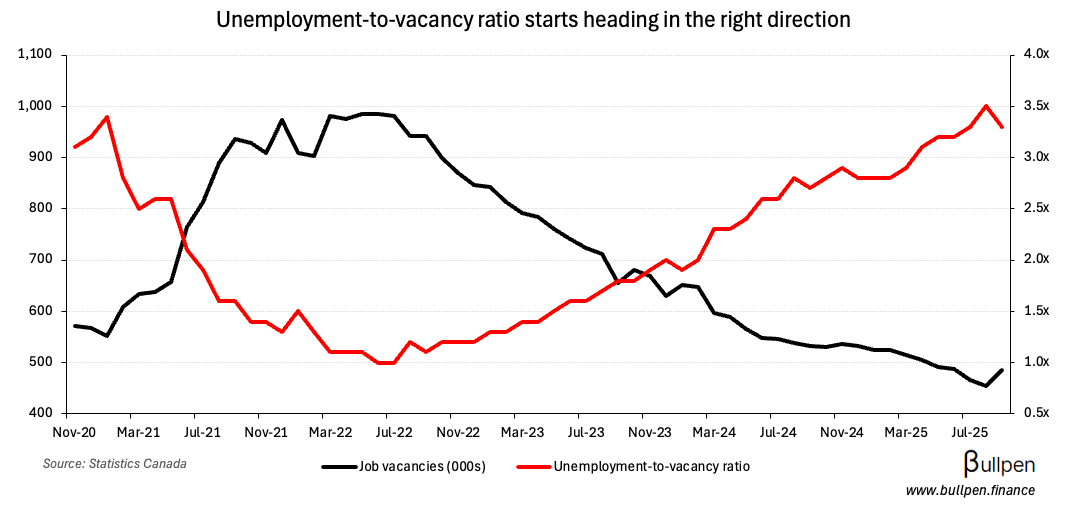

Job vacancies jump

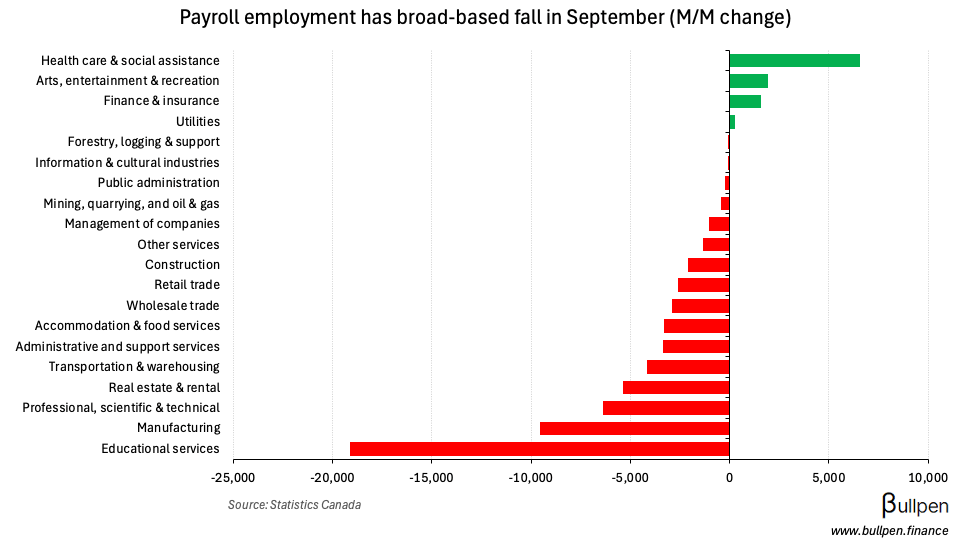

Payroll employment fell 0.3% in September, with broad-based declines led by education and manufacturing offsetting a decent pickup in health care adds.

If there was a silver lining in the print it was job vacancies, which recovered for a second straight month at the country level…

… led by by the first M/M build at the provincial level (up 6%) since the start of 2024. Construction (up 15%) and manufacturing (up 11%) drove the move and could signal a labour market finding its floor, should it continue.

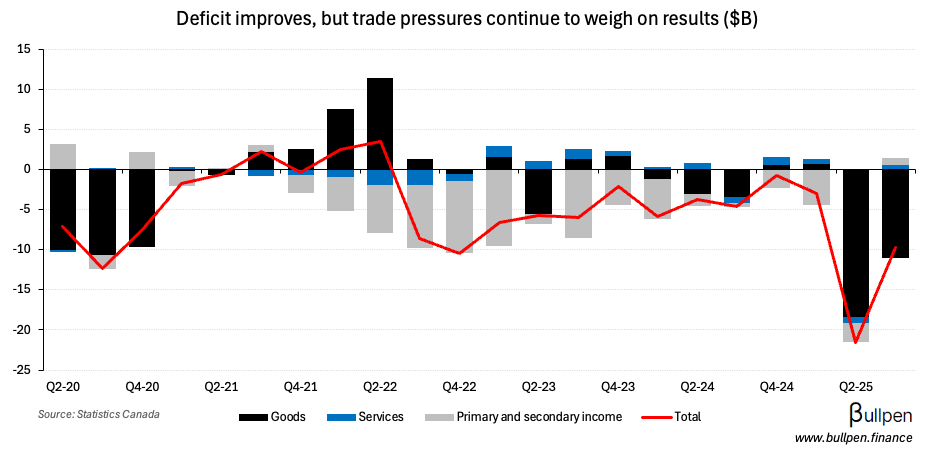

Current account deficit eases (to $10B)

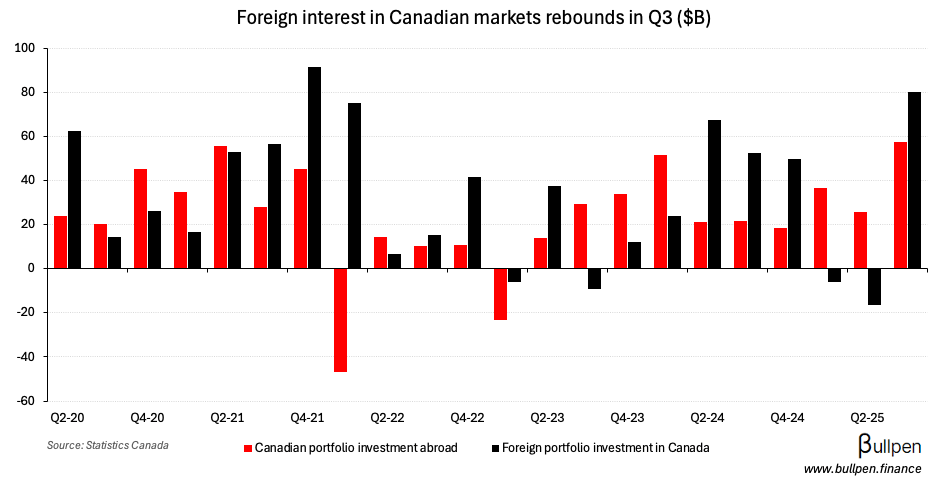

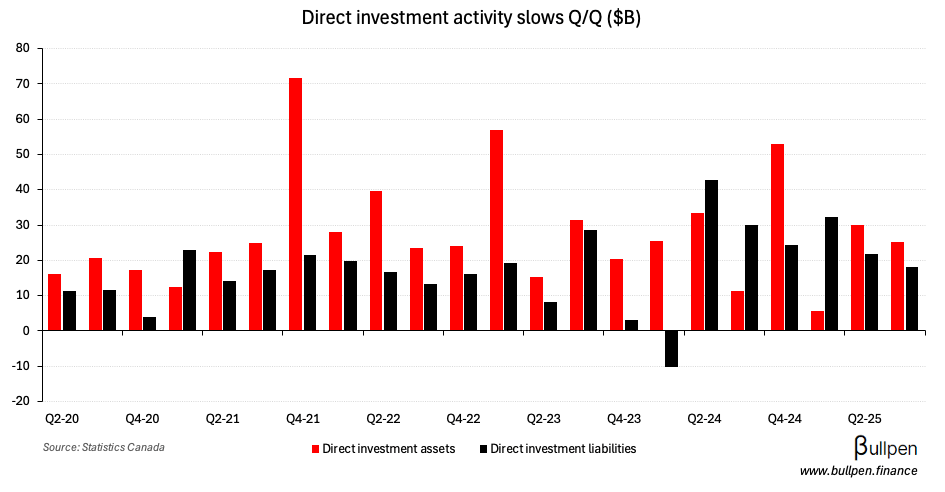

Q3’s current account deficit came in better than expected, easing from Q2’s record to $10B, as trade tensions continue to bite into the flow of goods.

Foreign demand returned to Canadian markets in size ($80B), led by an appetite for Canadian paper and helped by an $8B equity inflow - the largest since Q1/22. That more than offset $58B of portfolio investment abroad...

… which didn’t translate to corporate investment, as international M&A slowed to $3.5B, from $8B in Q2.

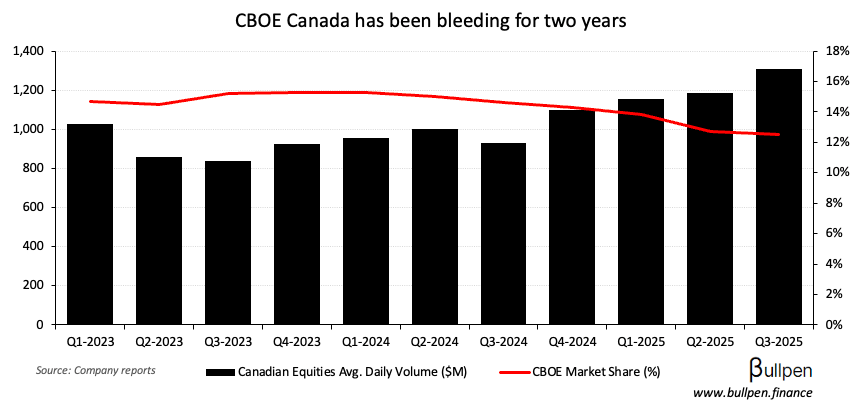

CBOE to pack up shop and leave Canada

From big box retailers to bank satellite offices, Canada is a tough nut to crack for foreign companies. Add CBOE to the list, who’s selling its Canadian exchange after bleeding share to homegrown peers.

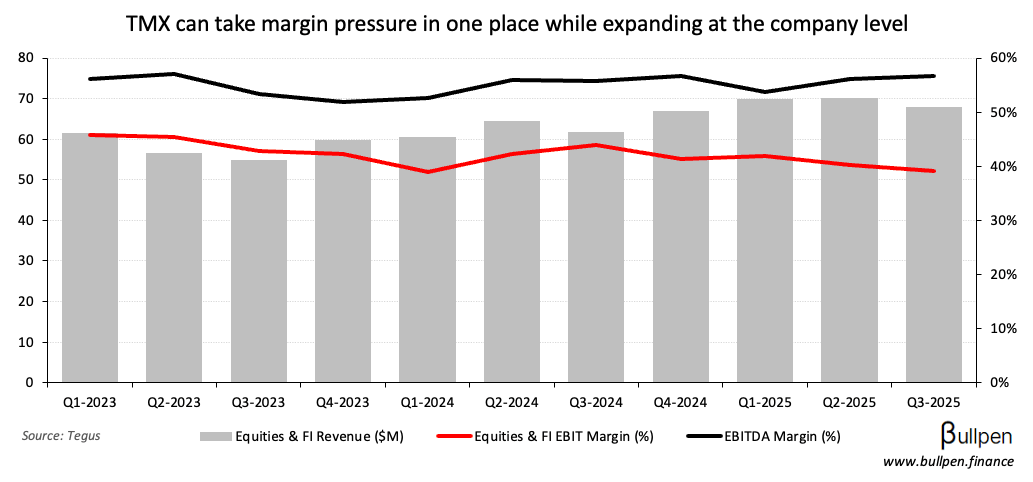

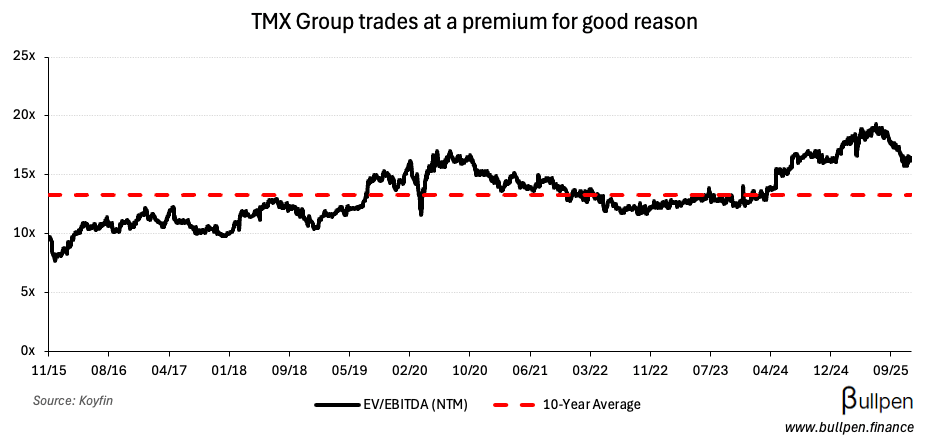

The CSE and Tradelogiq are said to be bidding, but it’s tough to imagine a different outcome. TMX Group (X) is the only platform that can handle competition in the segment without blinking…

… given equities and fixed income represent less than 20% of revenue. With control over most of the country’s public listings (at least the ones it wants), there’s a reason it trades at a premium.

FUNNY BUSINESS

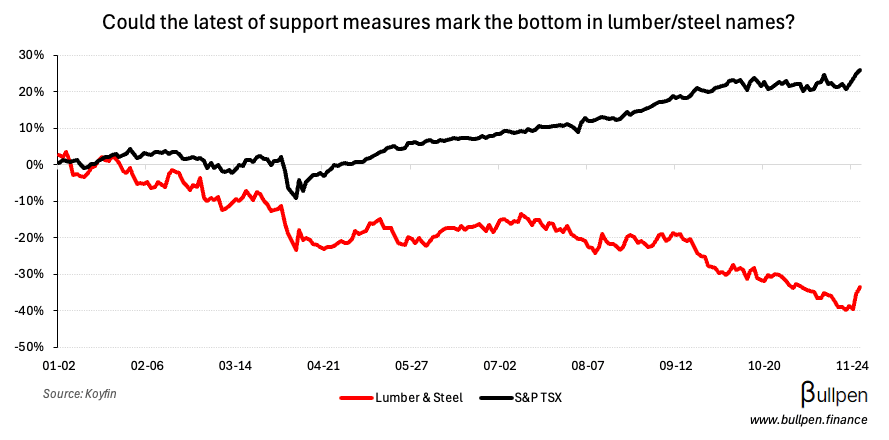

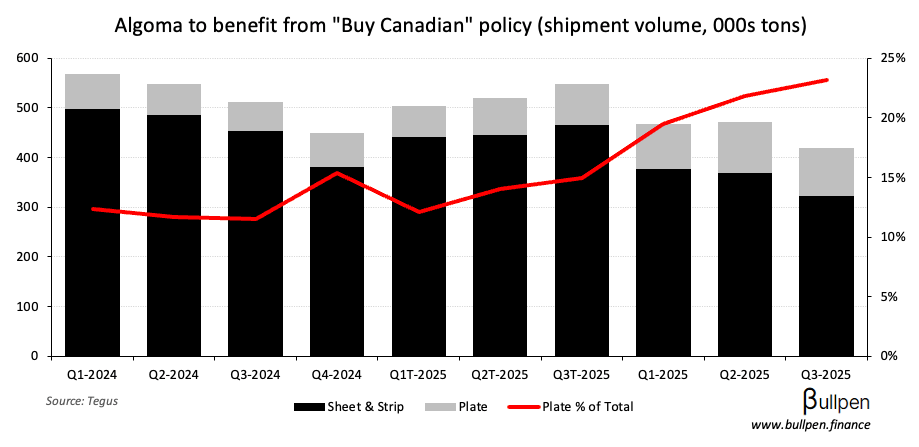

Right on queue, Carney announced additional support measures for steel and lumber focused on tightening protections, increasing accessibility, stimulating demand and funding labour costs.

With the government clearly willing to backstop these industries… it could be a good time to start doing work on the Canadian beneficiaries…

… Algoma Steel (ASTL) in particular, given they’re the only plate producer in the country - setting them up nicely for “Buy Canadian” tailwinds and the potential for a new pipeline (fingers crossed).

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Esther Findlay | IGM Financial (IGM) | $402K |

| Edmund Murphy | Great-West (GWO) | $6.1M |

| Ammar Al-Joundi | Agnico (AEM) | $4.9M |

| Shamus Welland | Manulife (MFC) | $2.3M |

| J.P. Lachance | Peyto (PEY) | $1.6M |

| Mazhar Shaikh | Artis REIT (AX) | $153K |

| Steven Joyce | Artis REIT (AX) | $2.5M |

| William Brennan | Altus (AIF) | $2.3M |

| Jason Shannon | Crombie REIT (CRR-U) | $153K |

| Christine Healy | Northland (NPI) | $501K |

Flagging the buying at Northland (NPI), which follows its 30% post-quarter sell off. While NPI likely stays in the penalty box a while, you like to see it from the CEO.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Calian (CGY) | 1.00 | 1.07 |

| 🇨🇦 Rogers Sugar (RSI) | 0.16 | 0.14 |

| 🇨🇦 Exco (XTC) | 0.22 | 0.12 |

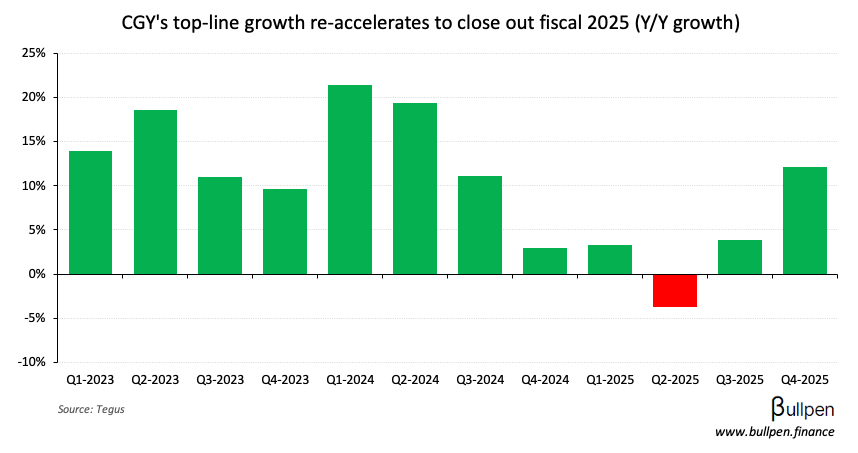

If there’s one chart to explain Calian Group’s (CGY) 12% post-earnings pop, it’s the defense led re-acceleration in revenue (up 12% Y/Y)…

… which reinforces the multi-year wave of government spending the company has in front of it. If it executes, I’d expect CGY to have a steady bid - with the potential for big upside moves on any non-core divestitures.

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Zoomd Tech (ZOMD) | AM | 3.8M |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Current Account | -9.7B | -16.5B |

| 🇨🇦 Weekly Earnings Y/Y | 3.1% | - |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

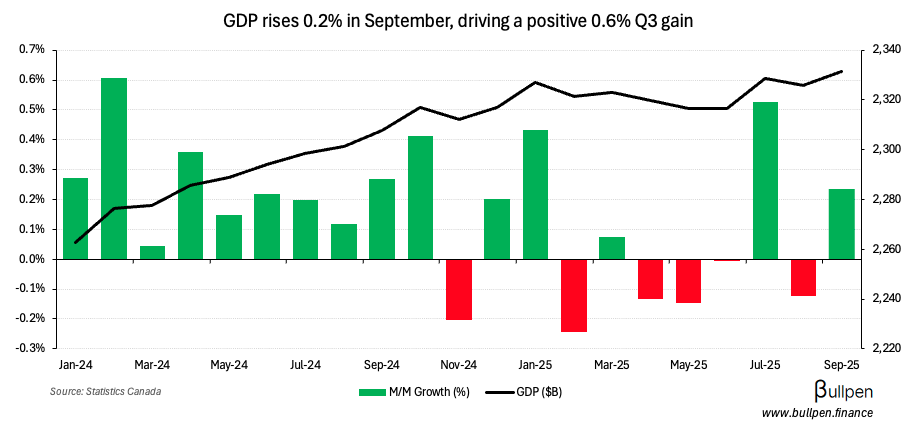

| 🇨🇦 GDP M/M | 9:30AM | 0.2% |

Was this forwarded to you? Join 3,500+ investors reading The Morning Meeting by clicking the button below.