|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Building permits jump $2B

Capacity utilization improves in Q3

Bombardier inks $400M deal

CAE runs 5% on $270M contract

HOT OFF THE PRESS

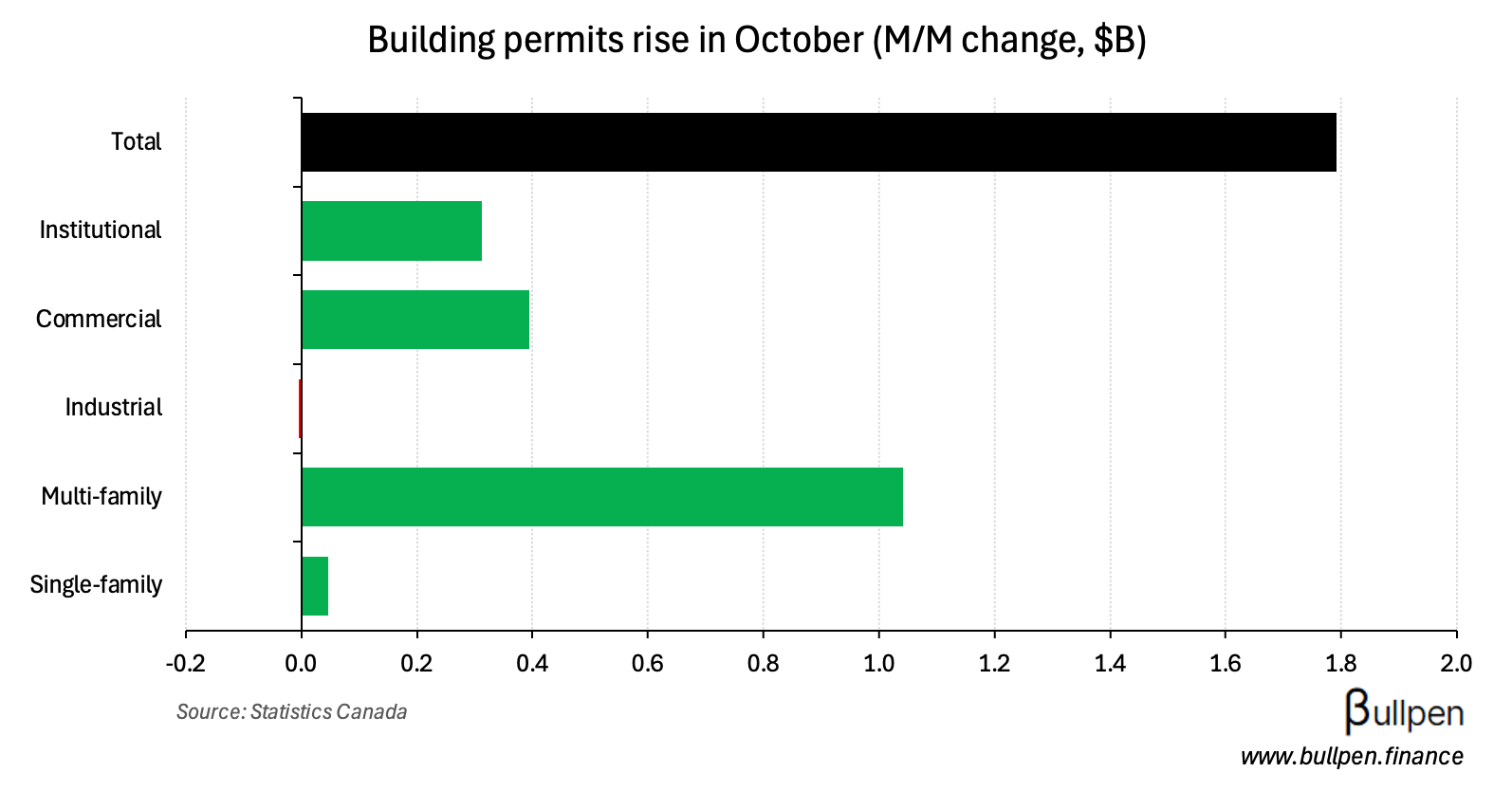

Building permits add $2B

Building permits rose 15% to $13.8B in October, well ahead of expectations for a 1% decline…

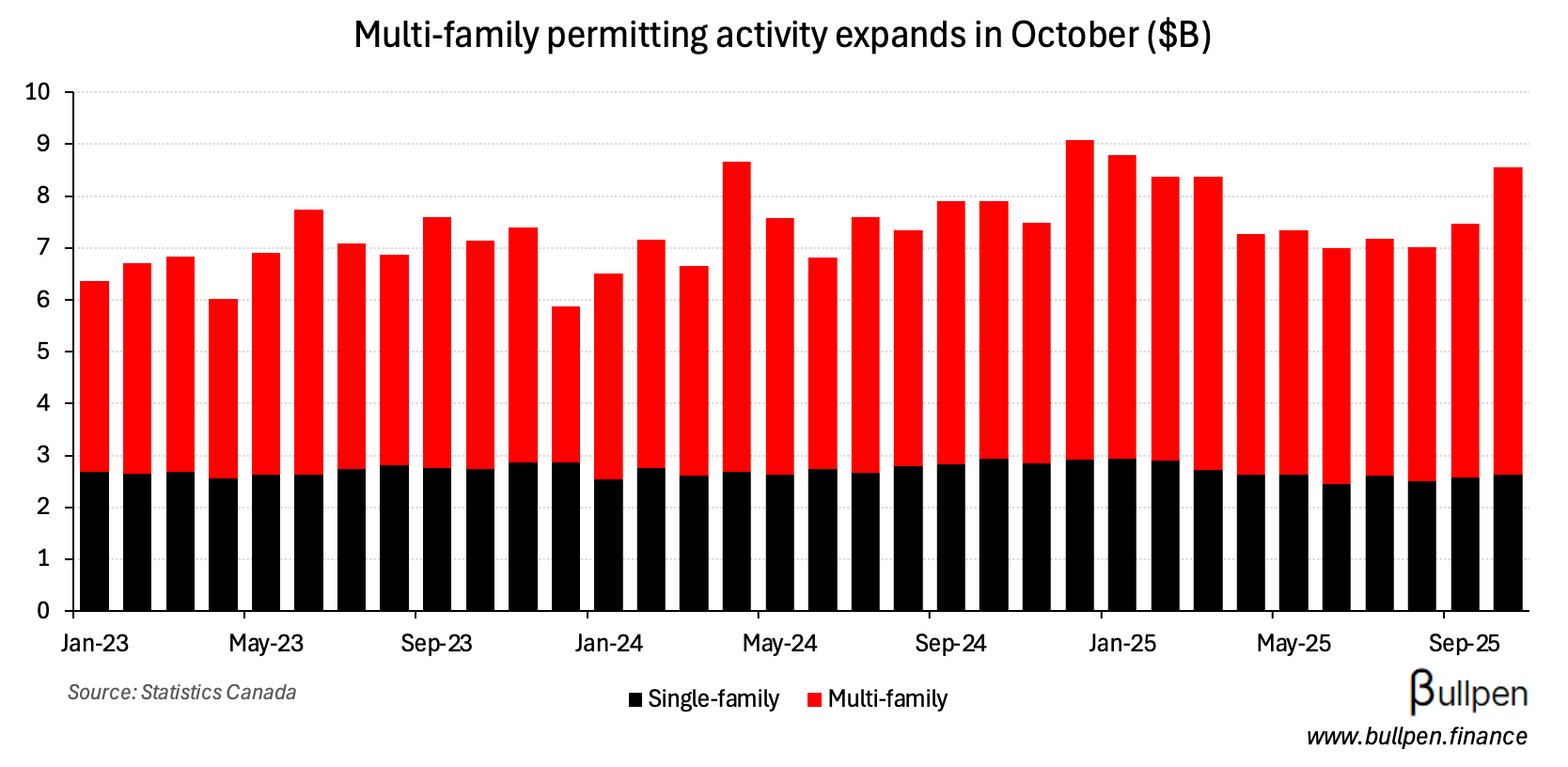

… driven by a $1.1B rise in residential construction intentions. A multi-family rebound in Ontario led the way, which has been a source of weakness for the majority of the year.

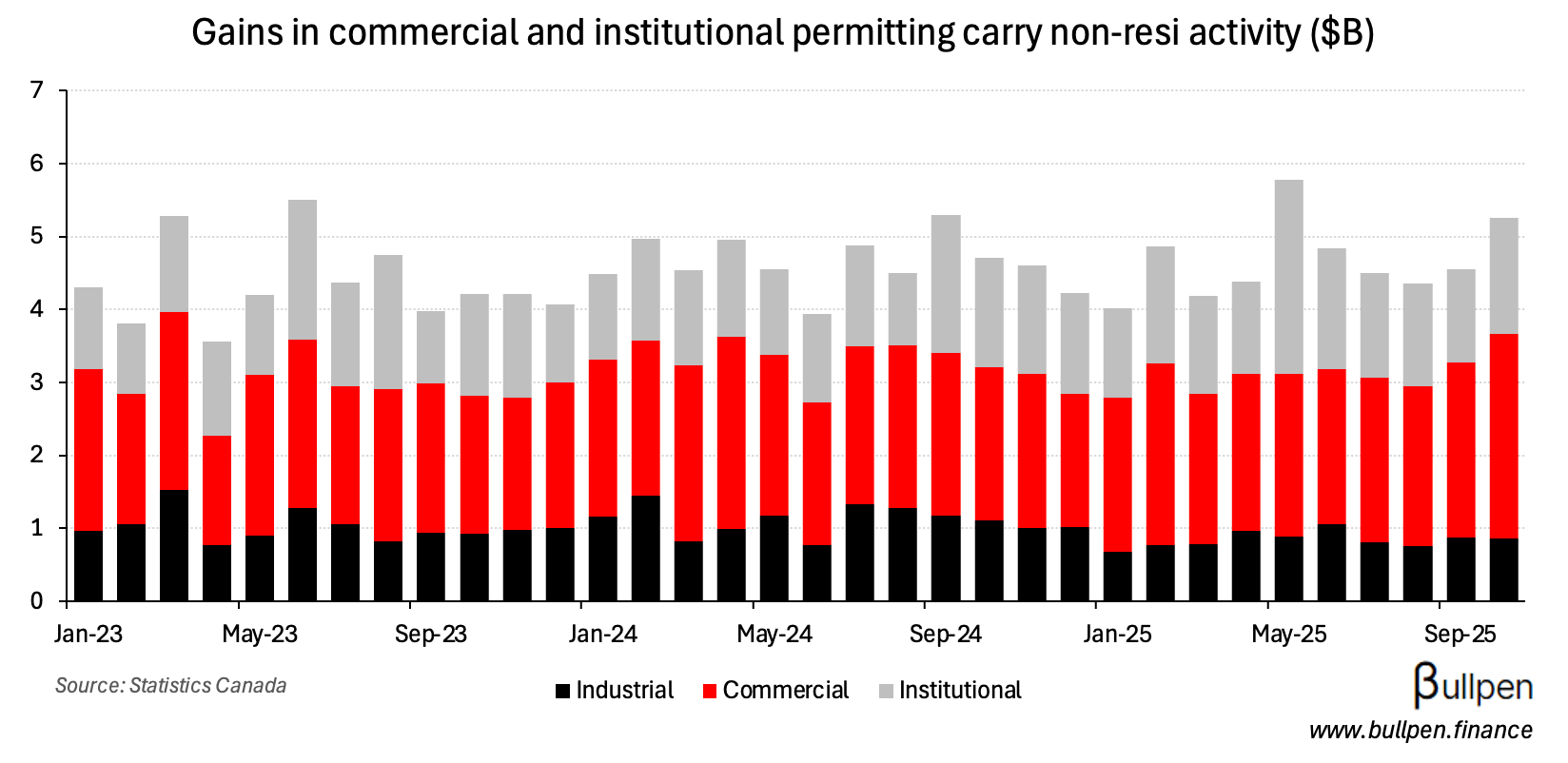

Non-residential permitting was strong too, with higher office permitting in Ontario and institutional activity in BC driving a $700M pickup versus September.

Q3 capacity utilization improves

Q3 capacity utilization came in at 78.5%, missing estimates of 79.3% but up from 77.6% in Q2 - with broad-based improvements in production efficiency. The gain in construction was notable, given it was the first in nine quarters…

… and manufacturing rebounded 1.2% after a weaker Q2, as it continues to close the gap to industrial capacity utilization.

Non-durable goods were the primary driver, thanks to an 11 point increase in petroleum and coal products Q/Q…

… while manufacturing efficiency in durable goods was mixed, with strength in transportation and furniture offsetting weakness in electrical equipment.

ON OUR RADAR

Flagging Bombardier’s $400M contract with the RCAF for six Global 6500 aircraft, keeping up the momentum from its $2B, 50 aircraft order in the summer. The deal should support continued backlog growth…

… which the company will need to execute on in order to grow into what looks to be a pretty rich valuation.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

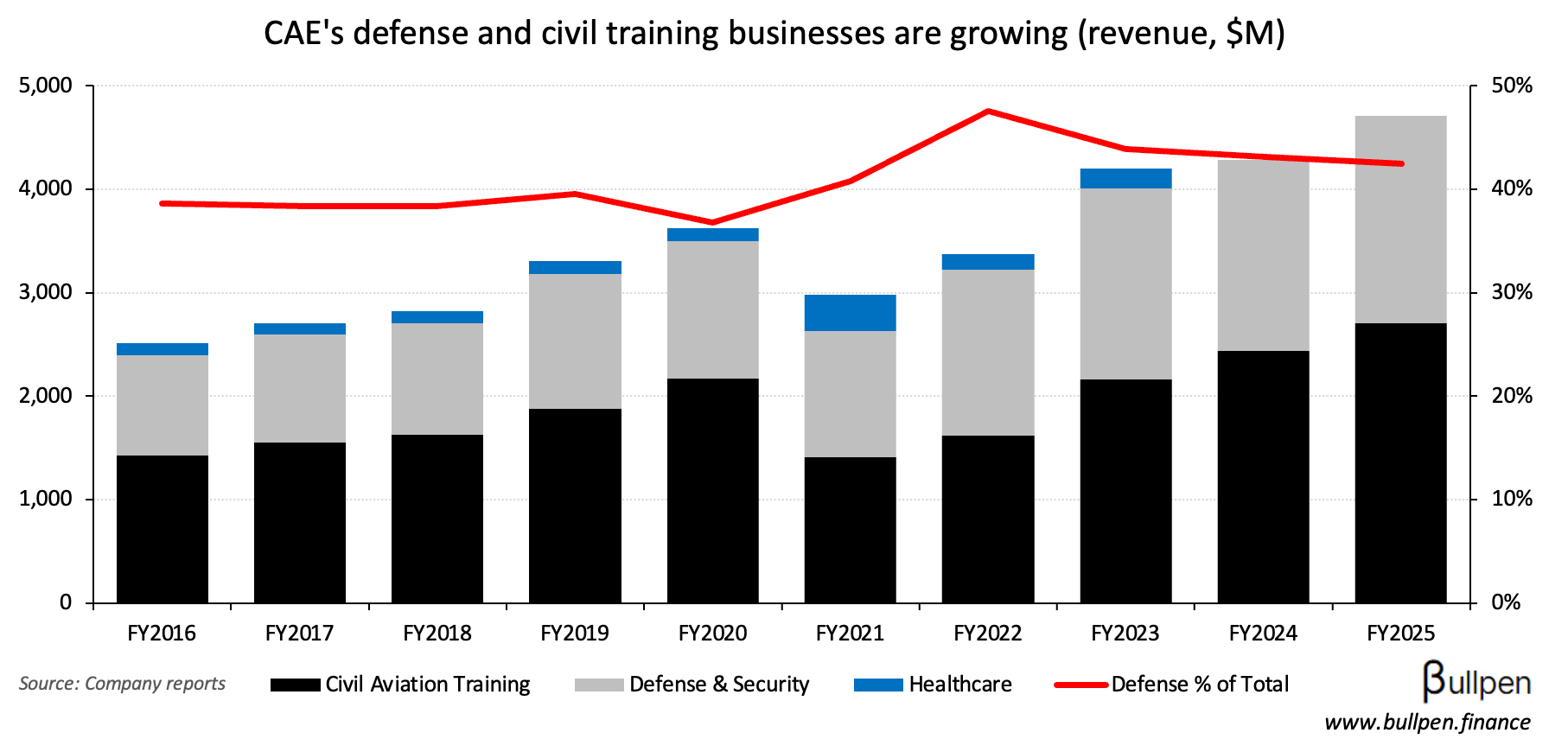

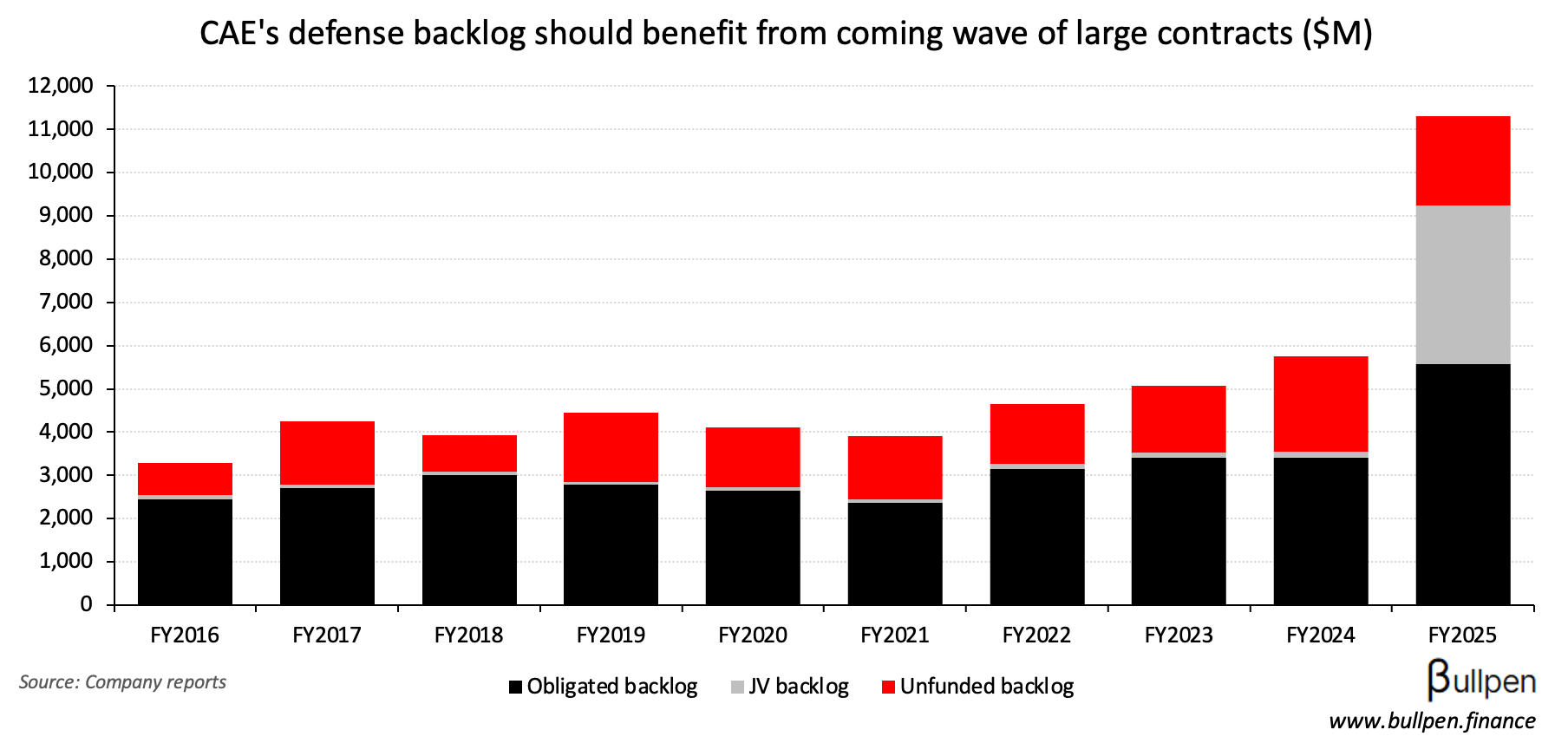

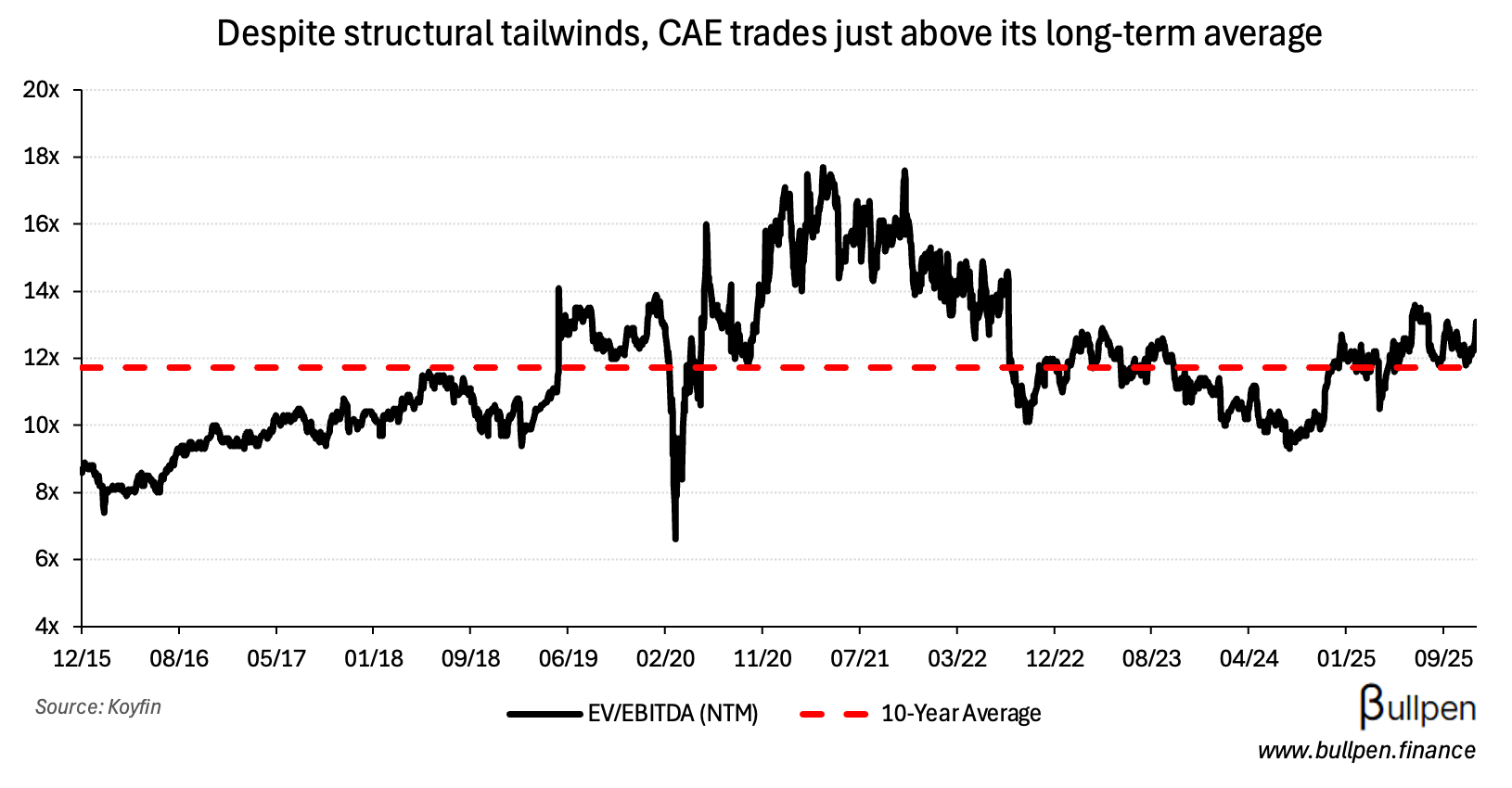

CAE Inc. (CAE) ran 5% Friday following its announced 10-year, $270M contract for Australia’s future air training system. Assuming an even yearly run-rate, the deal only adds 1-2% to defense revenue…

… but more importantly, it reinforces the multi-year setup for defense spending globally and builds on earlier large contract success in Canada. With the backlog sitting at $11B…

… and the new CEO likely to drive U.S. growth, CAE’s revenue runway is long - justifying a premium over its long-term average valuation.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Ian Arellano | Scotiabank (BNS) | $5.3M |

| Sime Armoyan | Morguard (MRT) | $172K |

| Jerrold Annett | Pecoy (PCU) | $279K |

EARNINGS

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Enghouse (ENGH) | AM | 0.37 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | 14.9% | -1.4% |

| 🇨🇦 Wholesale Sales M/M | 0.1% | -0.1% |

| 🇨🇦 Capacity Utilization | 78.5% | 79.3% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Housing Starts | 9:15AM | 248K |

| 🇨🇦 Inflation Y/Y | 9:30AM | 2.4% |

| 🇨🇦 Manufacturing Sales M/M | 9:30AM | -0.9% |

Was this forwarded to you? Join 4,000+ investors reading The Morning Meeting by clicking the button below.