Aritzia (ATZ) added 5% in Friday’s session after reporting another big quarter, with revenue and EPS beating estimates by 11% and 24%, respectively. Results were driven by a continued acceleration in U.S. growth…

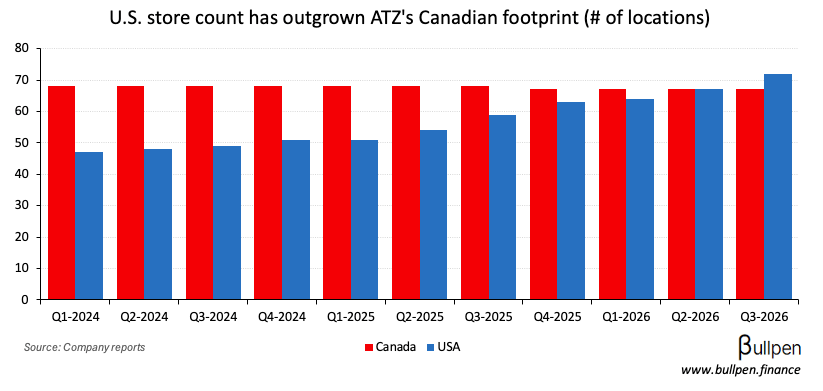

… which now has a larger physical footprint than in Canada and a lot of runway left. That’s translating to better margins and FCF conversion…

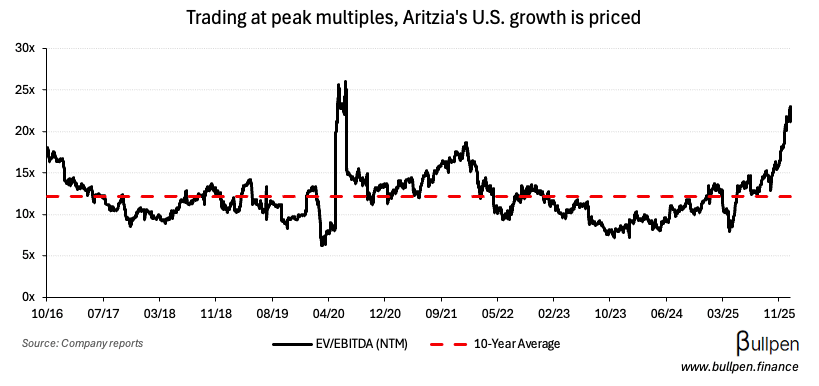

… but at this point, it’s tough to imagine that’s not priced. Trading at its peak multiple on forward EBITDA, it’s likely that future returns will be more a function of fundamentals than a re-rate.