|

TSX

1D %

YTD %

|

27,314.01

0.3%

9.7%

|

|

|

TSXV

1D %

YTD %

|

797.75

0.8%

29.2%

|

|

|

S&P 500

1D %

YTD %

|

6,296.79

0.0%

7.3%

|

|

|

NASDAQ

1D %

YTD %

|

20,895.66

0.0%

8.4%

|

|

|

US 10Y

1D

YTD

|

4.42

3 bps

15 bps

|

|

|

DJIA

1D %

YTD %

|

44,342.19

0.3%

4.6%

|

|

|

CA 10Y

1D

YTD

|

3.58

1 bp

36 bps

|

|

|

CAD/USD

1D %

YTD %

|

0.728

0.2%

4.7%

|

|

Brookfield’s billion dollar bet

NDM insiders sell before 50% drop

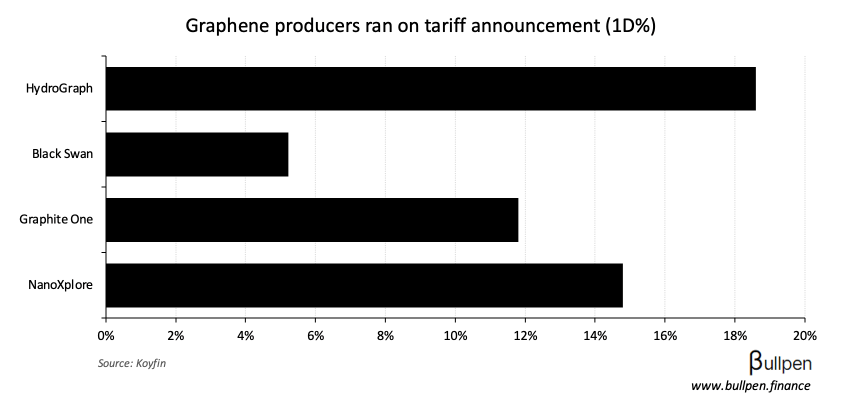

Graphene producers run on new tariff

Quiet weekend, so I decided to avoid coverage of useless headlines and instead go deeper on the one that matters. Let me know what you think of the format.

Brookfield’s billion dollar bet and strategy

BEP said the deal would add roughly 2% to FFO/unit in 2026 and will be financed by non-recourse debt and available liquidity, bringing us back to the real benefit of its 3 GW hydro deal with Google. Read CEO Connor Teskey’s framing of the strategy:

❝

But really where it becomes incredibly accretive is if you lock in a long-term contract at a higher rate, it immediately creates some very low-cost up-financing opportunity for our business and provides a very large injection of capital at attractive rates, let’s say, give or take, 5%, that we can turn around and deploy into new growth and new M&A at 15%.

Connor Teskey (CEO) - BEP Q1’25 call

Let’s walk through this Google announcement to hammer the point home. Included in the initial deal were the Holtwood and Safe Harbor assets (670 MW), which are producing roughly two million megawatt hours per year.

So on a deal the company said is worth in excess of $3B, Brookfield has locked in pricing at $85-90/MWh for two decades. That tracks to reported figures from the company…

… and recent management commentary.

❝

This quarter, we successfully executed 2 contracts with U.S. utilities at an average price of almost $90 per megawatt hour for an average duration of almost 15 years.

Wyatt Hartley (CFO) - BEP Q3’24 call

There’s a financial uplift from signing those deals, but the real juice lies in what comes after. You just signed a predictable 20-year cash flow stream with Google as your counterparty… banks are begging you to take their money.

So you slap some debt on the asset package and take the proceeds to go big game hunting in order to fill out your 5-year, $8-9B capital deployment target.

It’s a feedback loop: the more agreements you sign, the more debt you can layer on your assets, the more buying/building you can do, the more agreements you can sign…

… and with big tech’s current appetite for power, the market believes the underlying math. Whether it should is up for debate, and a topic I’ll dig into in the future.

Well, didn’t take long for my tin foil theory on Astronomer’s viral marketing strategy to get proven wrong:

| Insider |

Company |

Value |

| Douglas Nathanson |

Empire (EMP-A) |

$175K |

| Lee Curran |

Peyto (PEY) |

$439K |

| Barry Girling |

Santacruz (SCZ) |

$208K |

| Ronald Thiessen |

Northern Dynasty (NDM) |

$1.8M |

|

NanoXplore (GRA)

1D %

YTD %

|

2.87

14.8%

11.7%

|

|

|

Avino (ASM)

1D %

YTD %

|

5.04

6.0%

298.4%

|

|

|

Graphite One (GPH)

1D %

YTD %

|

0.95

11.8%

39.7%

|

|

|

Silvercorp (SVM)

1D %

YTD %

|

6.09

3.9%

41.0%

|

|

|

Perpetua (PPTA)

1D %

YTD %

|

23.61

8.3%

53.7%

|

|

|

WildBrain (WILD)

1D %

YTD %

|

2.00

3.9%

22.0%

|

|

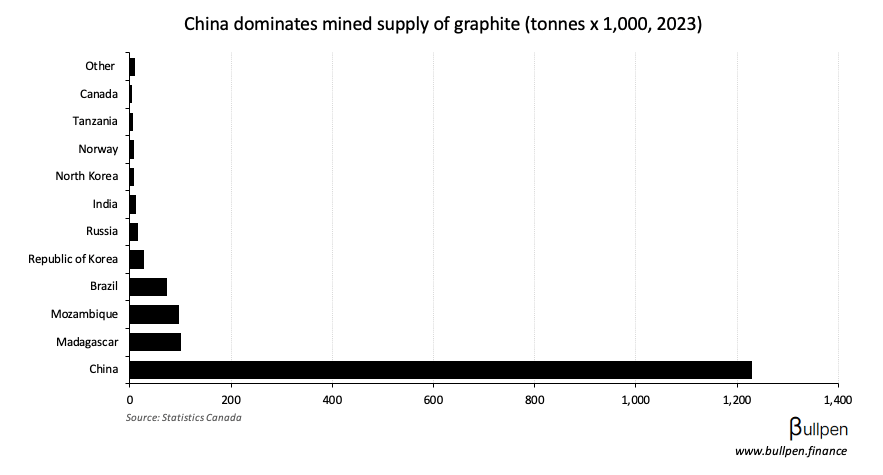

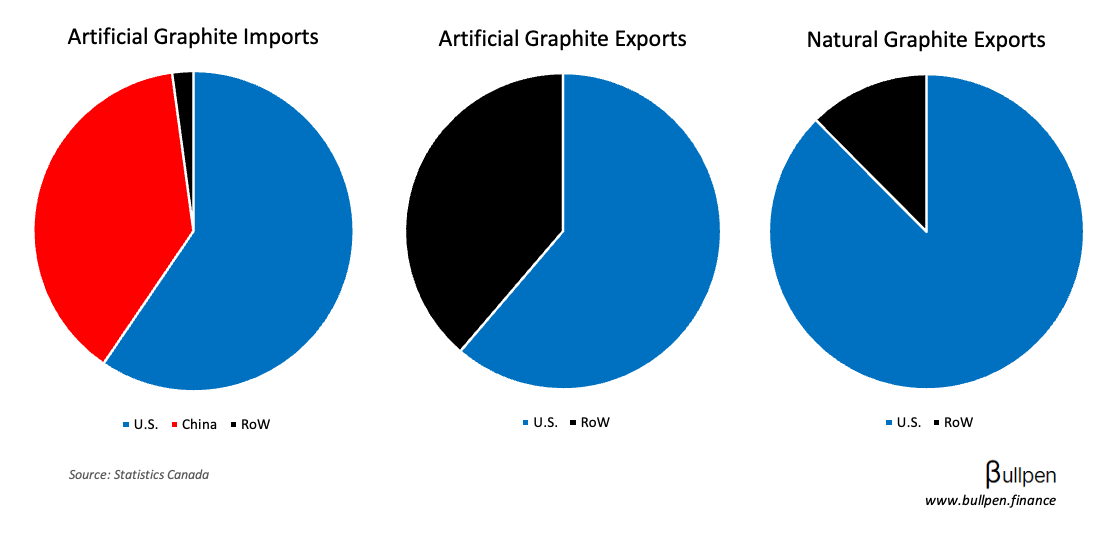

Given China’s dominance in natural graphite production…

… and its influence on artificial graphite supply, the import tax should take some margin pressure off of Canadian producers, who rely heavily on the U.S. export market.

FRIDAY’S EARNINGS

| Company |

Actual |

Consensus |

| 🇺🇸 Truist (TFC) |

0.91 |

0.93 |

| 🇺🇸 American Express (AXP) |

4.08 |

3.88 |

| 🇺🇸 Charles Schwab (SCHW) |

1.14 |

1.10 |

| 🇺🇸 3M (MMM) |

2.16 |

2.01 |

| 🇺🇸 Schlumberger (SLB) |

0.74 |

0.73 |

TODAY’S EARNINGS

| Company |

Time |

Consensus |

| 🇺🇸 Verizon (VZ) |

AM |

1.19 |

| 🇺🇸 Roper (ROP) |

AM |

4.83 |

FRIDAY’S ECONOMIC RELEASES

| Release |

Actual |

Consensus |

| 🇺🇸 Housing Starts |

1.32M |

1.30M |

| 🇺🇸 Building Permits Prel. |

1.40M |

1.39M |

| 🇺🇸 Consumer Sentiment |

61.8 |

61.5 |

TODAY’S ECONOMIC RELEASES

| Release |

Time |

Consensus |

| 🇨🇦 PPI M/M |

8:30AM |

0.3% |

| 🇨🇦 Raw Materials M/M |

8:30AM |

-0.2% |

|

WTI Crude

1D %

YTD %

|

67.38

0.2%

6.1%

|

|

|

Gold

1D %

YTD %

|

3,348.20

0.3%

27.6%

|

|

|

Nat Gas

1D %

YTD %

|

3.58

1.0%

0.6%

|

|

|

Silver

1D %

YTD %

|

38.12

0.1%

32.0%

|

|

|

Lumber

1D %

YTD %

|

666.63

1.2%

21.1%

|

|

|

Copper

1D %

YTD %

|

5.55

1.5%

39.5%

|

|

|

Soybean

1D %

YTD %

|

1,026.91

0.5%

2.7%

|

|

|

Aluminum

1D %

YTD %

|

2,635.90

1.8%

3.1%

|

|

|

Corn

1D %

YTD %

|

409.11

1.8%

10.7%

|

|

|

Wheat

1D %

YTD %

|

546.48

2.4%

0.9%

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.